- Fantom could potentially see a 234% price increase due to a hidden bullish divergence.

- Javon Marks suggests FTM’s price could reach a high of $3, triggering a substantial rally.

Fantom [FTM] has experienced more modest gains compared to other major altcoins this year. While altcoins like Solana and Toncoin have surged by over 100%, FTM has risen by only 40% year-to-date.

Recently, FTM has faced downward pressure, declining by 5.7% in the past day to a current price of $0.3393. Despite this short-term setback, the asset displayed a strong performance last week, climbing over 15% and briefly reaching above $0.36 on Sunday, 11th August.

234% rally on the horizon

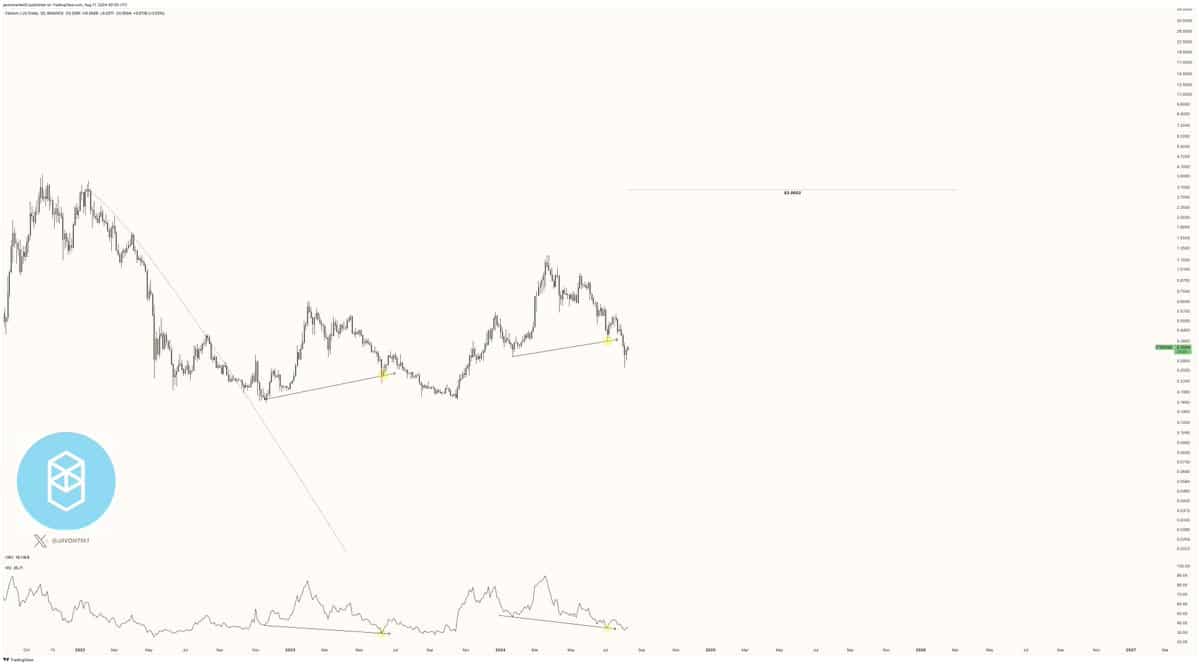

Javon Marks, an analyst within the crypto community, has highlighted a promising scenario for FTM.

According to Marks, Fantom is exhibiting signs of a Hidden Bullish Divergence on its charts, a technical signal often associated with potential upward movements in price.

This pattern suggests that despite recent price falls, the underlying momentum could be gearing up for a considerable upward trajectory.

Hidden Bullish Divergence occurs when the price records a higher low while the oscillator makes a lower low. This discrepancy between price action and momentum often indicates continuing bullish sentiment that could lead to significant price increases.

Marks speculates that this setup could propel FTM to increase by as much as 234%. Such a rally would not only reverse the recent losses but could push the cryptocurrency to new heights, potentially reaching the $3 mark.

This optimistic outlook is further bolstered by Fantom’s recent price activities which have shown volatility with a potential for recovery. Marks pointed out that similar retracements in the past have preluded substantial rallies.

Source: Javon Marks on X

Marks explained in a post,

“Fantom’s recent confirmation of a Hidden Bullish Divergence, although followed by a retracement, aligns with previous patterns that preceded major price recoveries”

This pattern suggests a possible surge towards a long-term target of $3.0053, a crucial breakout level for FTM.

Fantom (FTM) fundamental outlook

While the technical analysis paints a bullish future, it’s essential to consider FTM’s underlying fundamentals.

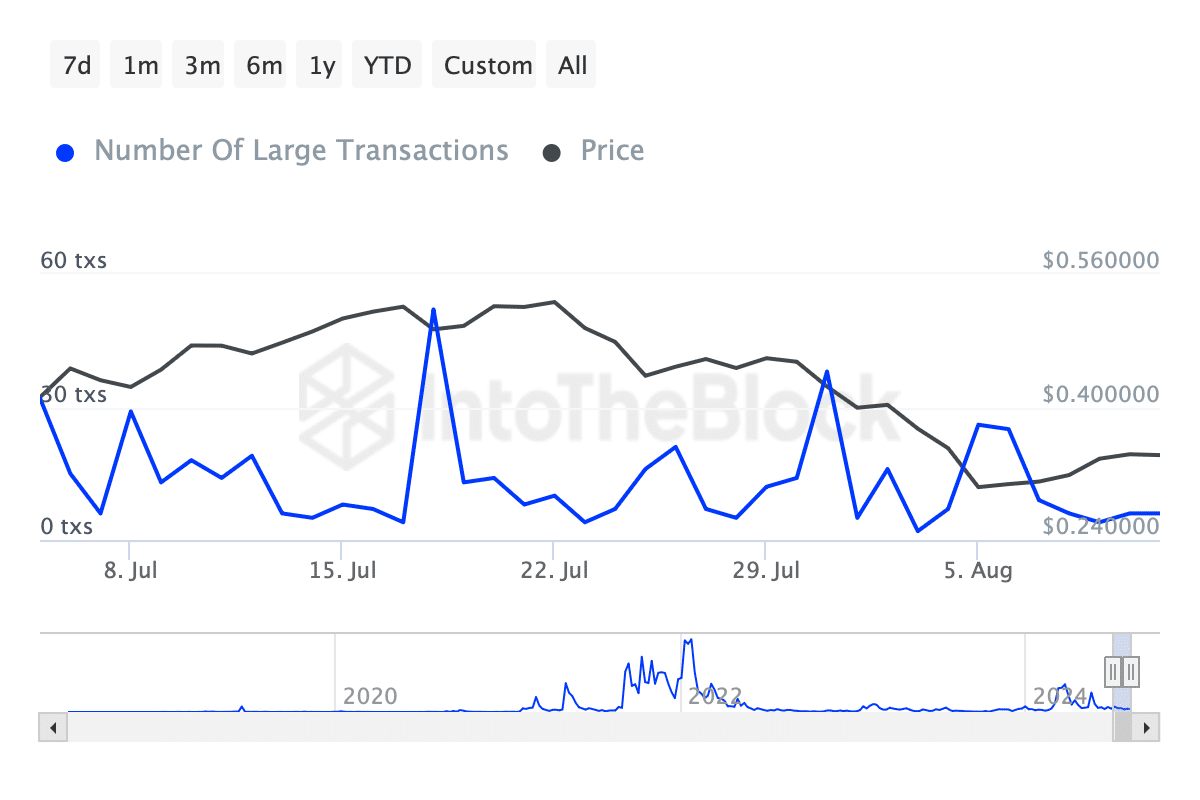

The number of large transactions (whale transactions), which can be a bellwether for smart money movements, has seen a notable decrease from over 20 significant transactions last week to just 6 this week.

Source: IntoTheBlock

This reduction in whale activity could suggest a temporary pullback in investor confidence or a consolidation phase before a potential rally.

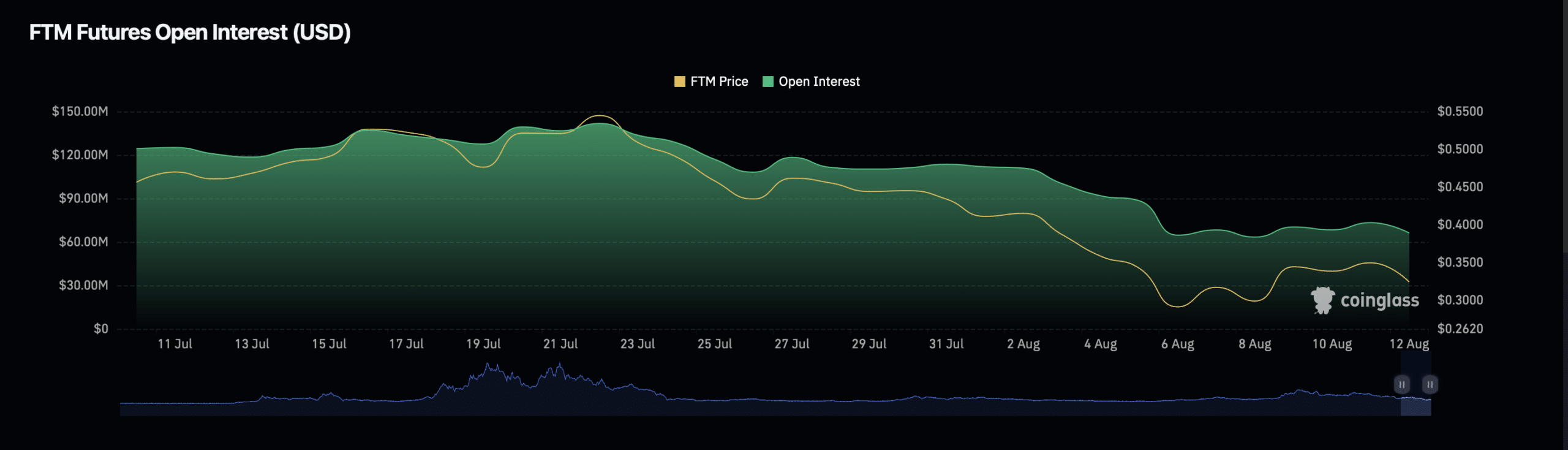

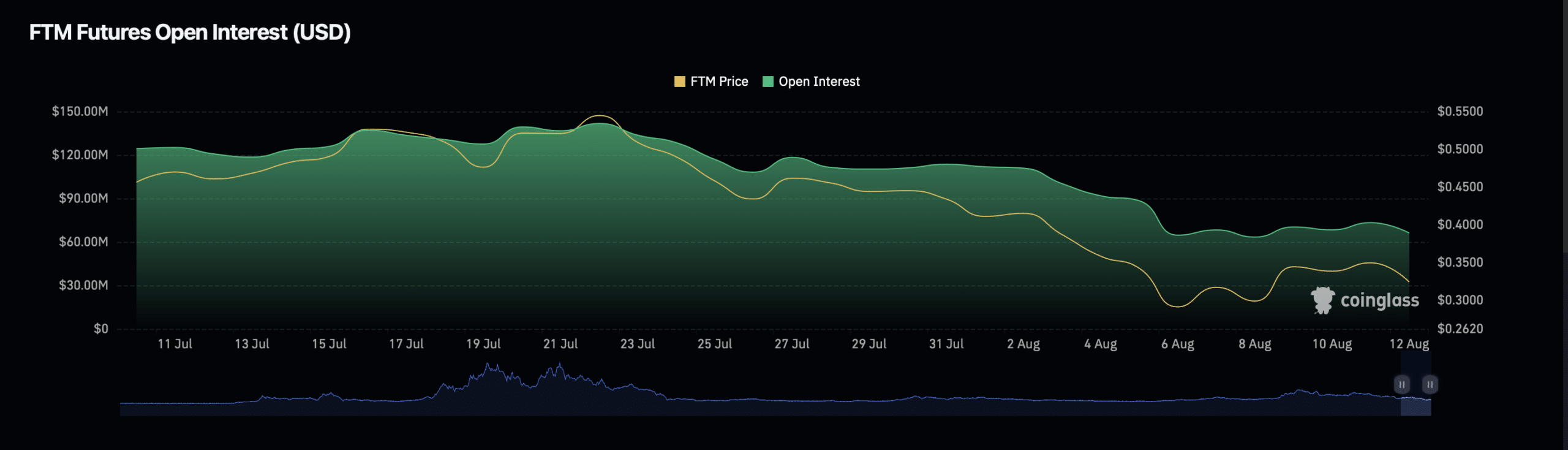

Furthermore, the open interest in FTM, which reflects the total number of outstanding derivative contracts, such as futures that have not been settled, has also seen a mix of trends.

Source: Coinglass

Realistic or not, here’s FTM’s market cap in SOL terms

While there’s been a 9.2% decrease in open interest, suggesting a cooling off from leverage positions, the open interest volume has surged by 47.59%.

This increase could indicate new money entering the market, possibly in anticipation of future price increases.