- Solana has seen a positive bounce in the last few days.

- The positive capital flow signaled long-term bullish moves.

Solana [SOL] continued to solidify its recovery phase with a strong resurgence in price and consistent positive capital inflows. As of the 24th of December, SOL traded around at $196, reflecting a 3.53% increase.

Backed by favorable technical indicators and robust market activity, Solana has demonstrated resilience following a bearish period in 2022.

With sustained positive net realized profits and increasing market confidence, Solana’s outlook for 2025 appears promising.

Solana price action: Rebound from key support levels

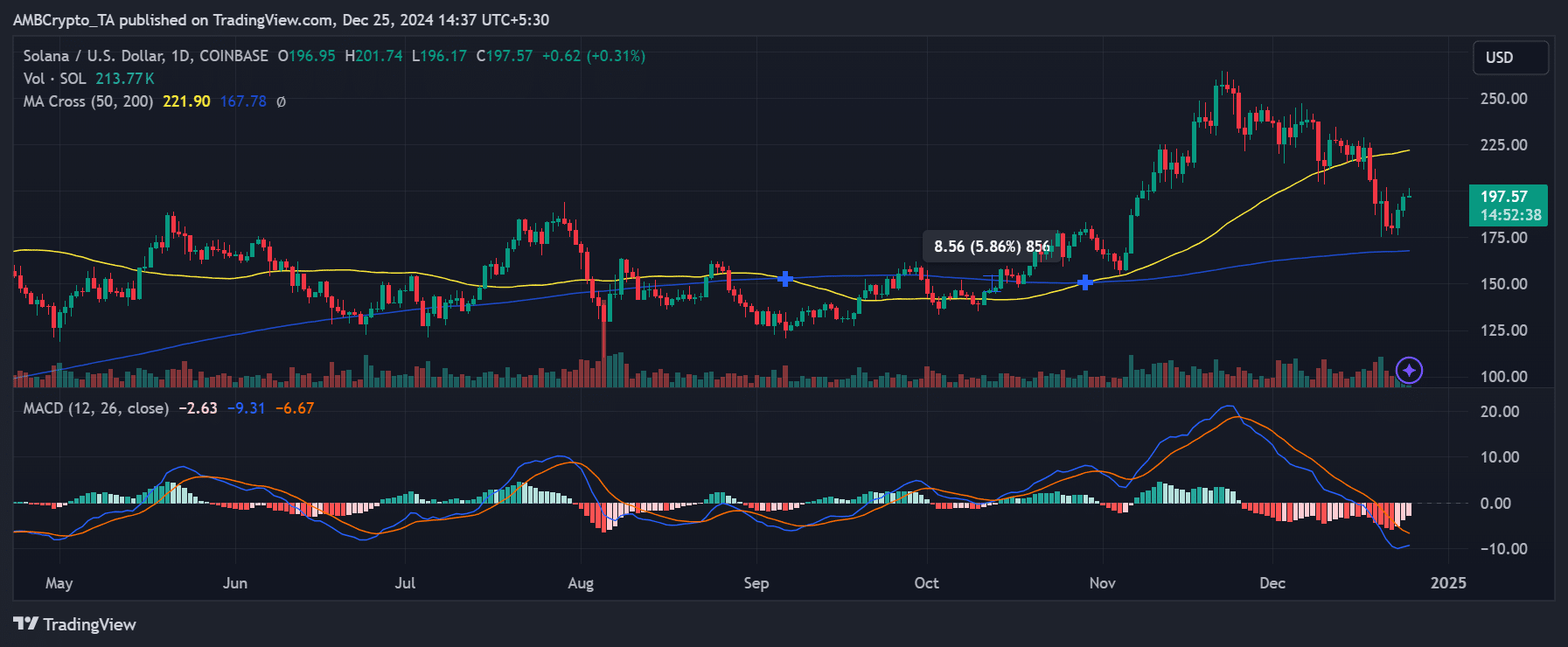

Solana’s recent price performance showcased a rebound from critical support near $175, marking a turnaround from the sharp decline earlier in December.

This price movement was bolstered by the 50-day moving average, which remained above the 200-day moving average at press time.

This bullish indicator signaled potential long-term upward momentum and aligned with the broader recovery observed since September 2023.

Source: TradingView

Despite the bullish backdrop, caution is warranted due to signals from the MACD (Moving Average Convergence Divergence) indicator.

The MACD line crossing below the signal line suggested bearish momentum in the short term. However, the flattening of the MACD histogram indicates that selling pressure might weaken.

Investors should watch for the MACD to reverse upward, which could validate a continuation of the current price rally.

Trading volumes have remained elevated, particularly during recent dips, suggesting active market participation.

These volume spikes indicated that retail and institutional investors have been accumulating SOL, even amid short-term price volatility.

A steady stream of capital

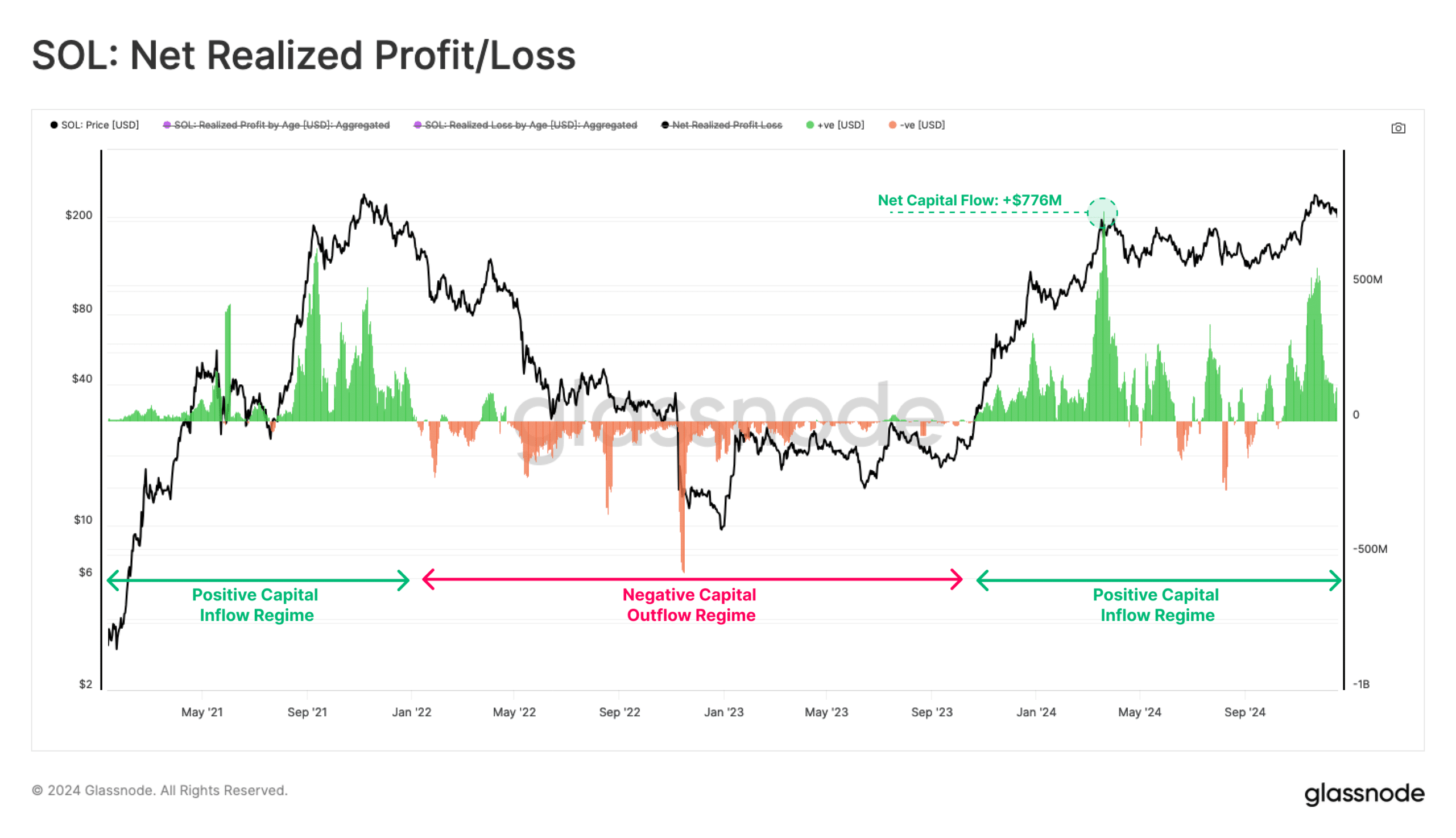

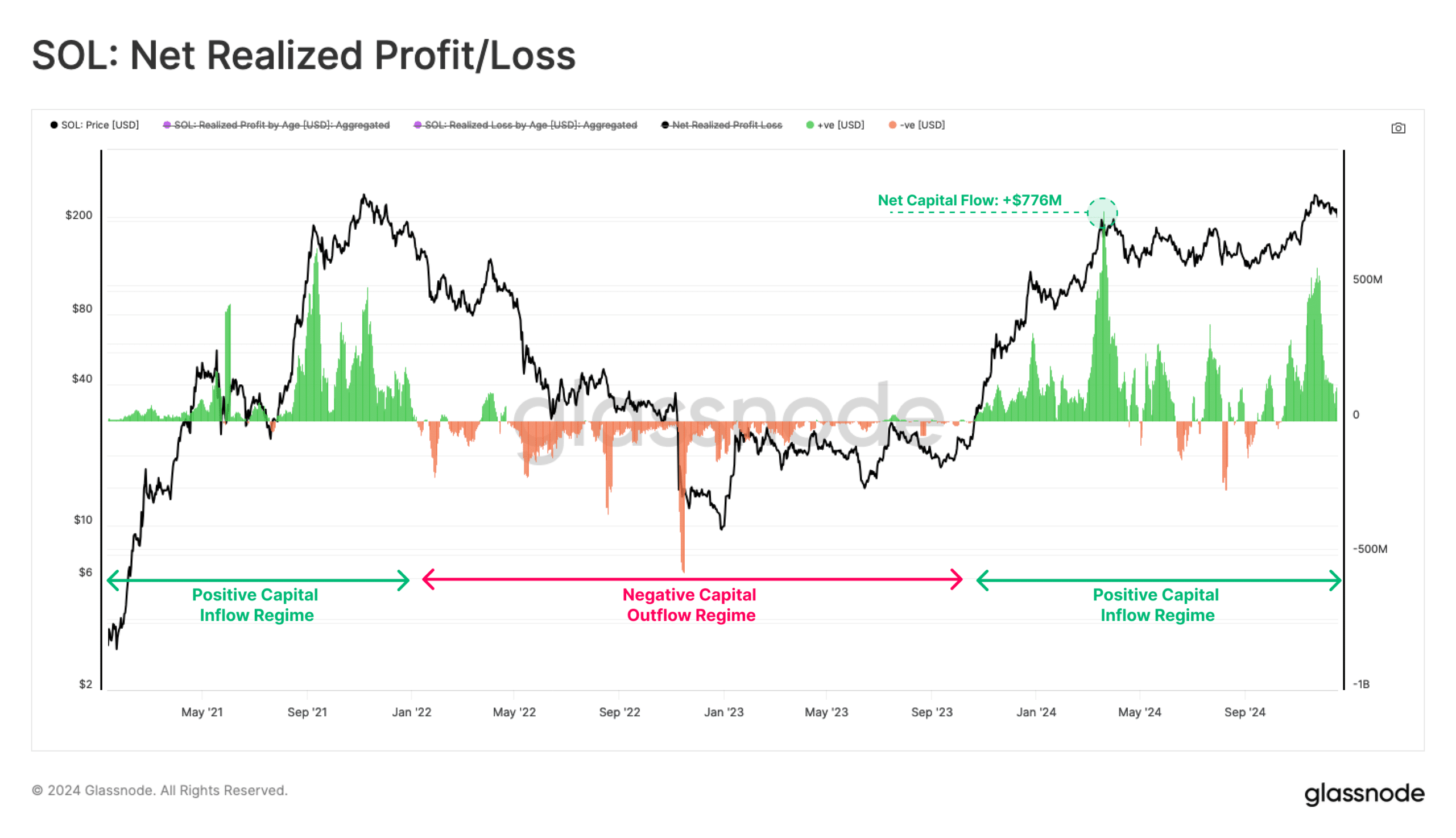

Complementing Solana’s price recovery is its consistent positive net realized profit/loss, as highlighted Glassnode.

Since September 2023, Solana has maintained a steady influx of capital, with realized profits significantly outweighing losses.

This sustained positive net flow of liquidity has acted as a foundation for Solana’s price appreciation, driving its value from sub-$20 levels in early 2023 to its press time position near $200.

Source: Glassnode

The chart reveals a peak inflow of $776 million daily, underscoring the scale of liquidity entering the ecosystem. This substantial inflow highlighted growing investor confidence.

The transition from a prolonged negative capital outflow regime (2022–August 2023) to the current positive inflow regime has been pivotal in reversing the bearish sentiment and setting the stage for sustained growth.

While minor outflows during this period reflect natural profit-taking, the overwhelming dominance of inflows underscores a strong bullish sentiment.

This capital influx has not only supported price stability but has also enabled Solana to recover from market downturns more effectively than other assets.

Key insights for Solana investors

The combination of positive capital inflows and bullish price action indicated Solana’s promising trajectory.

The “golden cross” and steady net realized profits signal a strong foundation for growth, while the MACD highlights short-term challenges.

Solana’s ability to sustain inflows at current levels will be crucial in maintaining its upward momentum, especially as it approaches significant resistance near $225.

The capital inflows suggest increased adoption of Solana’s ecosystem, driven by its speed, scalability, and cost-effectiveness.

Read Solana’s [SOL] Price Prediction 2024-25

With institutional and retail investors actively participating, Solana’s market positioning continues to strengthen.

However, breaking through $225 could unlock further upside potential as the asset approaches key resistance levels. At the same time, failure to do so might result in short-term consolidation.