- SUI’s stablecoin supply is closing in on the $1 billion milestone, and its monthly growth has outpaced Cardano.

- Is a leaderboard leap imminent?

Sui [SUI] is rapidly catching the eye of market speculators, who now see it as significantly undervalued when stacked up against legacy players like Cardano [ADA].

Sure, skeptics might brand this surge in attention as a textbook “sell-the-news” setup, but a deeper cut into the data suggests otherwise.

Climbing the leaderboard, one metric at a time

Just one glance at the 24-hour metrics and the shift is clear. SUI’s DeFi TVL (Total Value Locked) has jumped 4.74% to $2.838 billion, while Cardano’s has slipped 3.82% to $414.92 million.

Zoom out, and the gap turns into a canyon.

Over the past 12 months, SUI has absolutely exploded in terms of user engagement, with daily active addresses rocketing 1,770.9% to 1.4 million, while Cardano’s activity has shriveled, down 26.2% to a modest 23.5k.

When factoring in DEX volumes, transaction throughput, fee generation, and revenue metrics, SUI is clearly outperforming, establishing a commanding presence across the board.

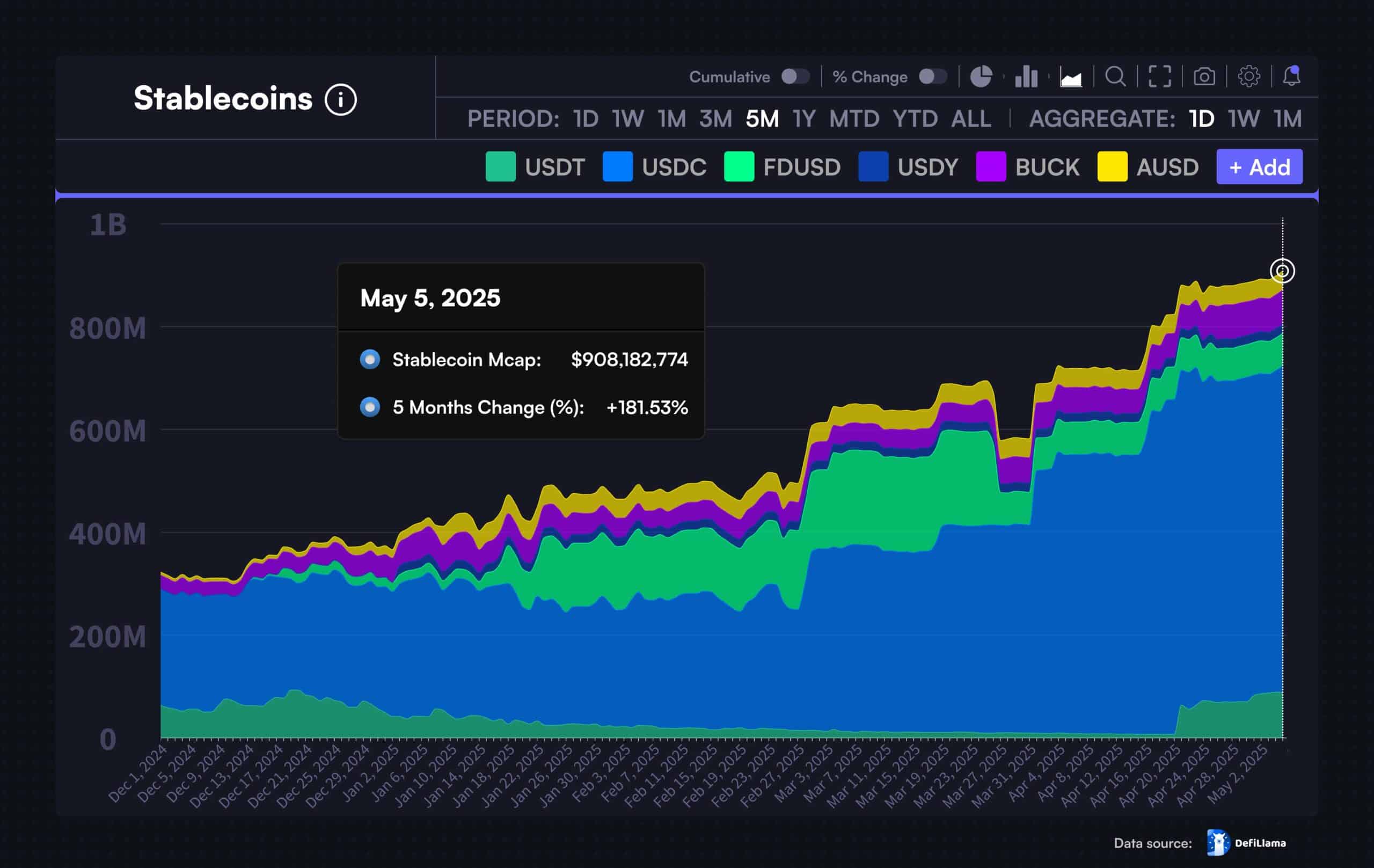

What’s more, stablecoin supply on SUI has spiked to an all-time high of 908 million, fueling liquidity and in turn, accelerating staking, farming, and overall network engagement.

Source: DefiLlama

In conclusion, despite being just two years old, SUI is clearly undervalued in comparison to the eight-year-old Cardano – an argument that is robustly supported by data-backed trends.

Thus, the recalibration of Layer 1 dominance is no longer speculative. All signs point to a compelling upward re-rating on the blockchain leaderboard.

ROI on SUI speaks for itself

Beyond the numbers, price action is making its own statement. Both SUI and Cardano have faced the brunt of market FUD, but it’s the bounce-back that investors are eyeing.

Looking at the monthly returns, SUI has rocketed up 51% — that’s more than a “double-your-money” moment in just 30 days. Meanwhile, Cardano? A modest 5% gain doesn’t quite have the same spark.

Sure, ADA still holds a 116% gain from its election day lows. Meanwhile, SUI has retraced over 40% from its highs.

But here’s the thing — SUI’s latest rally has dragged it back to mid-February levels, whereas Cardano hasn’t even re-tested the psychological $1 mark.

Source: TradingView (SUI/USDT)

This is where investor psychology comes into play.

Momentum chasers and fundamentals-driven traders are both leaning toward SUI– thanks to its structural growth and price resilience.

So while the battle for L1 dominance is far from over, the message is clear: SUI, though young, is actively gunning for Cardano’s legacy — and it’s not just wishful thinking anymore.