- The mid-range support’s failure was a heavy blow for the bulls.

- A move toward the $122 range low is possible, but the $140 level could also hold the sellers off.

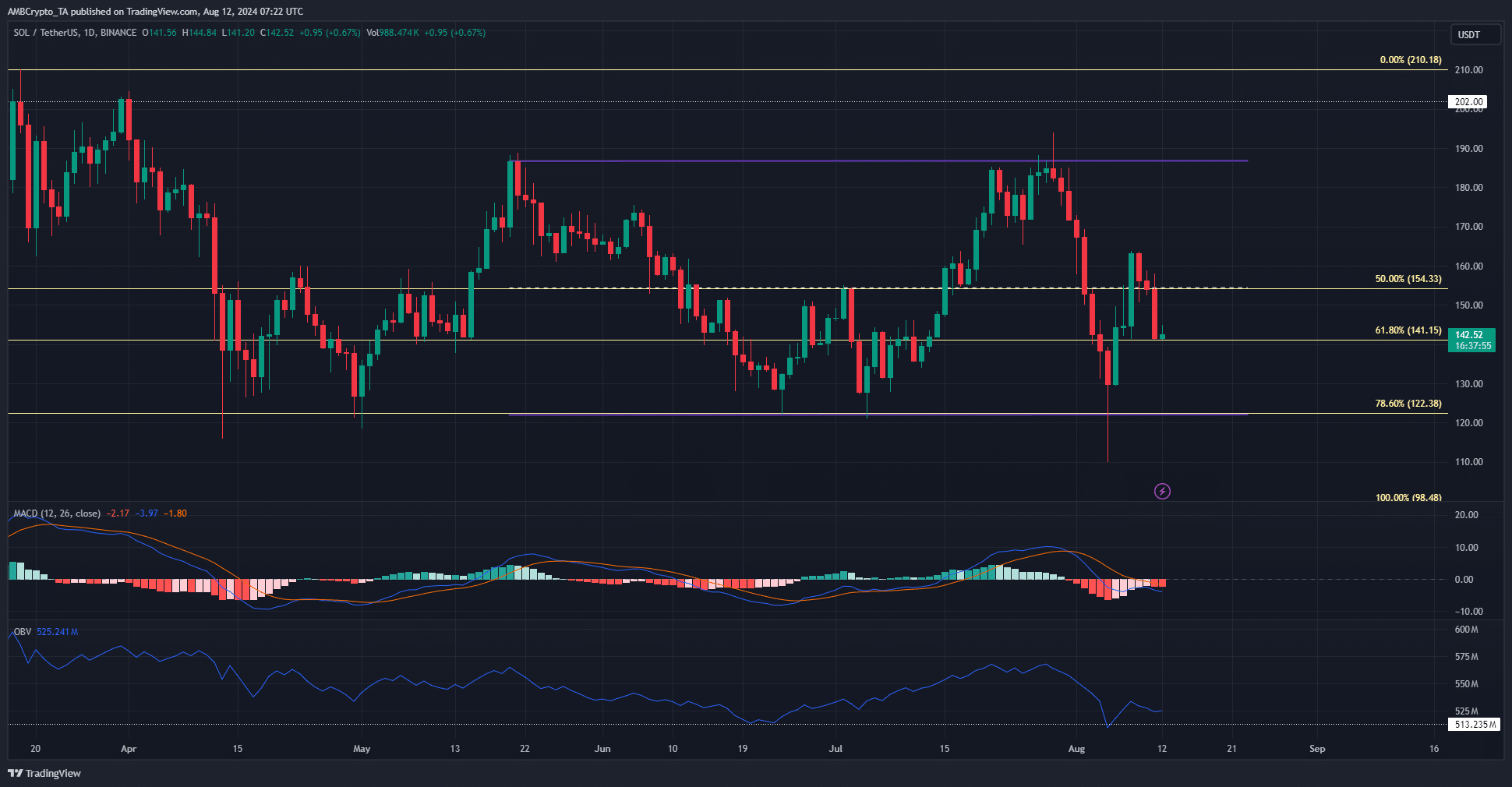

Solana [SOL] was below the $150 mark again and the bearish hurdles were getting bigger. The breakout past $160 was expected to yield a move to the range highs at $190, with sentiment also turning bullish last week.

This did not last.

Bitcoin [BTC] bulls were rejected at the $62.5k resistance zone. The king of crypto’s pullback saw Solana follow in its footsteps, and this journey likely has another leg southward.

The Solana mid-range support was decisively breached

Source: SOL/USDT on TradingView

Solana traded within a 3-month-old range that extended from $122 to $186. The mid-range level at $154 had confluence with the 50% Fibonacci retracement level, plotted based on the rally in February and March.

These levels were still pertinent, with the 78.6% level coinciding with the range lows. The buyers’ failure to defend the mid-range support over the weekend meant the short-term bias was bearish again.

The OBV bounced from the June lows, showing some bullish strength. However, the MACD formed a bearish crossover and fell below the zero line. The momentum was firmly bearish and the demand was not high enough to repel them.

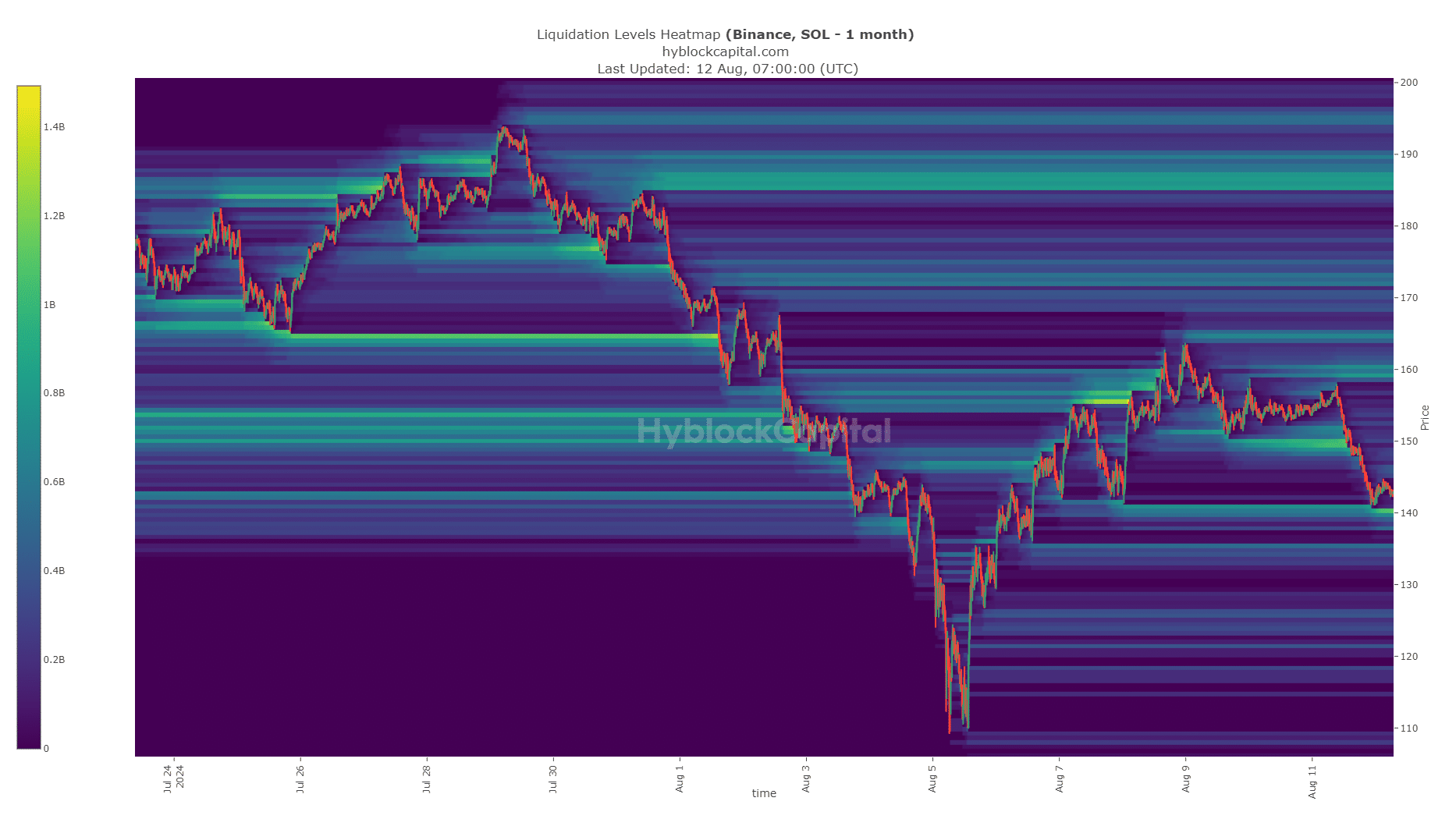

Could the $140 liquidity pocket reverse the bearish tides?

Source: Hyblock

AMBCrypto observed that there was a sizeable pocket of liquidity at $140. This is likely to attract prices lower. However, it was also a place where a bullish short-term reversal occurred on the 7th of August.

Is your portfolio green? Check the Solana Profit Calculator

Traders will have to be wary of a similar scenario playing out. Overall, the lack of demand and bearish momentum could propel Solana below $140 toward $130 or deeper to the range low.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion