- SUI has outperformed most coins, securing the weekly top gainer spot.

- Consequently, it might challenge LTC’s market positioning if the trend holds – what are the odds?

Sui [SUI] ended the week as the top gainer among the top 25 tokens, surging 49% to $1.62. Now in 21st place, SUI’s rise has analysts speculating about its potential to replace Litecoin, which gained 8% to $68.49.

With SUI aiming for its March ATH of $2.09, the odds of overtaking Litecoin in the top 20 are growing.

SUI is defying the odds but there is a catch

Source : Coinalyze

On the daily price chart, SUI has shown consistent green candles, starting September on a bullish note. Notably, SUI has gained over 100% since then, despite broader market volatility.

Meanwhile, LTC bears have thwarted breakouts twice, preventing LTC from rising above $65K. However, following Bitcoin’s upward swing, LTC bulls have retested the $68K ceiling.

In summary, LTC has proven more vulnerable to Bitcoin’s movements, while SUI has thrived, suggesting SUI may hold greater future value for stakeholders.

However, SUI’s surge throughout September was supported by high trading volume, with the RSI spiking into overbought territory, signaling accumulation. Similarly, the CMF has also surged above its previous resistance. This rate of growth has exceeded that seen when SUI reached its ATH.

In simple terms, high investor interest in SUI coincided with Bitcoin returning to the $64K range, making SUI a more attractive alternative.

If so, this raises questions about SUI’s long-term prospects, challenging the theory of it overtaking LTC. So, was the 49% surge just a momentary rise?

The chart hints at possible accumulation

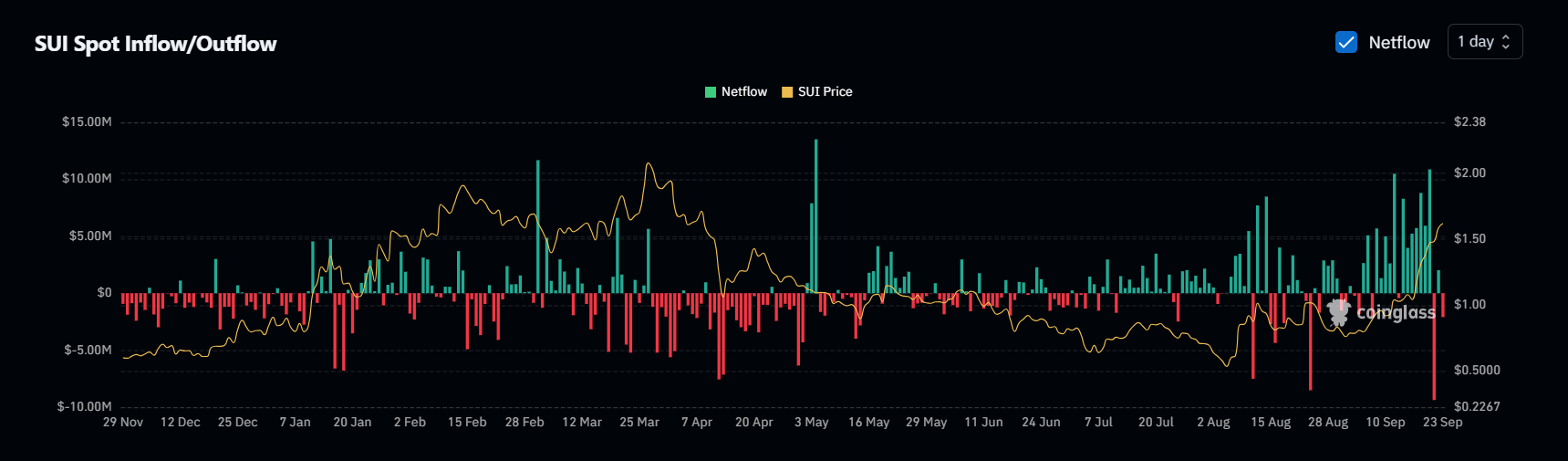

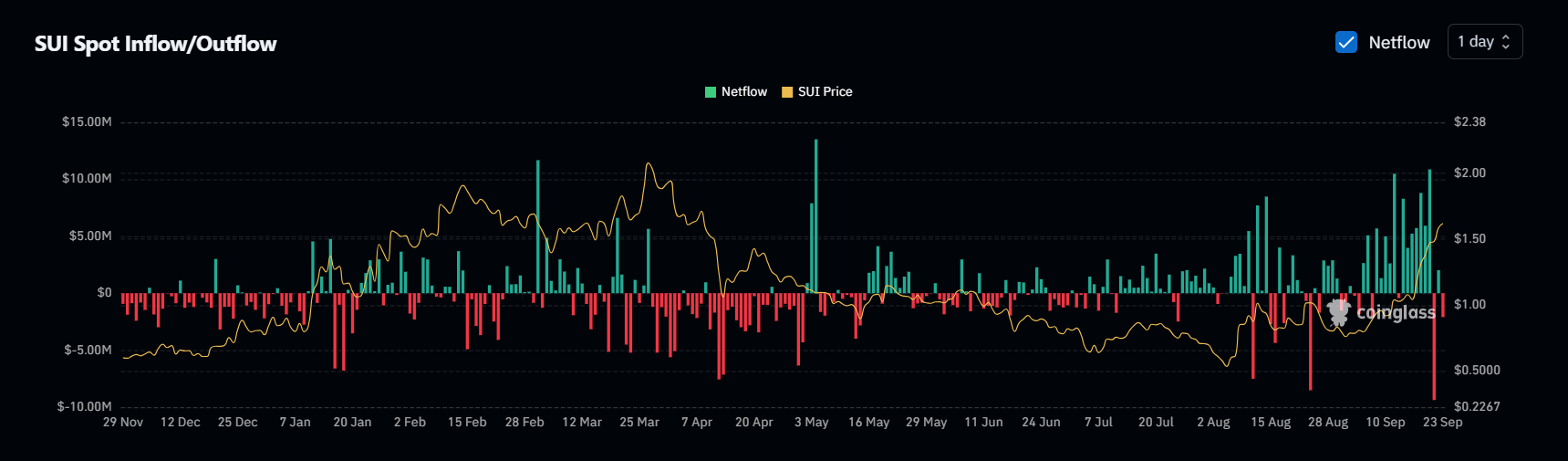

As mentioned earlier, SUI’s performance over the past week has secured its position as the top gainer. Surprisingly, this impressive surge was accompanied by increased inflow of SUI into exchanges.

Source : Coinglass

Put simply, this suggests that SUI was not entirely unaffected by Bitcoin’s volatility. However, accumulation by holders, as highlighted by the indicators above, helped prevent a pullback.

While accumulation is a bullish sign, it could harm the altcoin in the long run, leading many traders to cash out after securing their gains, as seen when SUI hit its ATH in mid-March, aligning with BTC’s own peak.

In the aftermath, as BTC plunged, SUI dropped even more sharply to $1.06 in just two weeks. Since then, it has trended bearishly, with momentum only rising after over 180 days.

If this trend repeats, SUI may be just a few days away from a solid retracement. However, if the bulls can hold the $1.70 resistance before targeting the ATH, the chances of SUI outperforming LTC will increase – Why?

The rate of growth matters

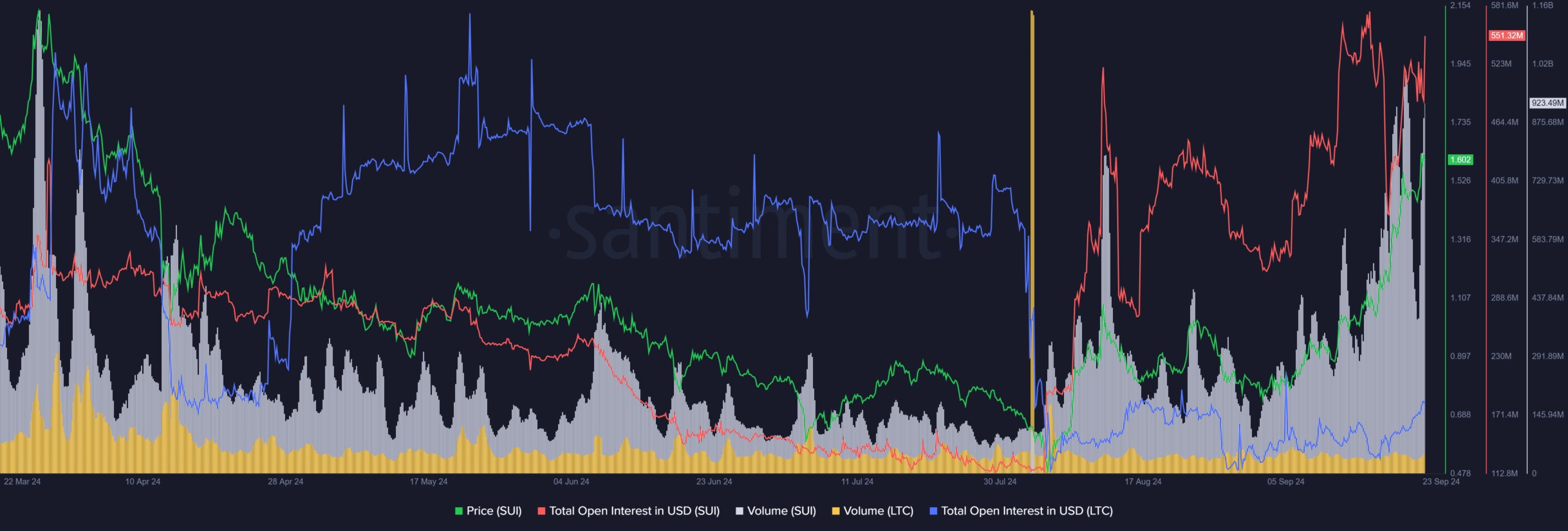

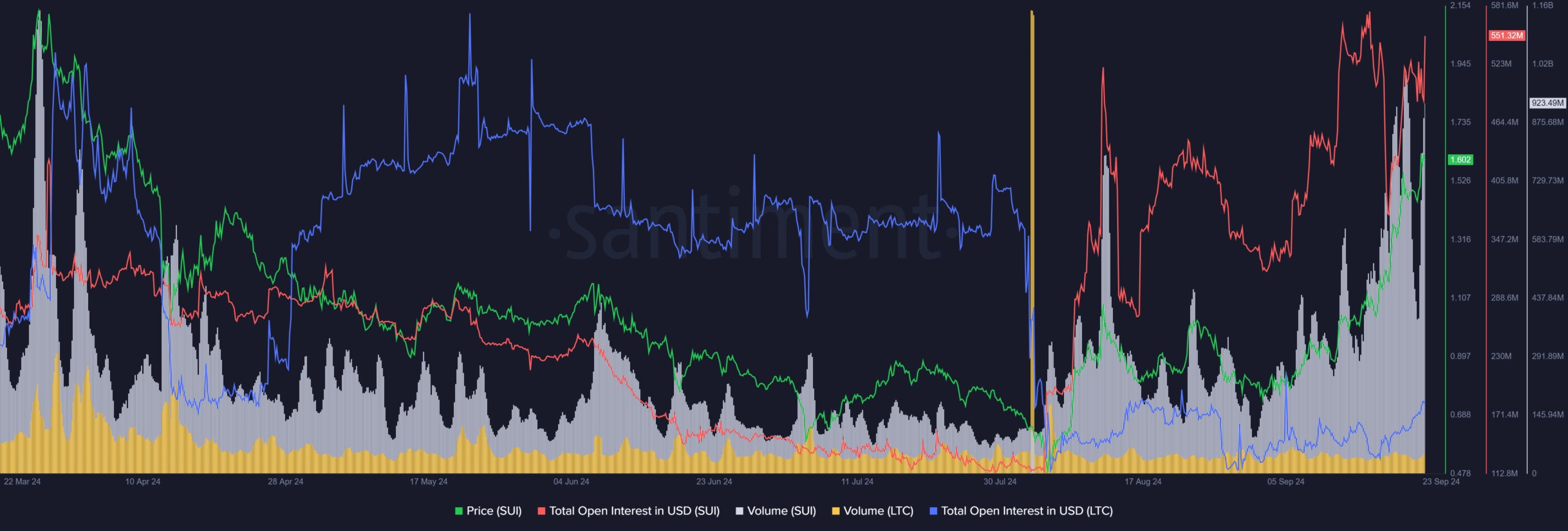

As the 20th biggest coin by market cap, LTC has been consolidating within a range of $60K to $70K for over a month. Meanwhile, SUI has experienced a significant rally during this time.

Despite LTC’s high transaction volume and low fees, no substantial outcomes have been observed. In fact, volume has declined from over $1B in April to $246M at press time. Additionally, open interest in USD has also halved.

Source : Santiment

Conversely, SUI has observed a notable rise in both volume and OI, with OI reaching half a billion dollars and volume approaching the $1B mark.

AMBCrypto notes that while these metrics indicate growth, they aren’t reliable predictors of future gains. The focus is on how quickly SUI is gaining interest compared to LTC.

Read Sui’s [SUI] Price Prediction 2024-25

The result is clear – SUI has risen through market lows to secure the top spot, gaining traction from holders. Its growth rate has significantly outpaced LTC.

Overall, if bulls can maintain liquidity and hold the $1.70 support while targeting the ATH, SUI stands a strong chance of replacing LTC as the 20th biggest coin by market cap.