- Shiba Inu’s burn rate spikes have historically spurred only short-lived price hikes

- Market sentiment highlighted mild optimism, but limited network growth may hinder sustained gains

Shiba Inu’s [SHIB] burn rate recently skyrocketed by a remarkable 254,078%, wiping out 5.63 billion tokens in a single day. However, despite this aggressive burn, SHIB only saw a modest 3.03% hike on the price charts. It was trading at $0.00001781 at press time.

Therefore, a pressing question arises – Will this latest burn finally trigger a sustained price rally, or will it simply echo past short-lived gains?

Did previous burn rate spikes affect SHIB’s price?

Historically, Shiba Inu’s burn events have delivered mixed results for its price. According to AMBCrypto’s previous analysis, even significant burn rate spikes, such as a 6,700% increase observed earlier, have generally failed to create lasting momentum.

For instance, a recent burn of over 324 million tokens sparked initial optimism. And yet, the rally quickly dissipated as sellers dominated. Consequently, while these events have occasionally fueled temporary gains, they rarely sustain bullish pressure on SHIB.

SHIB chart analysis – What does the price action suggest?

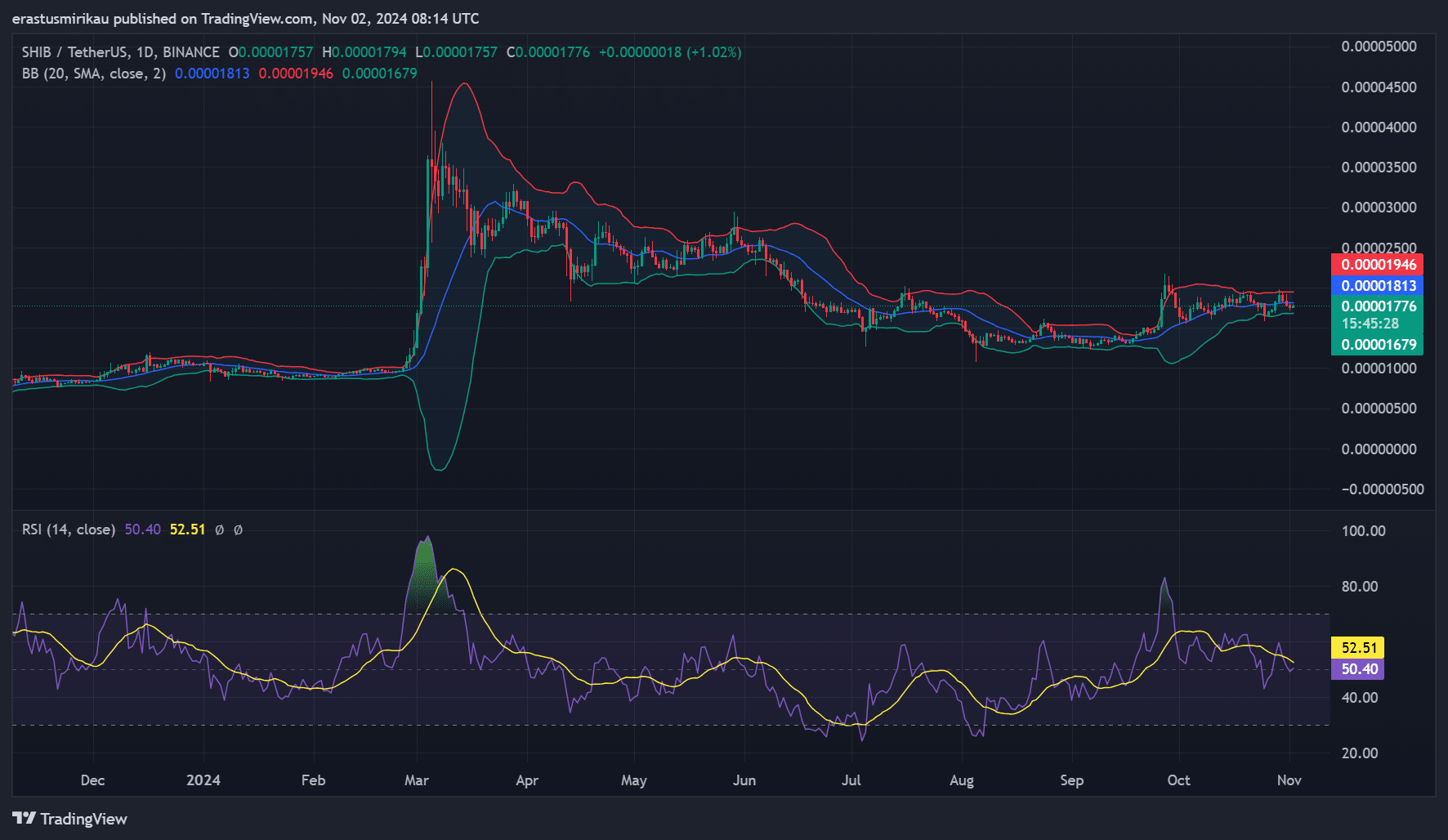

When analyzing SHIB’s charts, it became apparent that the price action has remained relatively flat following the latest burn surge. At press time, SHIB was trading at around $0.00001776, with modest intraday fluctuations. The Bollinger Bands revealed some low volatility too, suggesting limited price expansion.

Furthermore, the RSI was positioned near 52.5, indicating a neutral position—Neither overbought nor oversold.

This neutral technical setup seemed to imply that despite the recent burn, SHIB lacks the buying momentum needed to break through resistance levels or fuel a stronger upward trajectory.

Source: TradingView

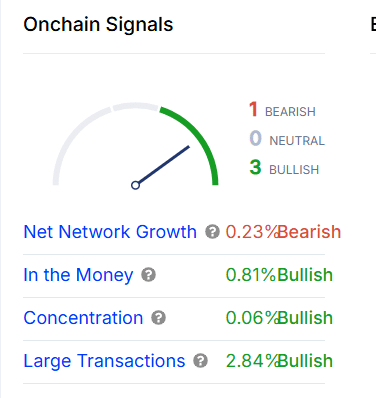

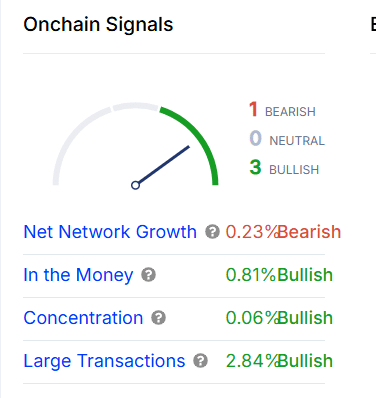

On-chain signals – A cautiously bullish outlook

Delving into SHIB’s on-chain data revealed a mixed, yet slightly optimistic sentiment. In fact, key metrics leaned towards mild bullishness. For instance, “In the Money” showed gains of 0.81%, while the concentration edged up by 0.06% and large transactions rose by 2.84%.

However, net network growth registered a slightly bearish note at -0.23%, indicating limited new address activity.

Consequently, while these indicators underlined cautious optimism, the lack of significant network growth may restrict SHIB’s ability to sustain gains.

Source: IntoTheBlock

Market sentiment – Open interest reflects uncertainty

Finally, the market sentiment around SHIB remains cautious, as evidenced by a 4.38% rise in Open Interest, with the same hitting $47.37 million. A hike in OI often means heightened engagement and potential future volatility.

However, the lack of a strong price action alongside this uptick suggested that traders are still uncertain about a clear directional trend.

This cautious position is in tune with historical patterns where past burn rate spikes had a mere superficial impact on the price.

Source: Coinglass

Is your portfolio green? Check out the Shiba Inu Profit Calculator

Can this burn spark a lasting rally?

Shiba Inu’s latest burn surge demonstrated the community’s persistent commitment to deflationary action. However, historical trends have revealed that burn events alone rarely spark enduring price rallies for SHIB.

While a slight price hike and cautiously bullish on-chain data highlighted potential, the absence of robust buying power or a broader market shift will limit its impact.