- Solana might be mirroring Ethereum’s 2024 breakout

- Solana’s double bottom pattern on the daily chart could be a precursor to a potential uptrend

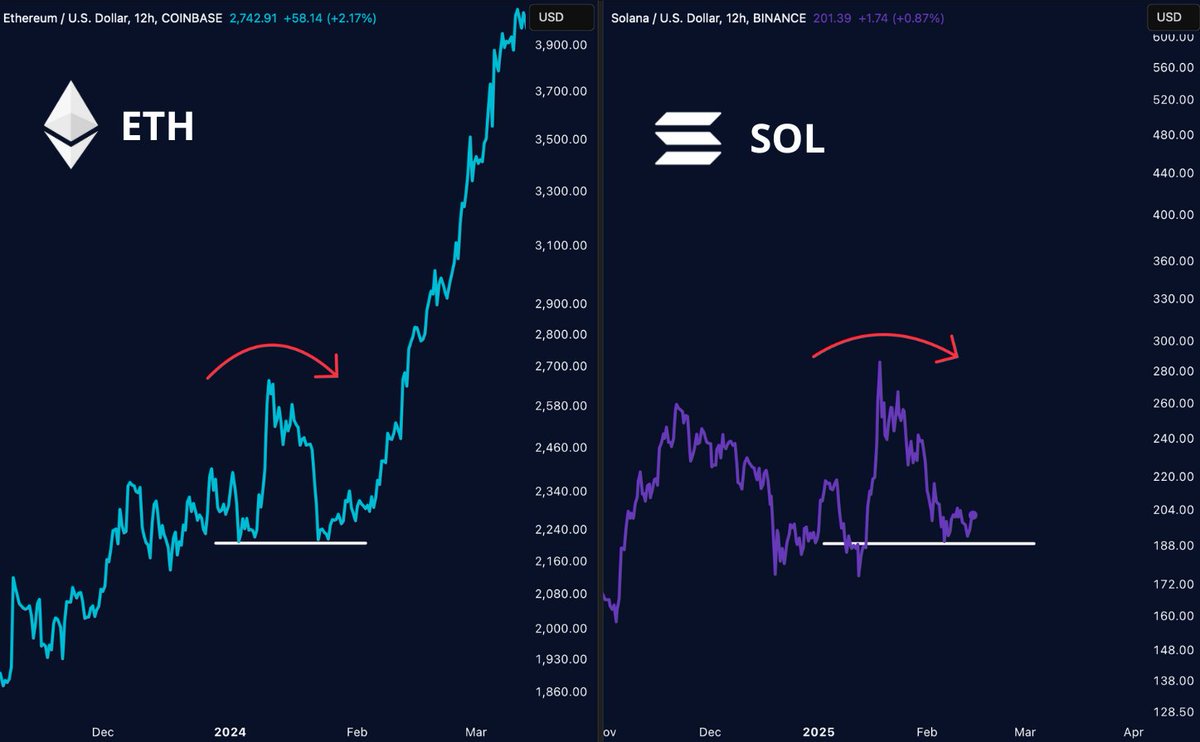

AMBCrypto’s analysis of Solana’s (SOL) prevailing price structure has revealed a compelling parallel with Ethereum’s 2024 surge. Back then, Ethereum went on a robust upward trajectory, one marked by a rally from $2,500 in December to $3,700 in March.

This movement highlighted a bullish recovery after the formation of a double bottom on the charts between mid-January to early February. At the time, key price levels were set at $2,400 and $2,800. Similarly, Solana may be exhibiting a potential bottoming pattern, with its price stabilizing above the $190-level at press time.

SOL’s chart indicated that its price action could be mirroring ETH’s previous breakout pattern. By extension, like in Ethereum’s case, upside could be incoming for Solana too. If it truly follows ETH’s trajectory and hikes by 80% as it did, SOL may go as high as $340.

Source: Trading View

Here, it’s important to note, however, that while historical parallels provide a bullish outlook for Solana, divergent market dynamics or broader economic factors could temper this trajectory. These may lead to fluctuations or a more moderate or realistic hike.

The correlation shown here underlines the potential for significant movements. Even so, market participants should also consider the potential for divergences due to unique factors affecting each cryptocurrency.

Double bottom signals potential reversal

A deeper look into the classic double bottom pattern, identified by two distinct lows around the $190-level, signaled potential reversal points for SOL. This technical formation, often interpreted as a bullish indicator, seemed to imply that SOL may have found strong support at this price range after a period of decline.

The pattern’s neckline, represented by the resistance line around $210, is crucial for confirming the trend reversal. If SOL successfully breaches this neckline, it could initiate a rally and target higher resistance levels near the $230-mark.

Source: Trading View

Conversely, failure to surpass the neckline might result in SOL retesting the support levels, with a risk of further declines if these levels fail to hold. A hike in volumes could confirm the breakout strength.

A sustained move above the $210-resistance would confirm this bullish scenario. On the contrary, a drop below the $190 support might indicate bearish continuation.

Solana’s mainstream adoption

Simultaneously, the Crypto Task Force‘s collaboration with Jito Labs and Multicoin Capital to explore staking within Exchange Traded Products (ETPs) could democratize access to yield generation on Solana.

This move could attract institutional investors, providing them with a familiar investment vehicle (ETPs) while leveraging the high yield opportunities of staking on Solana. This would increase liquidity and stability, further propelling Solana towards mainstream financial systems.