- Toncoin has witnessed a 1.07% price correction in the last 24 hours.

- Large transactions and active addresses signal a long-term bullish run.

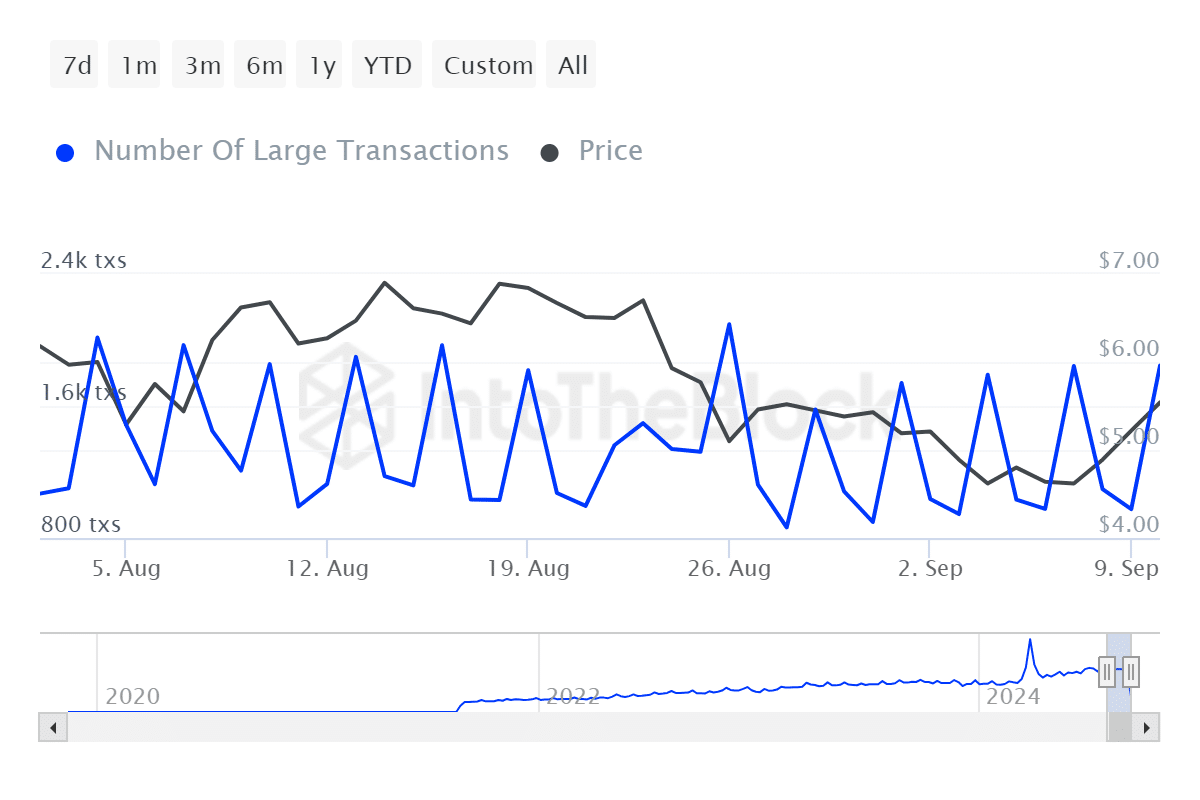

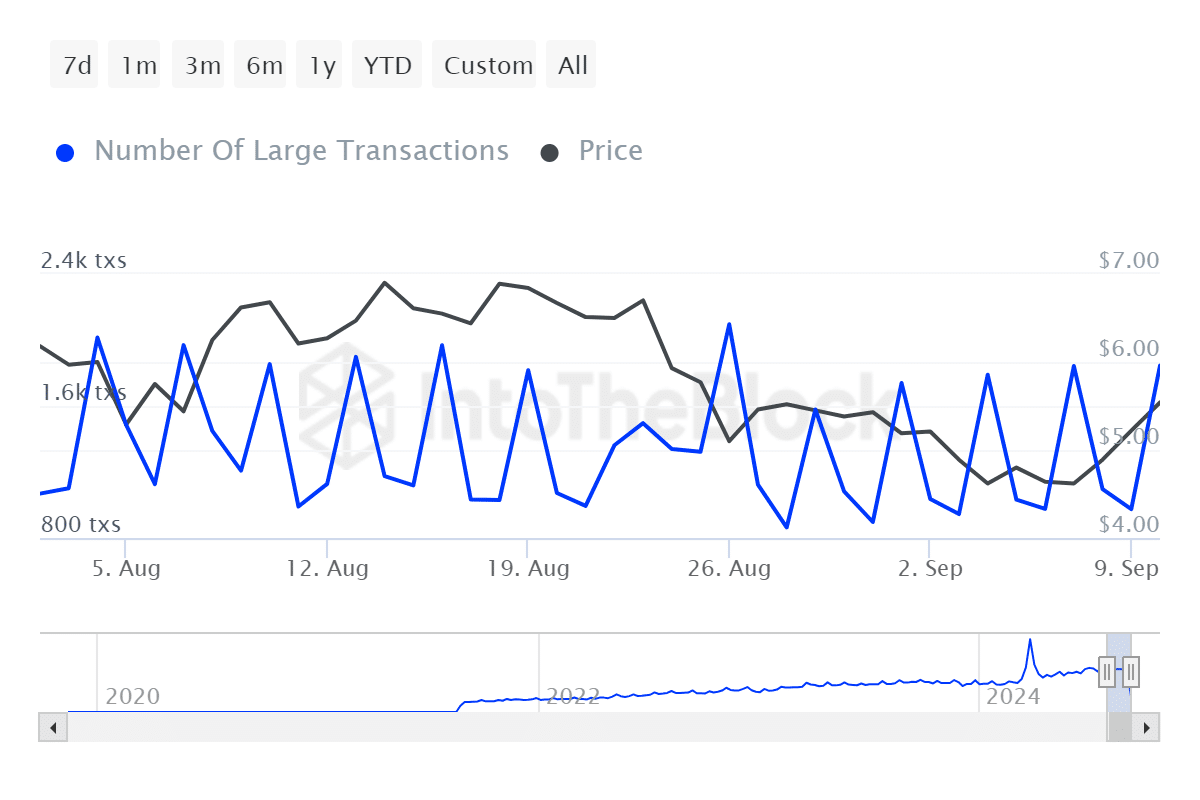

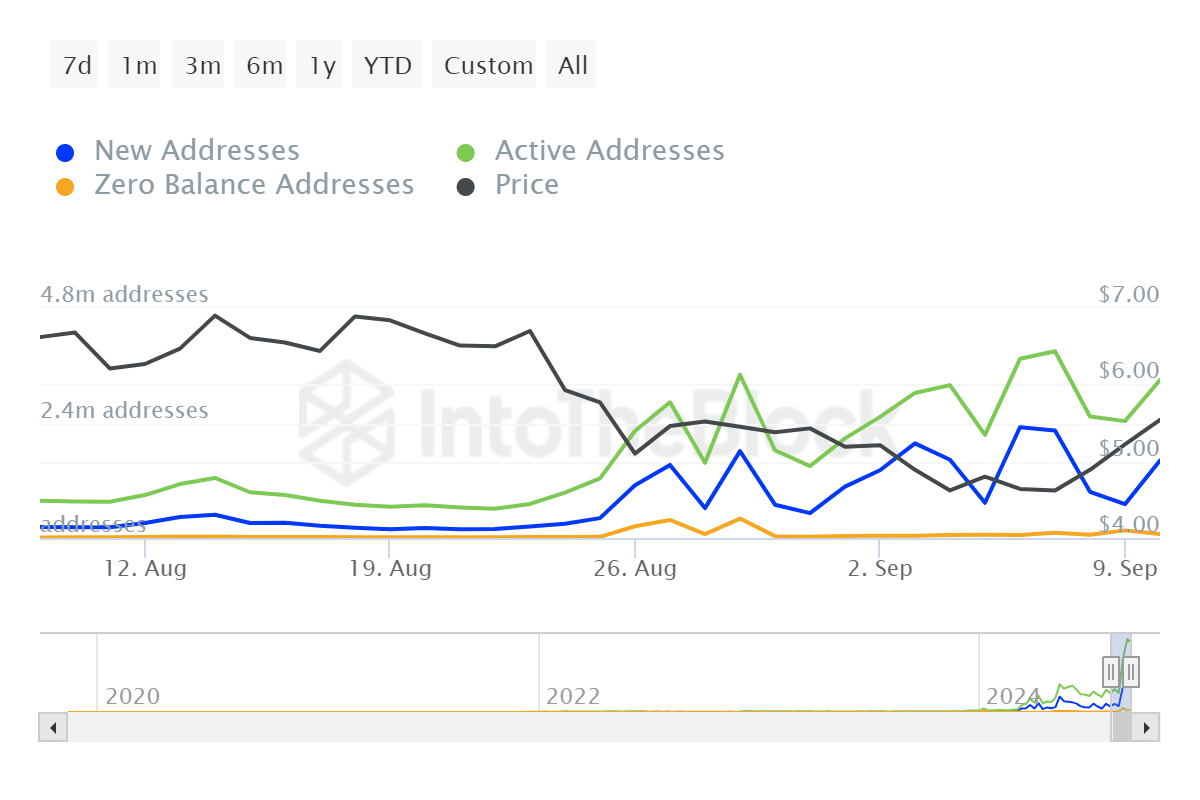

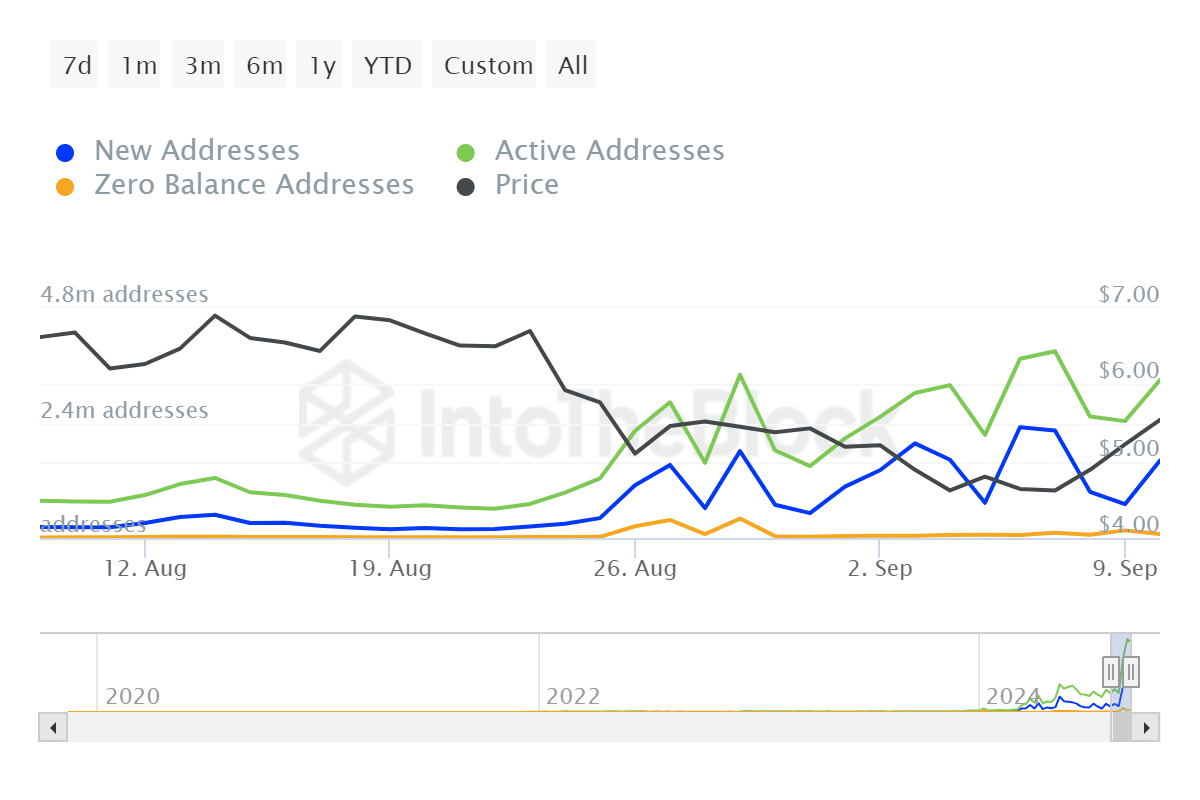

Toncoin [TON] has witnessed a 108% surge in the number of large transactions. Similarly, the number of active addresses has spiked by 35.13% from 2.44 million to 3.3 million.

This significant increase in the number of big players affirmed by the increase in market trading activity may bring a significant price movement for TON.

Toncoin price prediction shows…

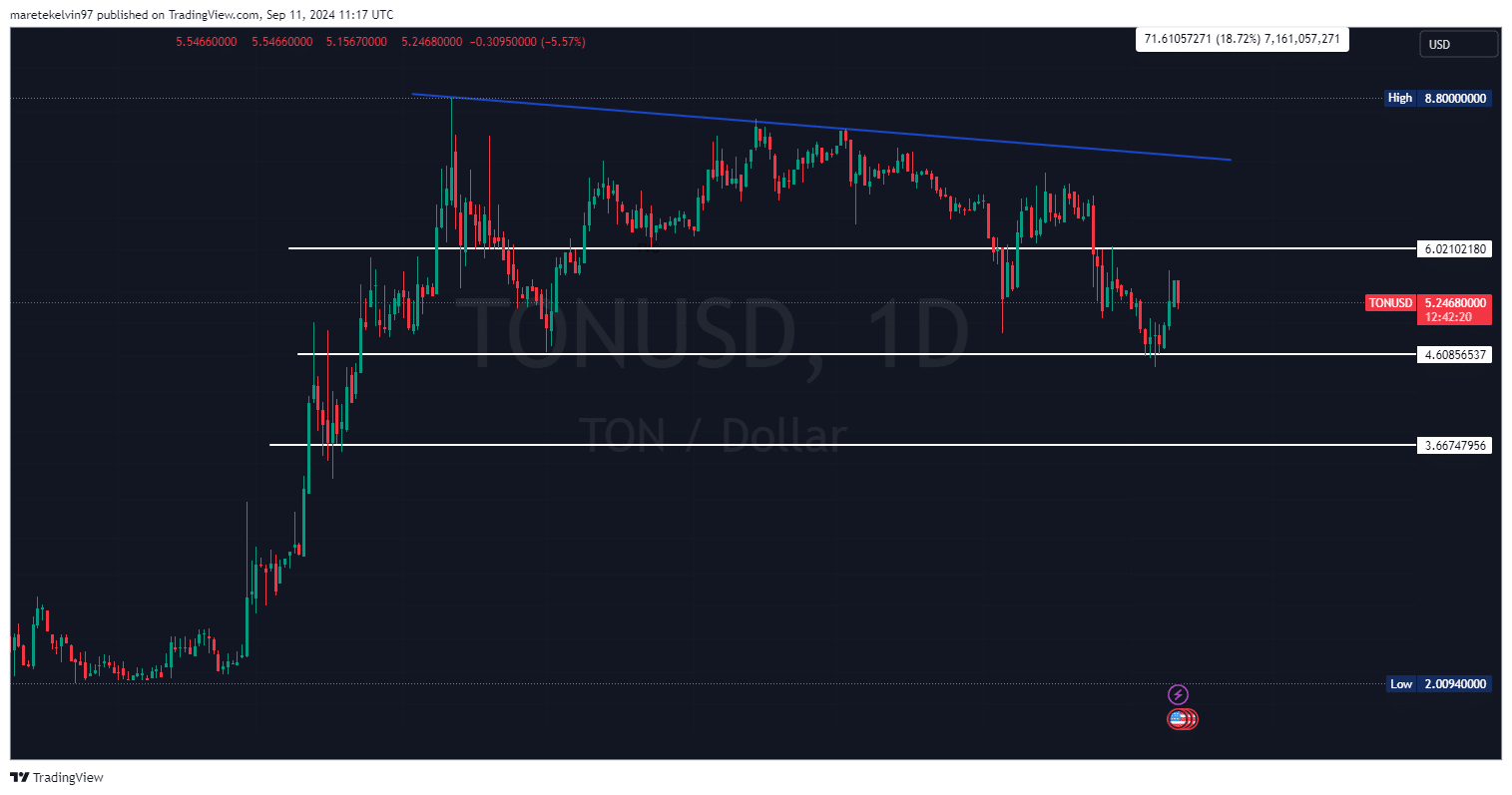

Toncoin price was approaching a key level at press time after a tremendous bullish rally. The altcoin had a 22% rally over the last three days before changing its trajectory.

In the last 24 hours, as per CoinMarketCap, the altcoin has plummeted by 1.06%, despite a long-term surge of 14.18% in the past seven days.

Source: TradingView

Whale on the move as trading activity surges

Toncoin bulls have defended the market with their increased large transactions, as indicated by the IntoTheBlock data. The number of large transactions spiked from 975 to 1.85K transactions.

The whale positions in the market suggest they anticipate an overall price rally towards the next resistance level in line at $6.02.

Source: IntoTheBlock

Adding more fuel to bullish bias, Toncoin trading activity has increased tremendously, with the number of active addresses surging significantly by 35% in the last 24 hours according to the IntoTheBlock data.

Source: IntoTheBlock

Source: IntoTheBlock

Bulls versus bears

Despite the bullish sentiments aforementioned, Toncoin has experienced a declining long-short ratio since 9th September. This may suggest a short-term price correction before the market resumes its upward trajectory.

The price correction may be nearing an end, as evidenced by increasing whale and trading activity.

Source: Coinglass

Is your portfolio green? Check out the TON Profit Calculator

The increasing whale activity and trading activity converges with the price action analysis. All indicators point to a bullish run continuation.

However, Toncoin may experience some correction in the short-term before rallying to the target price at around $6.02.