- Stacks strong correlation with Bitcoin suggested a possible rally.

- STX trading above the 200 EMA but has broken back in a 4-month resistance.

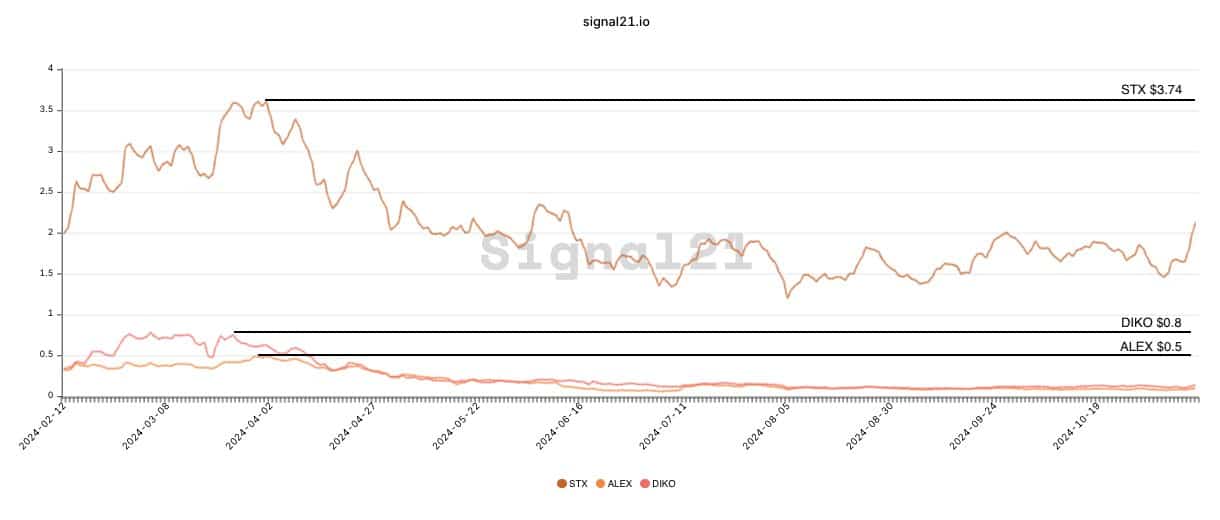

The correlation between Stacks [STX] and Bitcoin [BTC] prices has been strong, with a correlation coefficient of 0.86. Stacks served as a high-beta play on Bitcoin, providing leveraged exposure within the BTC ecosystem.

Likewise, ALEXLabBTC (ALEX) and Arkadiko Finance (DIKO), leading DeFi protocols on the Stacks platform, offered higher-beta opportunities linked to STX.

This created a multi-layered investment potential within the growing Bitcoin ecosystem. However, STX, ALEX, and DIKO remained well below their March highs from earlier this year.

Source: X

This backdrop sets the stage for assessing how Stacks could perform, following Bitcoin’s future movements.

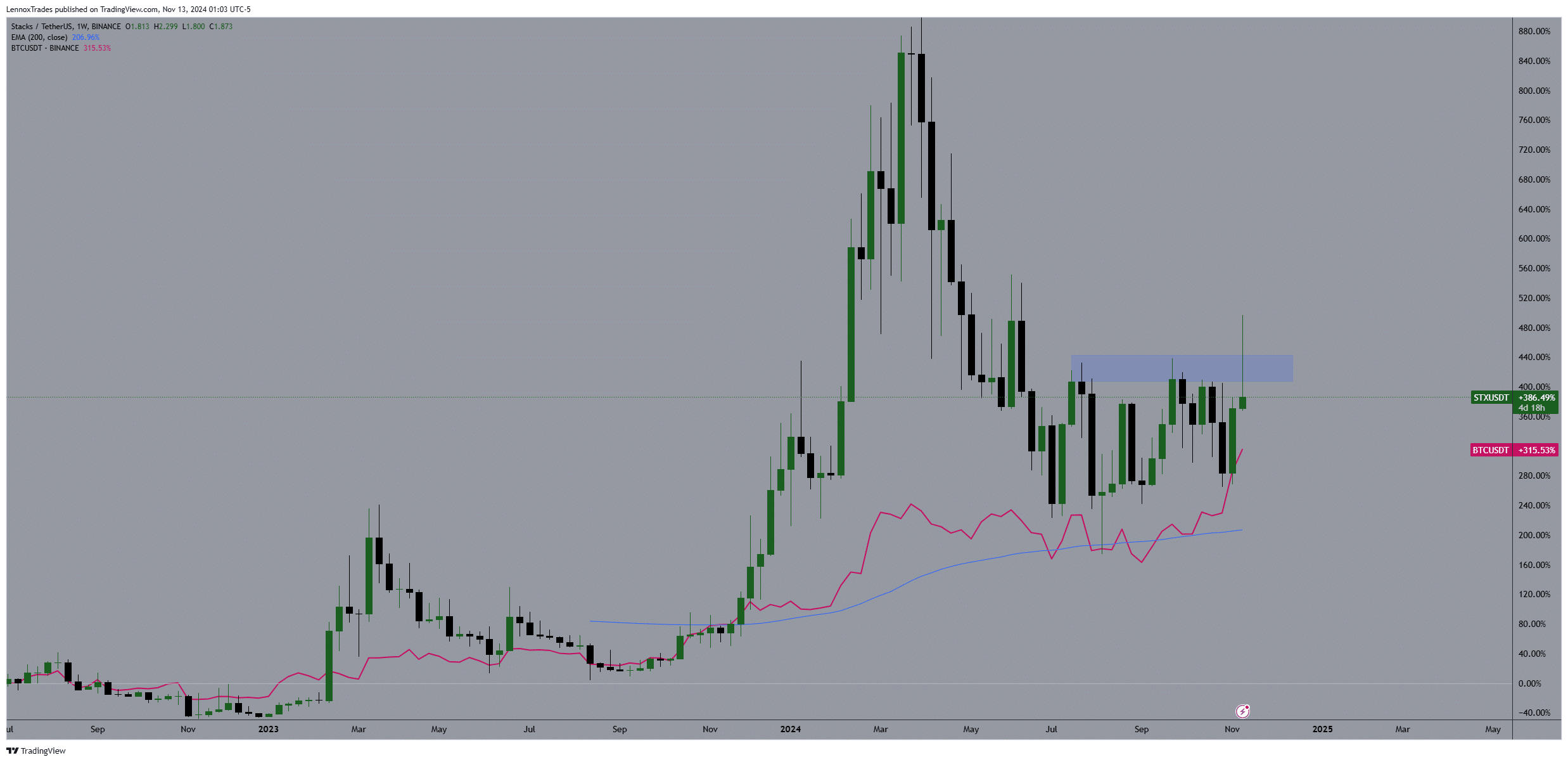

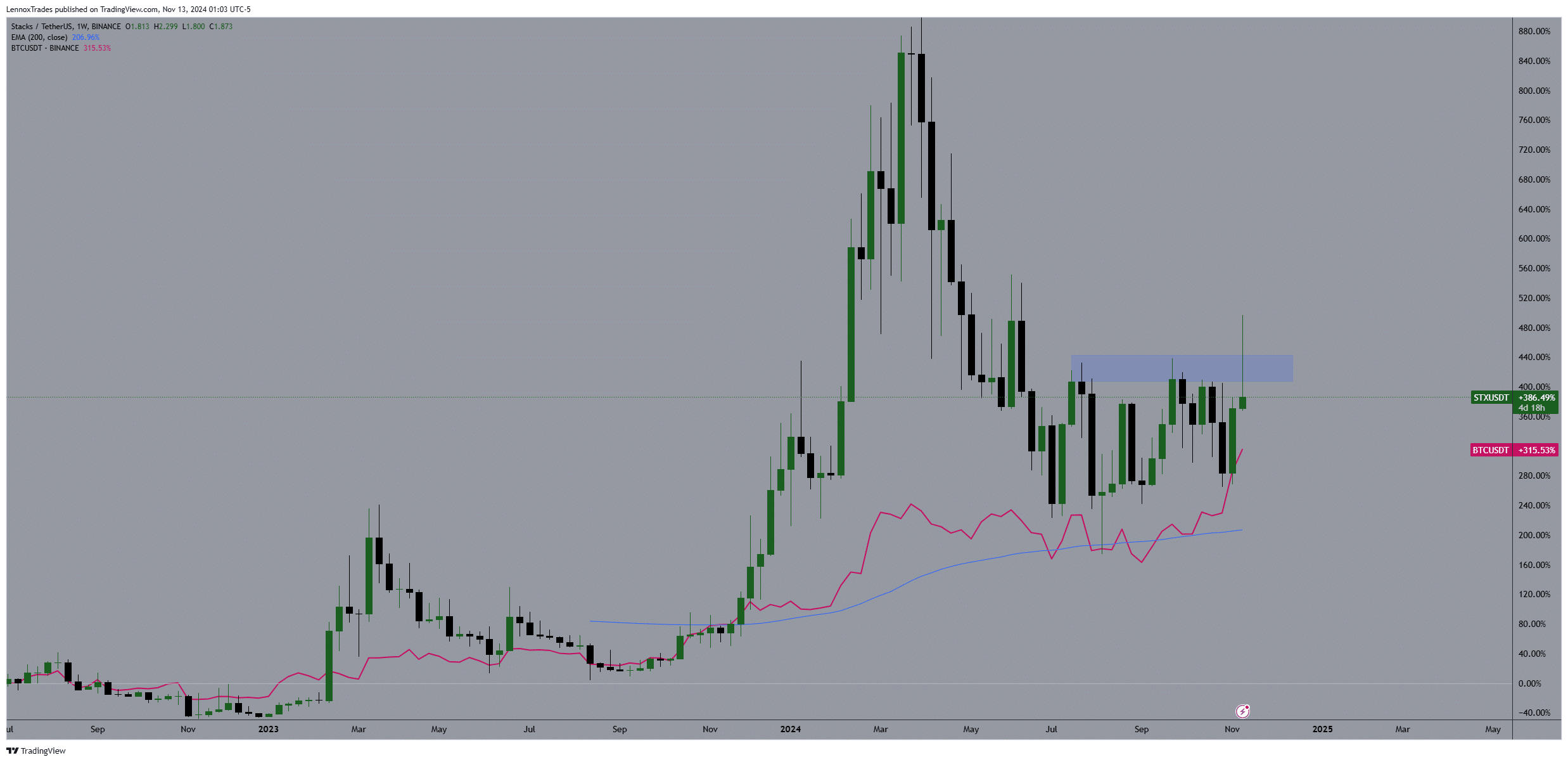

STX trades above 200 EMA

The price action of Stacks briefly broke above a four-month resistance level but then fell back within this range, indicating a possible false breakout on the weekly time frame.

Despite this retraction, STX traded above the 200-day EMA, suggesting an overall bullish long-term trend. The notable green candlestick breaking the resistance followed by a red one illustrates volatility and uncertainty at the breakout point.

However, maintaining a position above the 200 EMA on the weekly timeframe provides a stable outlook, supporting potential future gains.

Source: Trading View

The comparison of STX’s percentage gains against Bitcoin’s performance shows a correlation in their price actions, with STX mirroring Bitcoin’s general market movements.

This correlation suggested that if Bitcoin continues its upward trend, STX could indeed pursue the $4 target. Observing Bitcoin’s trajectory will be crucial for predicting STX’s movements, especially since it showed signs of following Bitcoin closely.

Open interests and premium index

As Stacks broke out of consolidation pattern within a defined range, the open interest rose sharply suggesting STX buying from traders, possibly in anticipation of a rally to $4.

Concurrently, the Aggregated Premium also saw a substantial spike, indicating that traders were willing to pay a higher premium on futures contracts, expecting future price increases.

This aligned with the volume bars showing increased trading activity, further supporting the bullish sentiment surrounding STX.

Source: Velo/Trading View

Read Stacks [STX] Price Prediction 2024-25

Given the rising Bitcoin prices and increased traditional finance attention, it’s likely that Bitcoin ecosystem plays like STX will benefit.

The uptick in open interest, coupled with rising premiums and volume, could propel the token to new highs as part of the broader bullish momentum in cryptocurrency markets linked to Bitcoin’s performance.