- A certain Crypto VC has doubled down on Stacks ahead of sBTC’s launch

- While the price uptrend has been strong, whales trimmed some exposure

Crypto VC Portal Ventures has doubled down on Bitcoin [BTC] L2 scaling solution Stacks [STX], citing strong fundamentals and low selling pressure from unlocks.

Catrina Wang, Partner at the VC, highlighted STX’s first mover advantage as BTC L2 with over 10 years of experience.

Stacks catalysts

In light of the ongoing BTC renaissance and its overall DeFi ecosystem, the upside potential for the Stacks protocol is big, according to Wang.

Besides, it is the only protocol that offers institutional investors a native Bitcoin staking yield on the pioneer crypto network without counter-party risk. In fact, part of her report stated,

“A key driver for institutional adoption is to use STX as the de facto BTC staking provider. STX was the first SEC-compliant token issuance and, in 2021.”

Additionally, 100% of STX’s supply has been unlocked, meaning there is no more sell pressure from early investors like other venture-backed coins.

Whales trim exposure

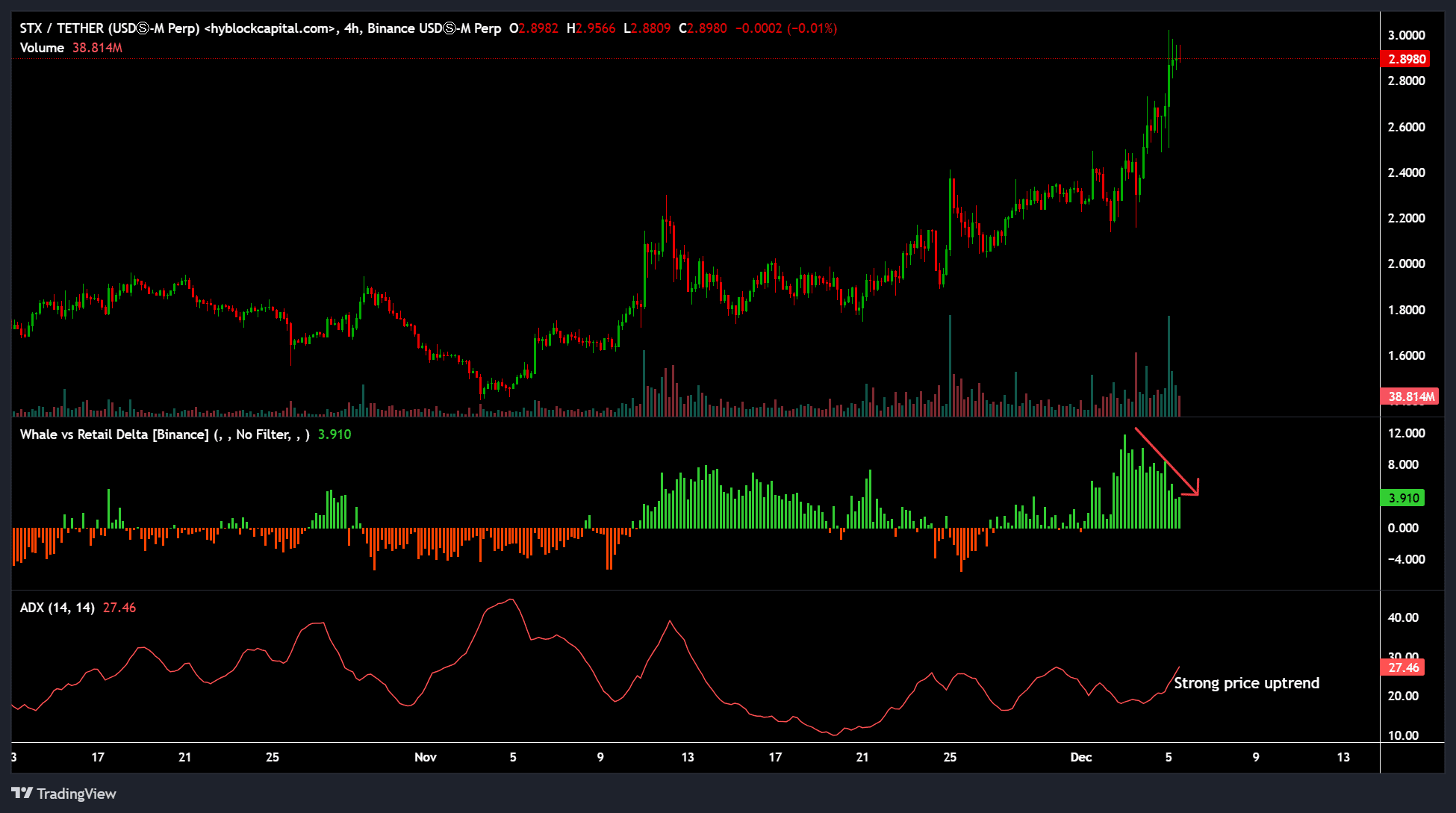

Source: Hyblock

STX began December on a bullish note, with a spike in whale positioning, especially on the Futures market. However, as of press time, they had trimmed their long positions, as evidenced by the decline in the Whale vs. Retail delta.

Even so, the uptrend has remained strong, as shown by the Average Directional Index (ADX) staying above 20. If the momentum continues, STX could eye its 2024 high of $3.8.

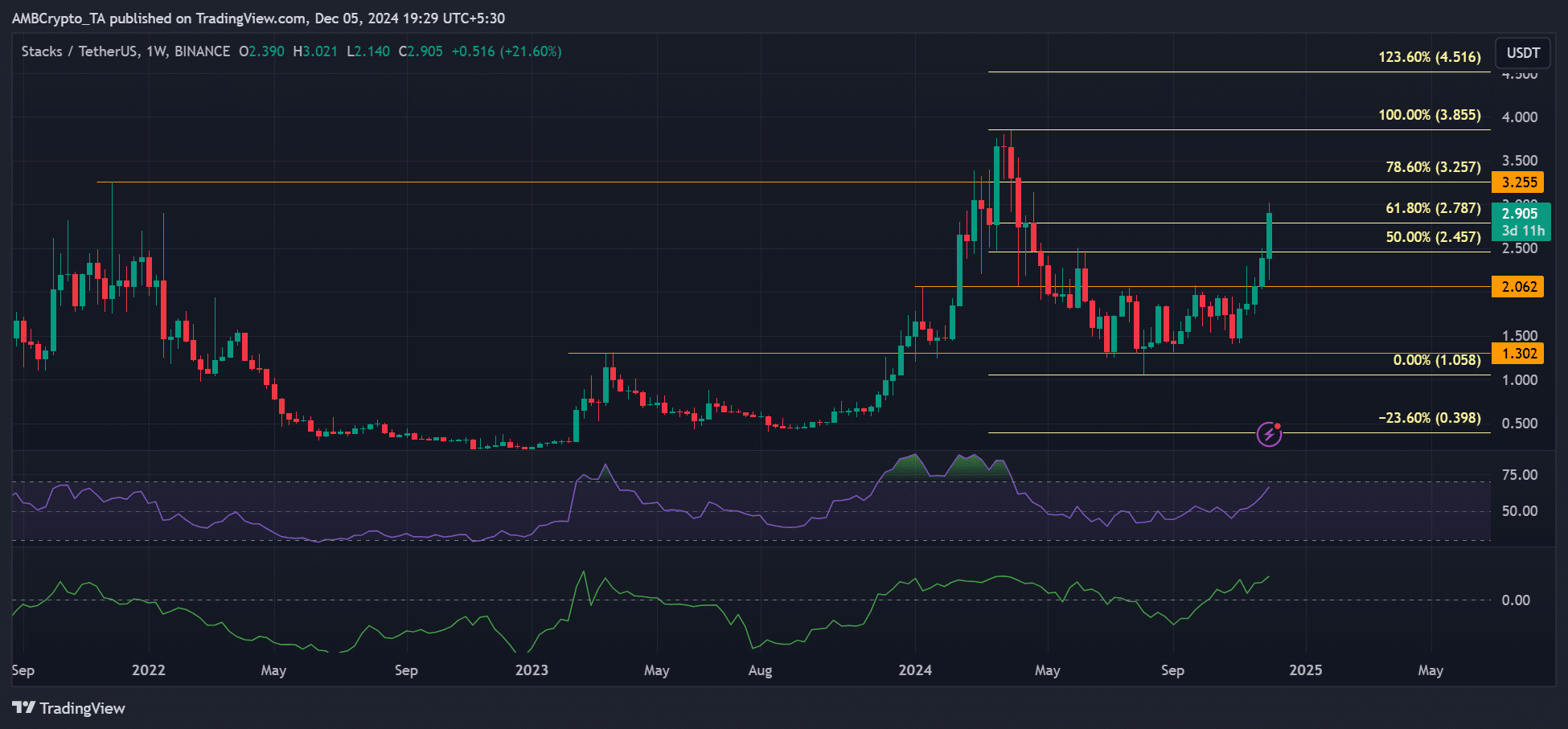

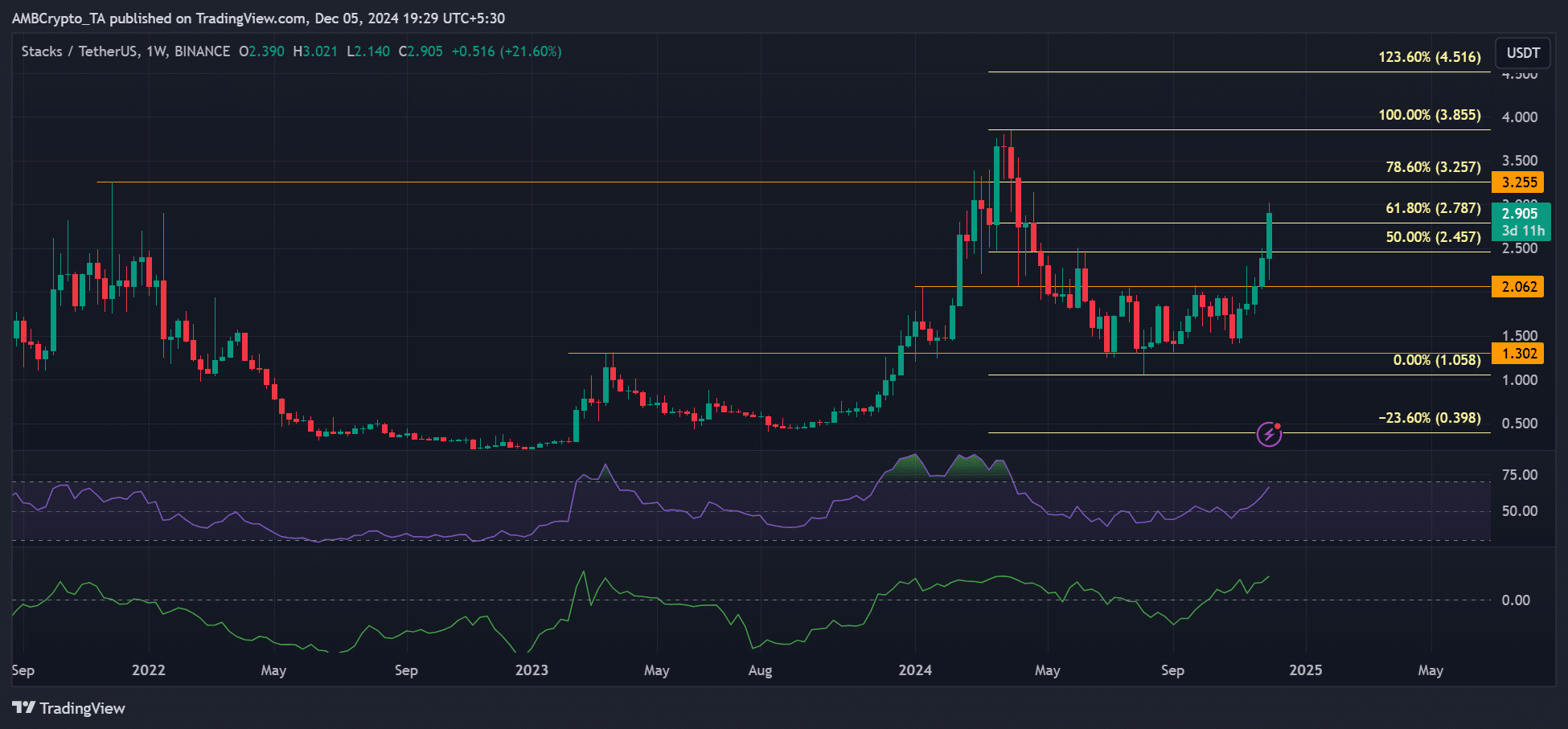

Source: STX/USDT, TradingView

On the price charts, $3.2 seemed to be the short-term roadblock to clear for the uptrend to extend itself. As revealed by the altcoin’s technical indicators, strong capital flows and buying pressure suggested that STX could push higher on the charts.

Read Stacks [STX] Price Prediction 2024-2025

Here, it’s worth noting that the protocol may be set to launch its sBTC mainnet on 16 December to upgrade its native BTC staking. This would allow programmable BTC to move to the Stacks blockchain, opening up more DeFi capabilities on BTC’s network.

In conclusion, STX’s strong fundamentals were also evidenced by its recent price action. While the upcoming update could be a positive catalyst, how STX’s price reacts in the short term remains to be seen.