- DOGE could soar by 17%, reaching the $0.175 level, if it closes a daily candle above the $0.15 level.

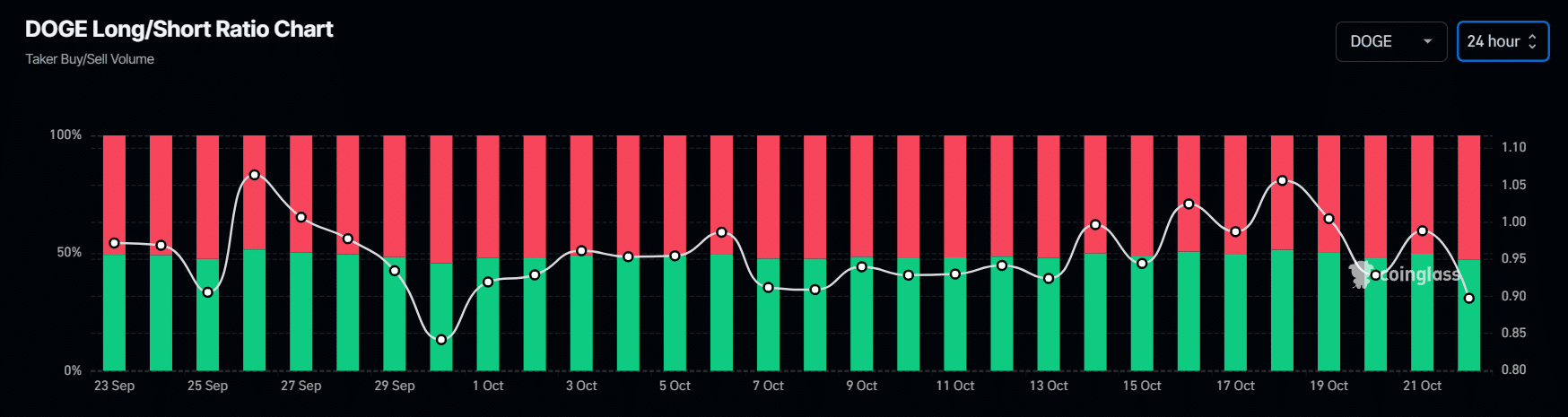

- DOGE’s falling Open Interest and a Long/Short Ratio below 1 indicated weak bearish sentiment among traders.

Dogecoin [DOGE], the world’s largest memecoin by market cap, continues to gain significant attention from crypto enthusiasts following its impressive performance and recent rally.

However, it is currently consolidating within a tight range, which appears to be a price correction.

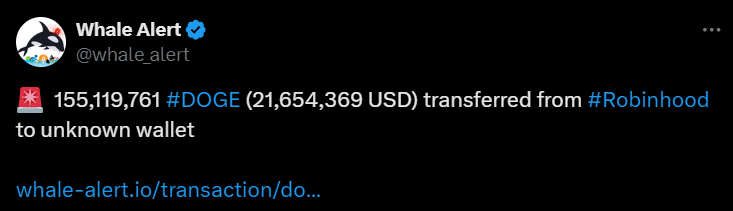

Whale adds 155 million DOGE

Amid this consolidation, a whale seized an opportunity in DOGE and made a notable transaction.

On the 22nd of October 2024, blockchain transaction tracker Whale Alert posted on X (formerly Twitter) that the whale had transferred 155 million DOGE tokens worth $21.65 million, from the Robinhood cryptocurrency exchange to an unknown wallet.

Source: X

It appears that the whale might have withdrawn these significant tokens from Robinhood, likely due to bullish price action and positive market sentiment.

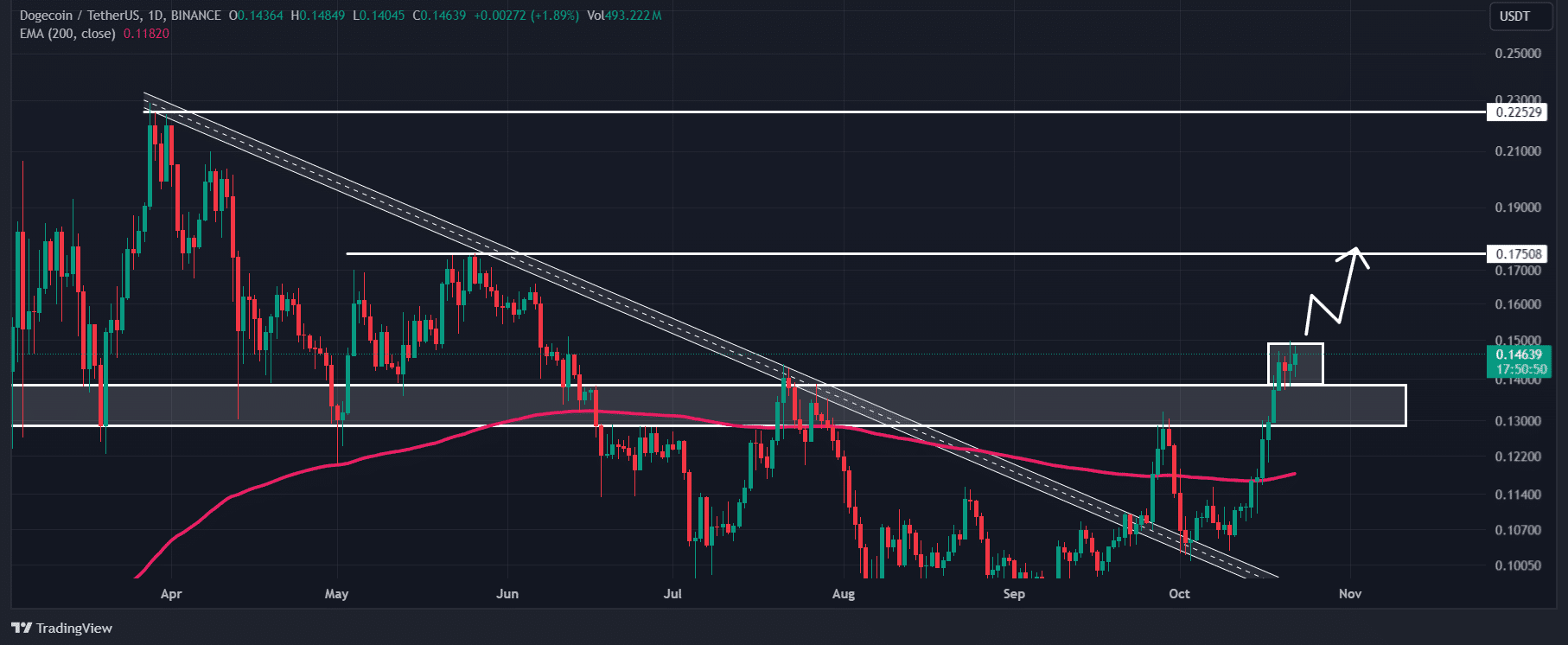

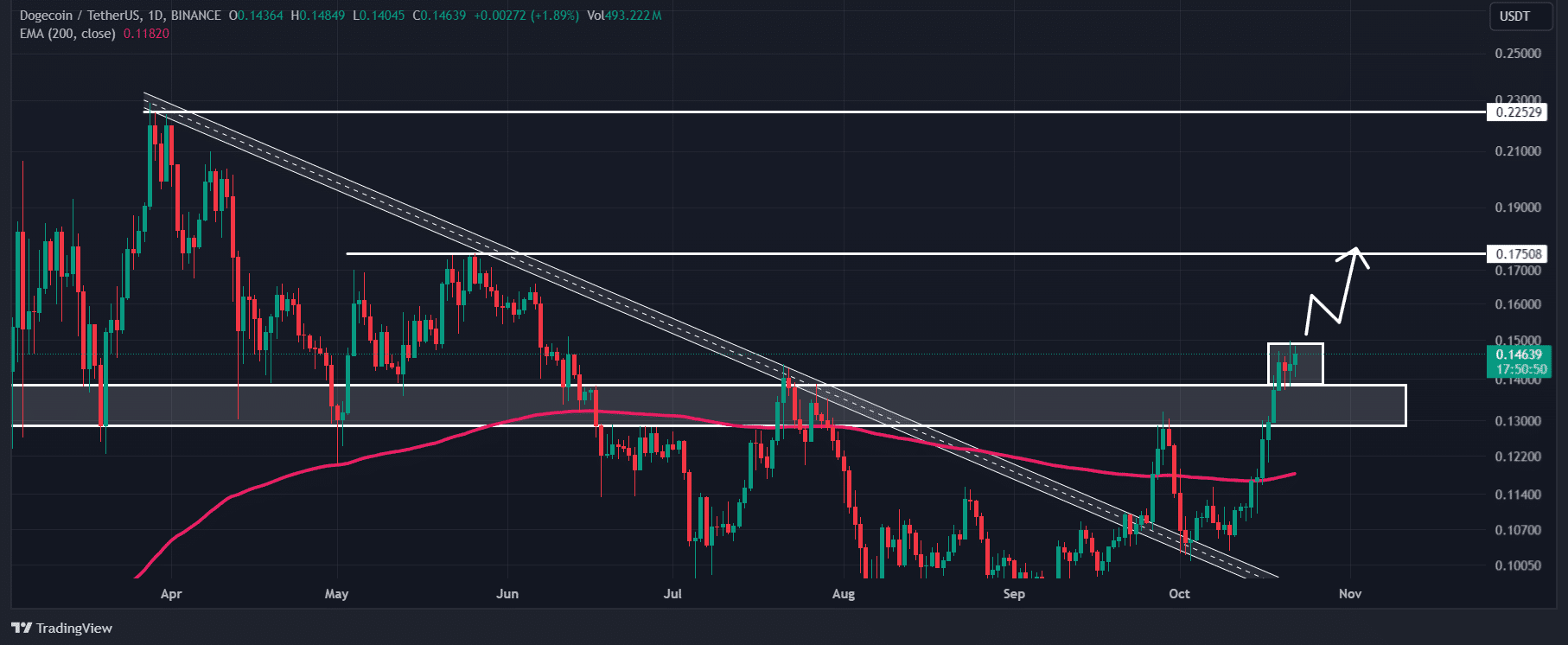

Dogecoin’s technical analysis and key levels

According to AMBCrypto’s technical analysis, DOGE appeared bullish as it had recently broken out and closed a daily candle above a strong resistance level of $0.138.

Source: TradingView

This notable breakout occurred during its 40% rally, but the price was consolidating within a tight range.

This consolidating was a positive sign for DOGE holders, as it suggested an accumulation phase before the next upside rally.

Based on recent price action and historical momentum, if DOGE breaks out and closes a daily candle above the consolidation zone at the $0.15 level, there is a strong possibility it could soar by 17%, reaching the $0.175 level in the coming days.

However, this bullish thesis will only hold if DOGE breaks out and closes a daily candle above the consolidation zone.

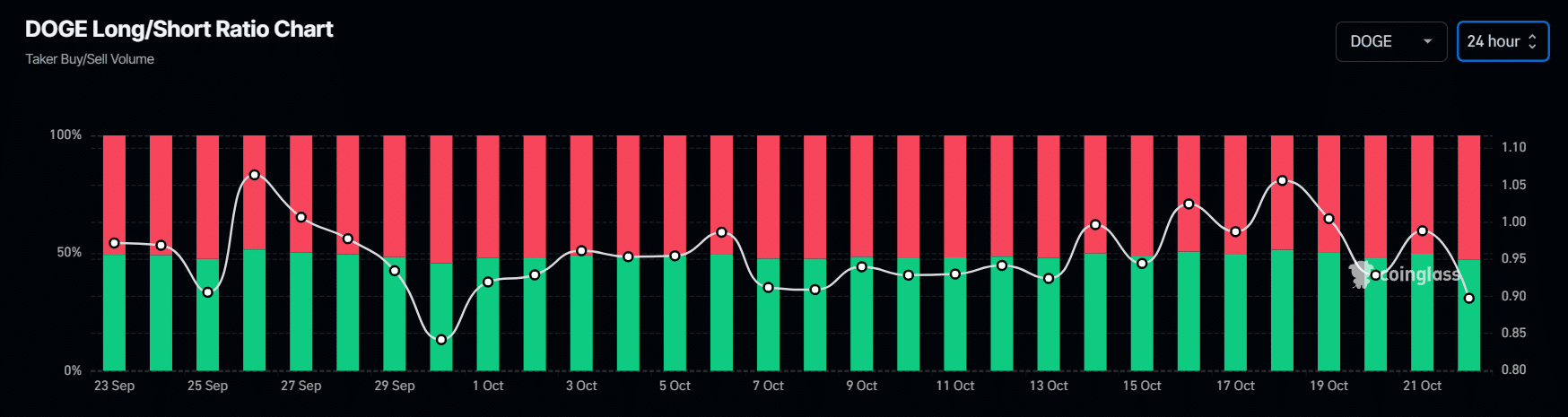

DOGE’s on-chain metrics

Despite this bullish outlook, DOGE’s chain metrics currently present a weak trader’s interest on the long side. According to the on-chain analytics firm Coinglass, DOGE’s Long/Short Ratio stood at 0.89, indicating bearish sentiment among traders.

Source: Coinglass

Additionally, its Open Interest had dropped by 3.5%, suggesting that traders have either liquidated their holdings or exited their positions due to the correction.

The combination of falling open interest and a Long/Short Ratio below 1 indicates weak bearish sentiment among traders.

Realistic or not, here’s DOGE market cap in BTC’s terms

At press time, DOGE was trading near $0.144, at press time. The memecoin experienced a price decline of over 1.8% in the past 24 hours.

During the same period, its trading volume dropped by 2.6%, indicating a slight decline in participation from traders.