- Tron outperformed the rest of the top blockchain cohort in terms of transaction efficiency.

- TRX showed signs of potential pivot as the bears lose momentum, and whales accumulate.

TRON[TRX] has emerged as the blockchain network with the highest transaction value among its top peers. A recent analysis indicates that Tron ranks highest in cost-effectiveness.

According to CryptoQuant, Tron had the highest Transaction-to-Price Ratio (TPR). This metric compares the total daily transaction value to the price of the network’s native cryptocurrency.

Tron’s TPR outpaced major blockchain rivals, including Bitcoin [BTC], Ethereum[ETH], and Toncoin [TON].

This transaction efficiency positively impacted the Tron network. The daily transaction count grew from 3.4 million to 10.47 million over the last 12 months.

Source: IntoTheBlock

In the short term, daily transactions on the Tron network grew from 6.09 million on the 12th of January 12 to 8.37 million on the 20th of January. This surge reflects recent market excitement, showing Tron’s ability to capitalize.

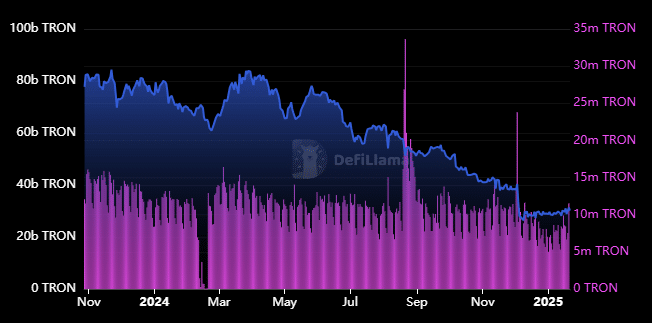

Tron network fees cooled down slightly in 2024 after reaching impressive levels earlier in the year.

For example, daily fees dipped below $6 million at the end of December as the Q4 2024 bearish momentum ran out of steam.

source: DeFiLlama

Tron fees soared to $11.49 million on 20 January, reflecting the recent transaction spike. TVL outflows also leveled out in the last six weeks.

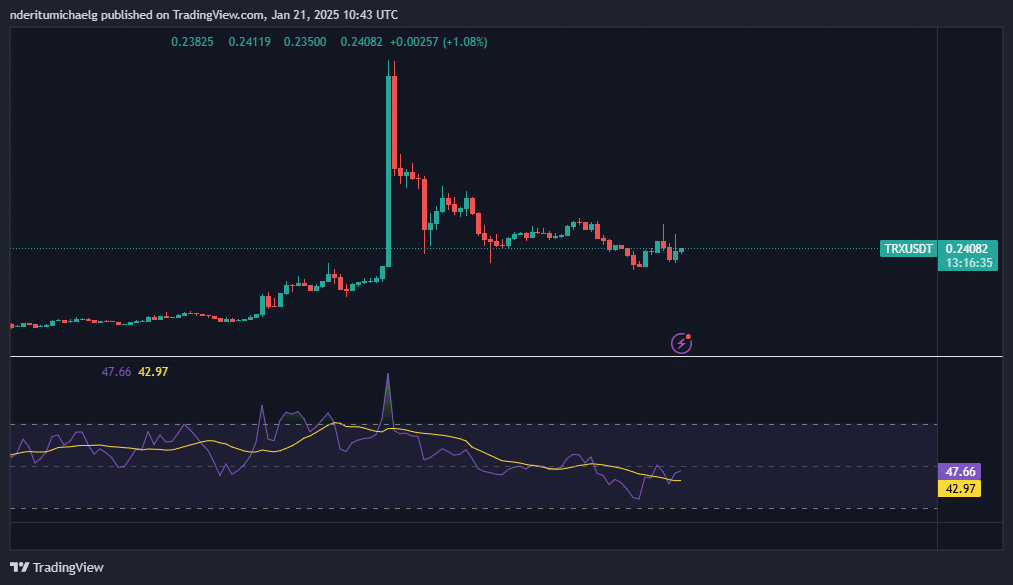

TRX consolidates, but can the bulls take advantage?

The bearish momentum that TRX has been experiencing since early December is finally showing signs of retreat. Price dipped by 51% from its December 2024 top to its $0.21 lowest price on the 13th of January.

It has consolidated since then, with a bit of upside to its $0.24 press time price.

Source: TradingView

Its RSI has shown a pivot, indicating building bullish momentum. Coinglass noted a surge in inflows since mid-January. Although outflows have persisted, inflows have offset the selling pressure.

This resurgence in demand coincided with the cooling down of selling pressure. TVL has shown positive flows, a volume uptick, and a slight surge in Open Interest.

Read TRON’s [TRX] Price Prediction 2025-26

Could these observations signal an upcoming pivot? Historical concentration data revealed that whale holdings grew from 56.43 billion TRX on the 1st of January to 56.89 billion TRX on the 20th of January.

This indicates that whales have been buying the dip. While it has not fueled a major rally, it is a healthy sign for the bulls.