- TRUMP has dominated spot trading volumes, growing to $38 million within a few days of its launch.

- Derivates and spot traders showed mixed market sentiments, with no clear direction.

Official Trump [TRUMP], the official memecoin of the 47th U.S. President, Donald Trump, was launched on the 17th of January, a few days before his inauguration and assumption of the presidential role.

A few hours into its launch, it crossed over a billion-dollar market capitalization, reaching $15.02 on the 19th of January. Since then, it has dropped by over 50%, with its press time market cap at $7.39 billion.

AMBCrypto found that while TRUMP appeared bullish, not all market sentiment aligned with this outlook.

Volume hike could open a new path

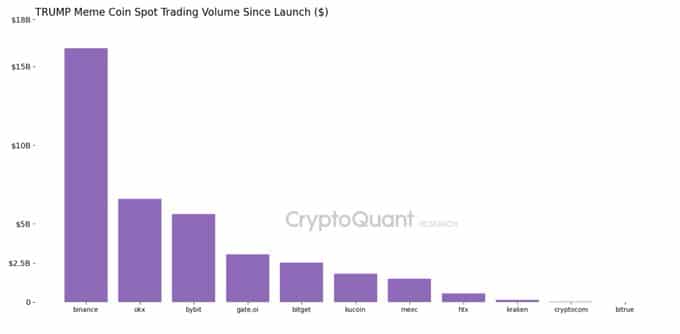

Following the launch of TRUMP across multiple centralized exchanges, the total spot trading volume grew significantly, reaching as high as $38 billion, according to CryptoQuant.

Binance, the world’s leading exchange, recorded the highest total spot trading volume, reaching $16 billion.

However, TRUMP saw its single highest trading volume hit $17 billion on the 19th of January, which positively impacted the price, as TRUMP reached an average of $62.

Source: CryptoQuant

However, in the past 24 hours, TRUMP’s volume and price have simultaneously declined, dropping by 59.01% to $8.73 billion and 13.74% to $36.97, showing weakening momentum.

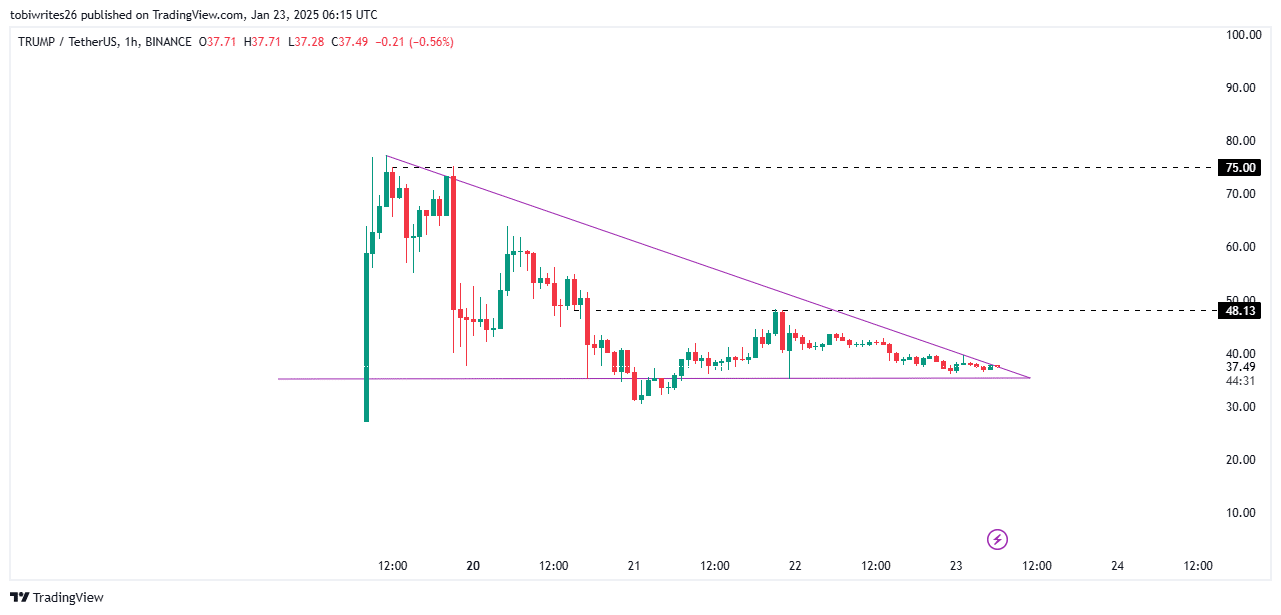

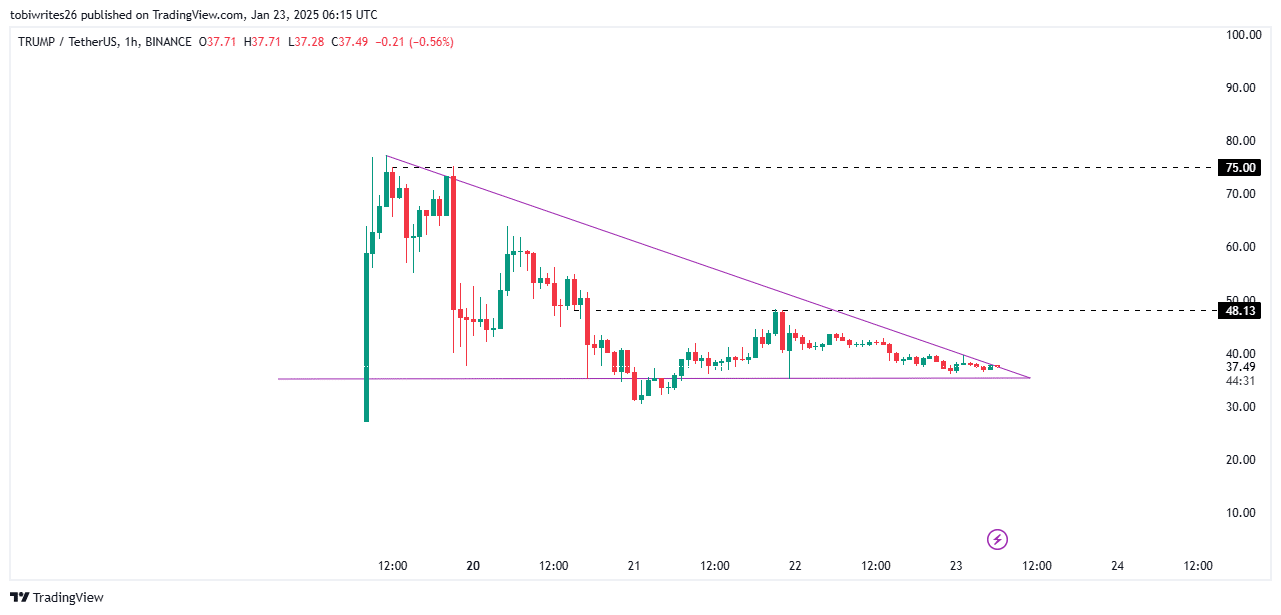

AMBCrypto observed on the chart that this weakening momentum could favor TRUMP as it is trading within a bullish structure.

TRUMP is being accumulated

On the chart, TRUMP presents the potential for an upswing as it has entered a bullish accumulation zone, indicated by a symmetrical triangle pattern.

This pattern consists of converging support and resistance, within which the price trades. After an extended period, it typically breaks out as it nears the point of convergence.

Source: TradingView

When this happens, there are two major price targets for TRUMP. First, it is likely to reclaim $48.13 before making a final rebound to $75.00, close to its all-time high.

On-chain metrics are giving mixed signals at this point, with no clear indication of the price’s next direction.

No clear signal ahead

While TRUMP is in a bullish accumulation zone, there is no definitive signal as on-chain metrics remain divided.

Press time data on Coinglass showed that while the Funding Rate was bullish, the exchange netflow indicated bearish trends.

The Funding Rate measures derivative traders’ attitudes in the market. When it’s positive—like in TRUMP’s case, with 0.0097%—it suggests more traders are convinced about the market rally.

Read Official Trump’s [TRUMP] Price Prediction 2025–2026

Spot traders, on the other hand, have turned bearish and have started selling the token. In the past 24 hours, over $58.85 million worth of TRUMP was sold, adding downward pressure.

When key metrics provide mixed signals, fundamental factors could play an impactful role. Policies from Donald Trump, perceived as net positive for the ecosystem, could catalyze a rally.