- Stacks blockchain relies on the Proof of Transfer model, which taps Bitcoin’s Proof of Work consensus mechanism

- The Nakamoto mainnet rollout marked a significant step towards enhancing Stacks’ transaction speed, security capabilities

Bitcoin Layer 2 project Stacks (STX) has revealed the updated timeline for the much-anticipated Nakamoto hard fork. In its latest communication, Stacks Foundation said core developers have scheduled the mainnet activation for Bitcoin Block #867,867, projected to occur around 30 October, as per the countdown on Stacks’ website.

“Fittingly, just before the Bitcoin whitepaper’s 15th birthday, you’ll have fast blocks on the leading Bitcoin L2,” Stacks Foundation wrote in its 17 October blog.

The selection of the new block for the hard fork is the last preparation step in the Nakamoto activation sequence.

However, the lead-up to the Nakamoto finalization has been bumpy, highlighted by delays that have frustrated the Stacks community. According to the initial timeline, the Foundation planned to finalize the Nakamoto activation at Bitcoin Block 864,864. However, it did not materialize.

Expectations post-Nakamoto

The Nakamoto hard fork represents a critical upgrade for the Stacks blockchain as it addresses pain points in the existing design. Among them are slow confirmation times arising from Bitcoin’s block production rates and micro-blocks rendered ineffective due to limitations in the current protocol.

Once activated, it will put into action several core improvements addressing these issues, most notably separating Stacks block production from Bitcoin’s block schedule. This decoupling adjustment will enable blocks to be produced in seconds, ultimately improving transaction speed.

In addition, the Nakamoto’s release aims for a finality closely tied to Bitcoin’s block finality. A transaction once confirmed on the Stacks blockchain would be as difficult to reverse as re-organizing Bitcoin itself.

Nakamoto will also improve the cryptographic sortition algorithm to ensure fairness. It will specifically adjust the algorithm to make it more resistant to miner extractable value (MEV) by requiring competitive spending and increasing the randomness involved in miner selection. This will effectively reduce Bitcoin miners’ ability to exploit their position to extract value unfairly.

Stacks (STX) price action

Last month, asset manager Grayscale included Stacks (STX) in its list of top 20 crypto assets with a potential for returns based on prevailing market narratives and fundamentals. With market participants largely expecting crypto prices to continue rising in Q4/2024, Stacks (STX) may be well-positioned for further price hikes.

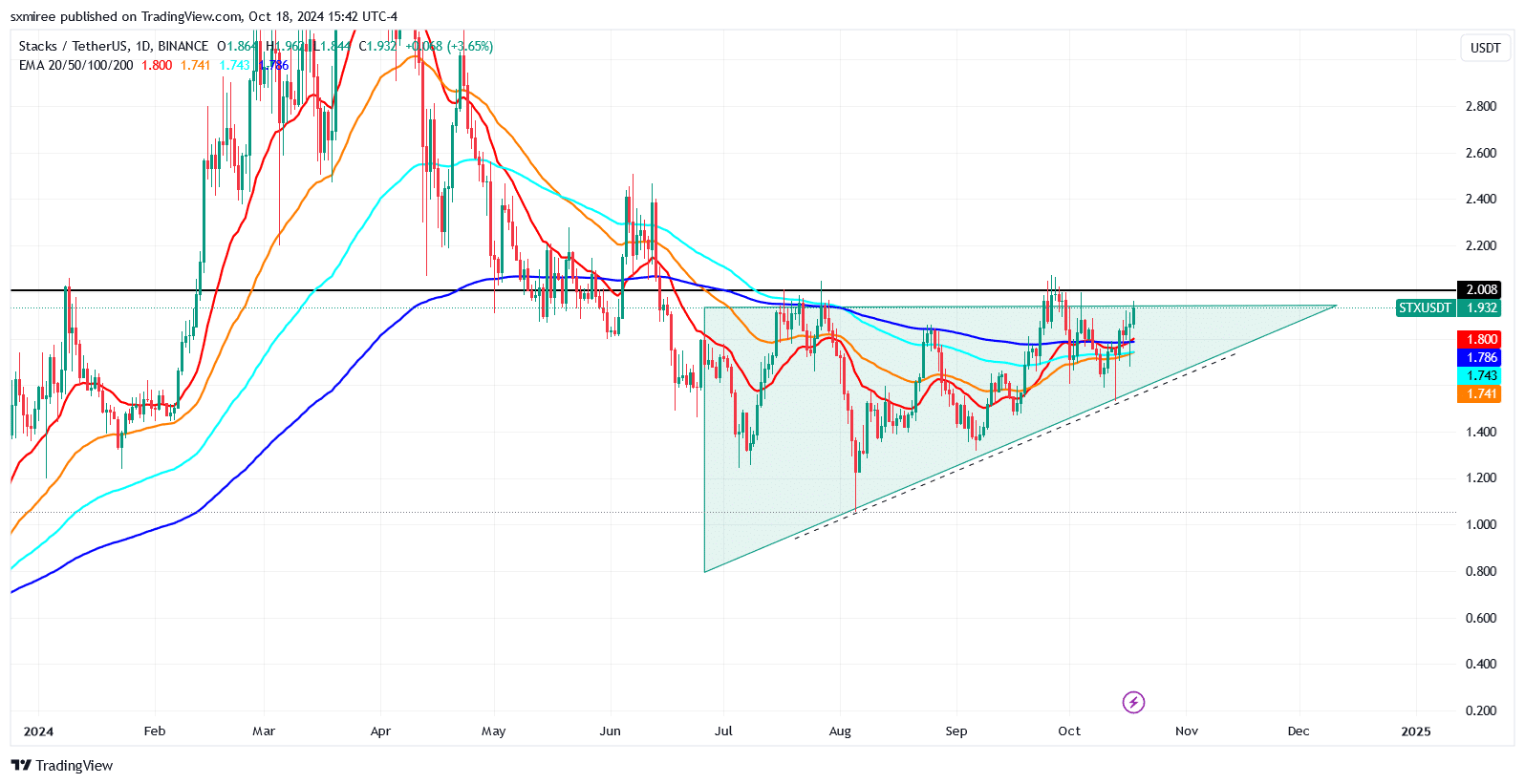

Source: TradingView

Riding on Bitcoin’s renewed momentum, STX’s price has moved up 12% in the last seven days, contributing to 30% gains in the past month.

On the daily chart, STX, at press time, was still trading within an ascending triangle above both its short-term and long-term exponential moving averages.