- Bitcoin’s $90 billion pullback remained minor in the face of the macro deleveraging cycle.

- The next leg up may arrive sooner than the market expects.

Contrary to market consensus, Bitcoin’s path to $100k appears increasingly probable in the wake of the ‘trade dump.’

Since the 19th of February, the U.S. stock market has shed $11 trillion in market cap, with 54.55% of that drawdown accelerating post-‘Liberation Day.’

Yet, this may be just the beginning. Gold (XAU) marked a Q2 peak at $3,143 per ounce before a near 3% retracement, erasing $520 billion in market capitalization since the 2nd of April. Bitcoin [BTC], meanwhile, has corrected 5.17% from its $1.74 trillion valuation.

A $90 billion dip is minor compared to the broader market flush. Consequently, Bitcoin’s increasing divergence from risk assets and macro swings is reinforcing its long-term positioning.

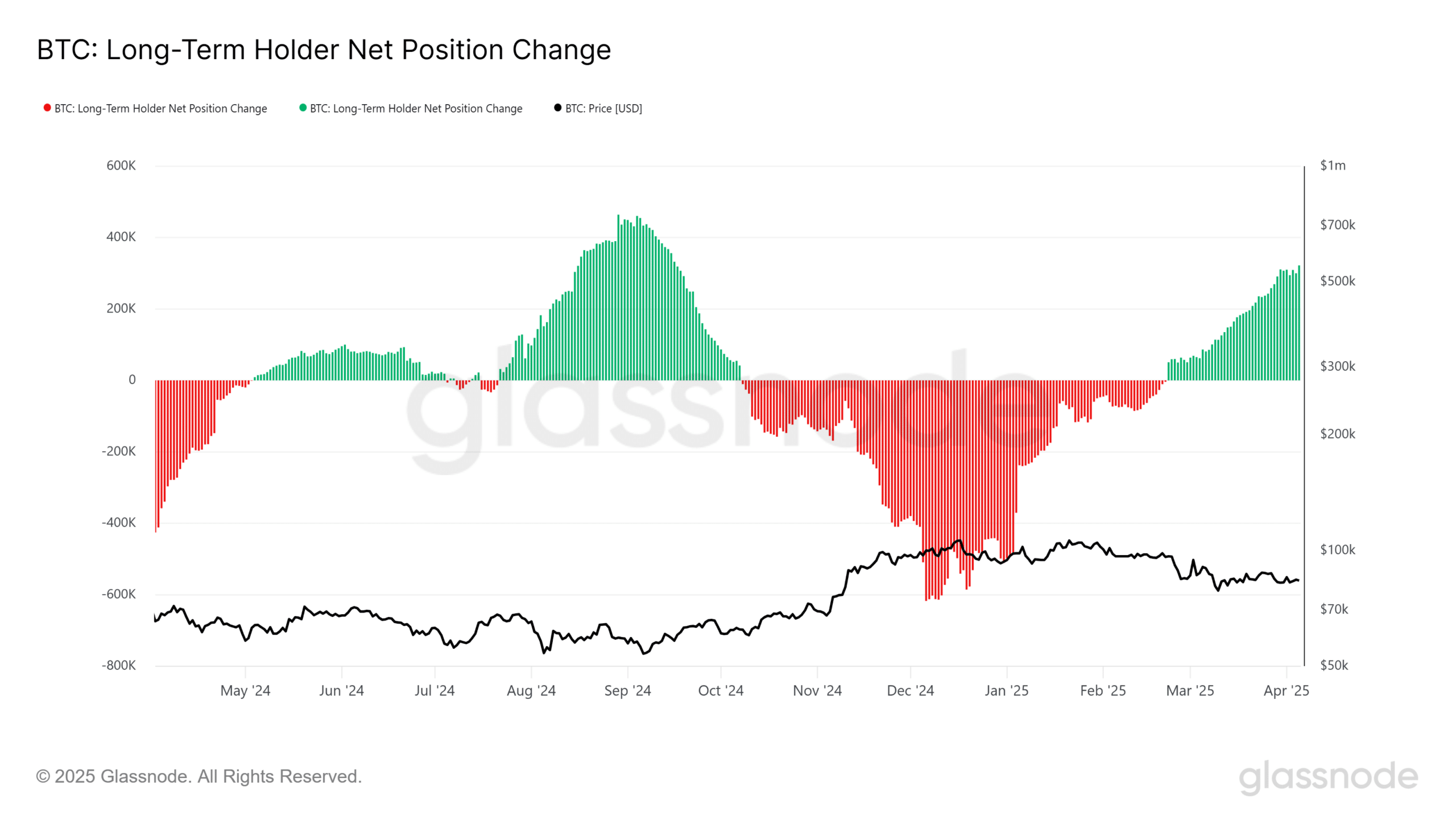

Long-term holders accumulate, reinforcing conviction

Short-term holder supply (<155 days) has declined to a two-month low of 3.7 million BTC, reflecting approximately 3 million BTC in realized losses amid Bitcoin’s retracement from its $109k all-time high.

Conversely, long-term holder (LTH) supply has expanded over the same period.

The Net Position Change metrics signal aggressive accumulation at an average cost basis of $84k per BTC, underscoring strong conviction.

Source: Glassnode

At press time, Bitcoin remained capped below $85k, a critical breakeven threshold for weak hands.

However, persistent LTH accumulation and BTC’s widening decoupling from U.S. equities indicate a critical inflection point that could set the stage for BTC to reclaim $100k.

The key driver? Capital is flowing out of risk assets – and even safe havens – into BTC.

Germany recently initiated a pullback of 1,200 tonnes of gold worth $124 billion from New York reserves. If more countries follow suit, it could weaken Gold’s role as a global haven.

With Bitcoin holding strong while the S&P500 sheds $4 trillion in a week – the biggest drop since the COVID-19 crash – and Gold losing steam, BTC is in a prime position to attract capital from governments, institutions, and retail investors alike.

Bitcoin’s haven status back in focus

In the short term, to trigger FOMO, Bitcoin must break resistance at $85k–$87k, a key zone where profit-taking intensifies. It’s been a month since these levels were last tested.

Therefore, establishing a strong bid wall within this range is critical for bullish continuation. Still, a breakdown below $80k remains a low-probability event.

Since March 12, whale cohorts (>1K BTC) have aggressively accumulated, driving holdings to a three-month-high. With deep-pocketed entities absorbing supply, a retest of the $77k support appears increasingly unlikely.

Source: Glassnode

BTC’s ability to hold strong despite macro uncertainty keeps fueling its case as a hedge against market turbulence.

As long as demand stays firm, Bitcoin’s path to six-figure price discovery stays well-positioned. Capital inflows could pick up even more, especially with U.S. stocks facing increased downside risk from rising tariff pressures.