- AVAX could soar by 23% to hit the $50.50-level if it holds the $40-level.

- Traders seemed to be over-leveraged at $39.24 on the lower side and $41.64 on the upper side

At the time of writing, Avalanche’s native token AVAX appeared bullish, with the altcoin poised for significant upward momentum on the charts. In fact, it formed a bullish price action pattern on its daily timeframe.

This, on the back of the larger crypto-market, including the likes of Bitcoin (BTC), Ethereum (ETH), and Solana (SOL), showing strength too.

80% of top AVAX traders go long

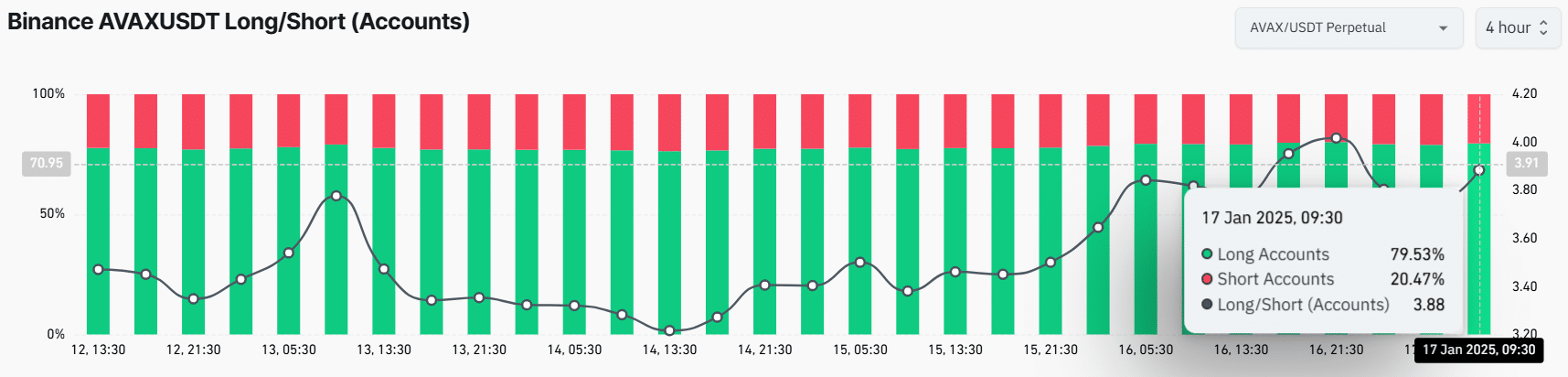

Needless to say, amid this bullish outlook, traders appear to be enthusiastic as they have been making strong bets on the long side, as reported by the on-chain analytics firm CoinGlass.

At press time, Binance’s AVAX/USDT Long/Short ratio stood at 3.88, indicating that for every 3.88 long positions, there was one short position. This alluded to strong bullish market sentiment among the altcoin’s traders.

Source: Coinglass

Data further revealed that 79.53% of top AVAX traders on Binance held long positions, while 20.47% held short positions.

$6.65 million of AVAX outflows from exchanges

Given this bullish outlook, not only traders but also long-term holders have shown strong interest in AVAX. Data from CoinGlass’s spot inflow/outflow revealed that exchanges saw outflows of $6.65 million in the last 24 hours alone

Such significant outflows from exchanges are a bullish sign for token holders, as the withdrawal of these tokens by long-term holders from exchanges to their wallets suggests potential accumulation. This could lead to buying pressure and further drive an upside rally on the charts.

AVAX price action and key levels

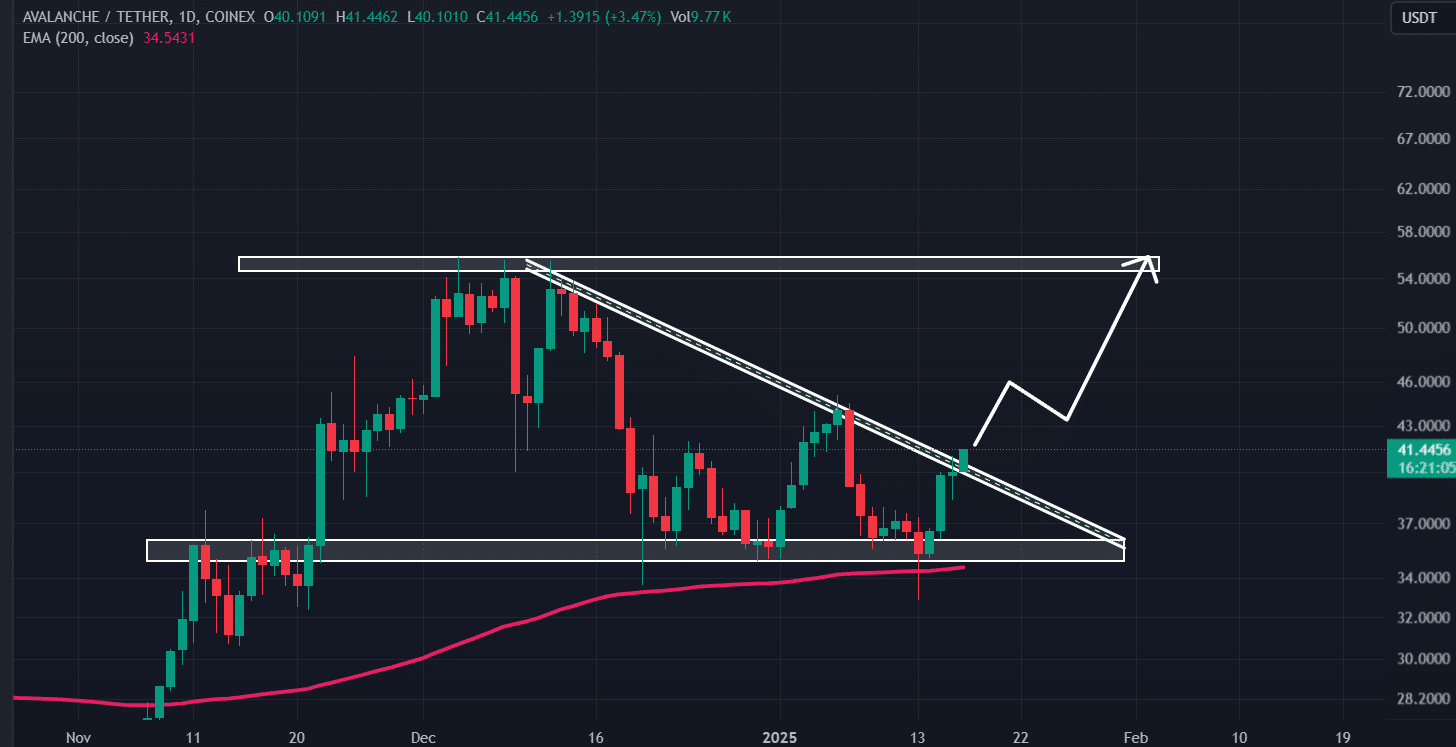

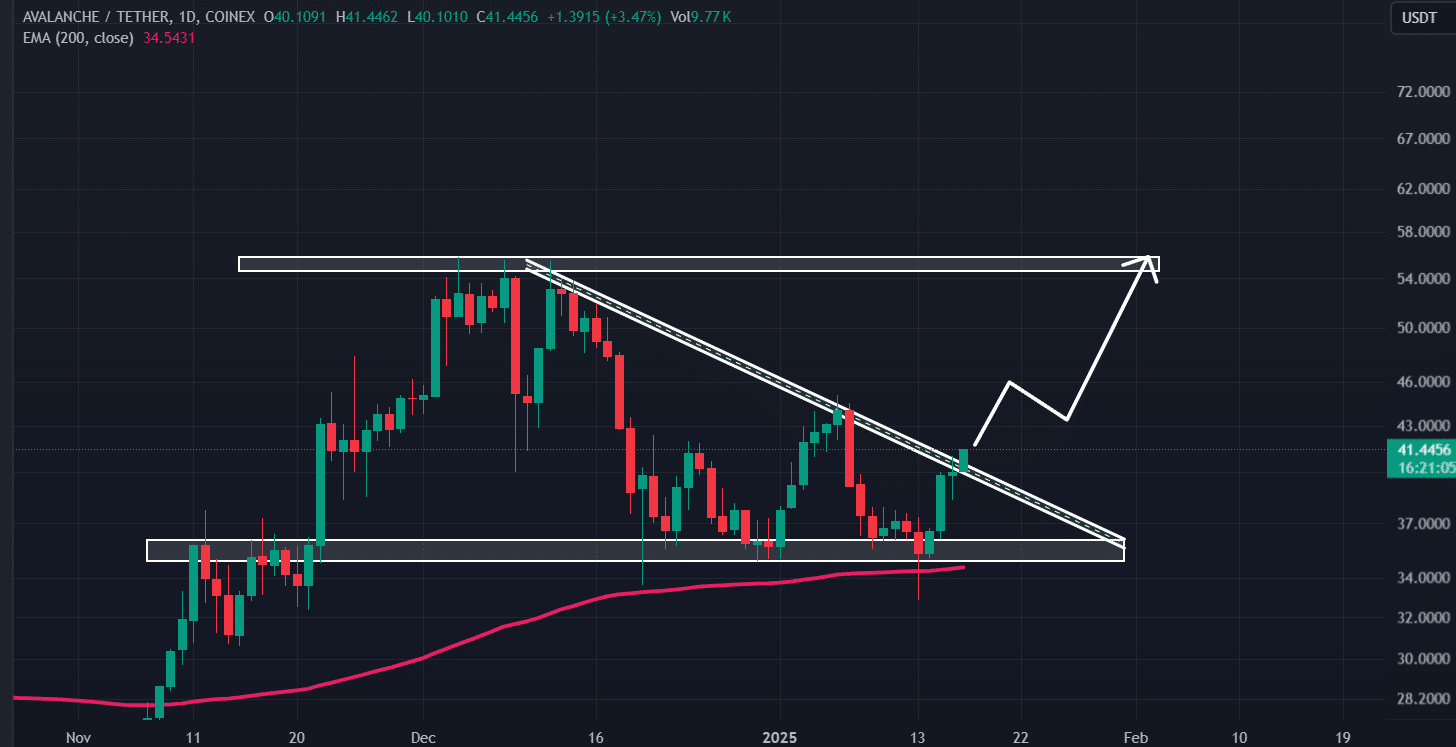

According to AMBCrypto’s technical analysis, AVAX appeared bullish after recently breaking out from a trendline it has been following since December 2024.

Source: TradingView

During this period, the altcoin faced resistance three times, with price declines occurring each time. However, as the market sentiment changed, AVAX strongly breached this trendline resistance, with the crypto now poised for a massive upside rally.

Based on its recent price action and historical momentum, if AVAX stays above the $40-level, there is a strong possibility it could soar by 23% to hit $50.50 in the future.

Major liquidation levels

Finally, traders seemed to be over-leveraged at $39.24 on the lower side and $41.64 on the upper side, as revealed by CoinGlass’s exchange liquidation map.

At these levels, traders have built $7.90 million worth of long positions and $5.70 million worth of short positions. If the price moves in either direction, these positions will be liquidated.