- Memecoins have been outperforming altcoins in market activity and hype.

- Tokens like Dogecoin and Pepe are outpacing altcoins in trading volumes.

While altcoins like Ethereum [ETH] and Solana [SOL] have long dominated the spotlight, memecoins are now taking center stage, driving both hype and market performance.

With iconic tokens like Dogecoin [DOGE], Shiba Inu [SHIB], and Pepe [PEPE] seeing significant price movements, many are beginning to wonder: Is memecoin season the new altcoin season that everyone’s been waiting for?

The numbers behind the hype

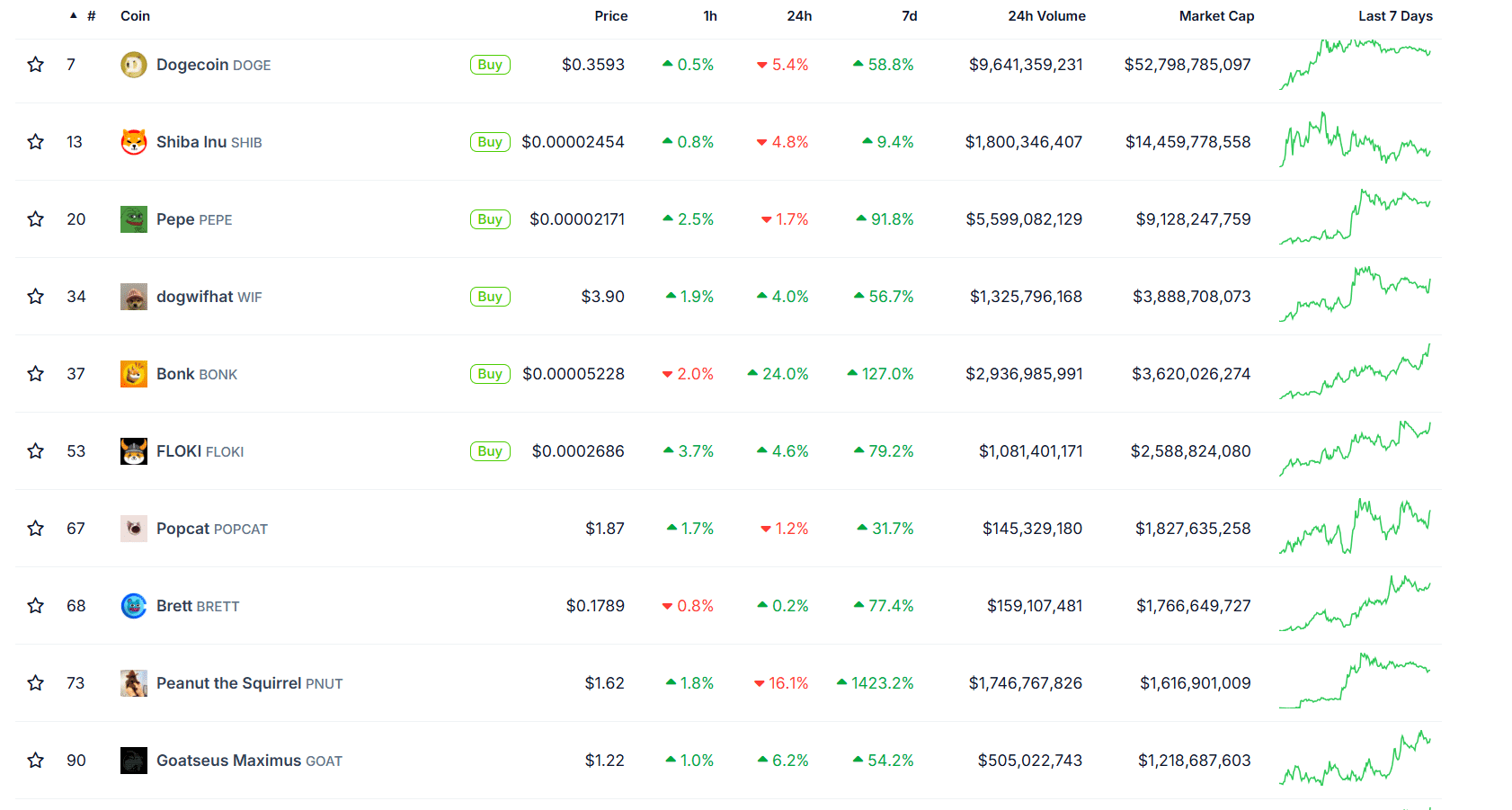

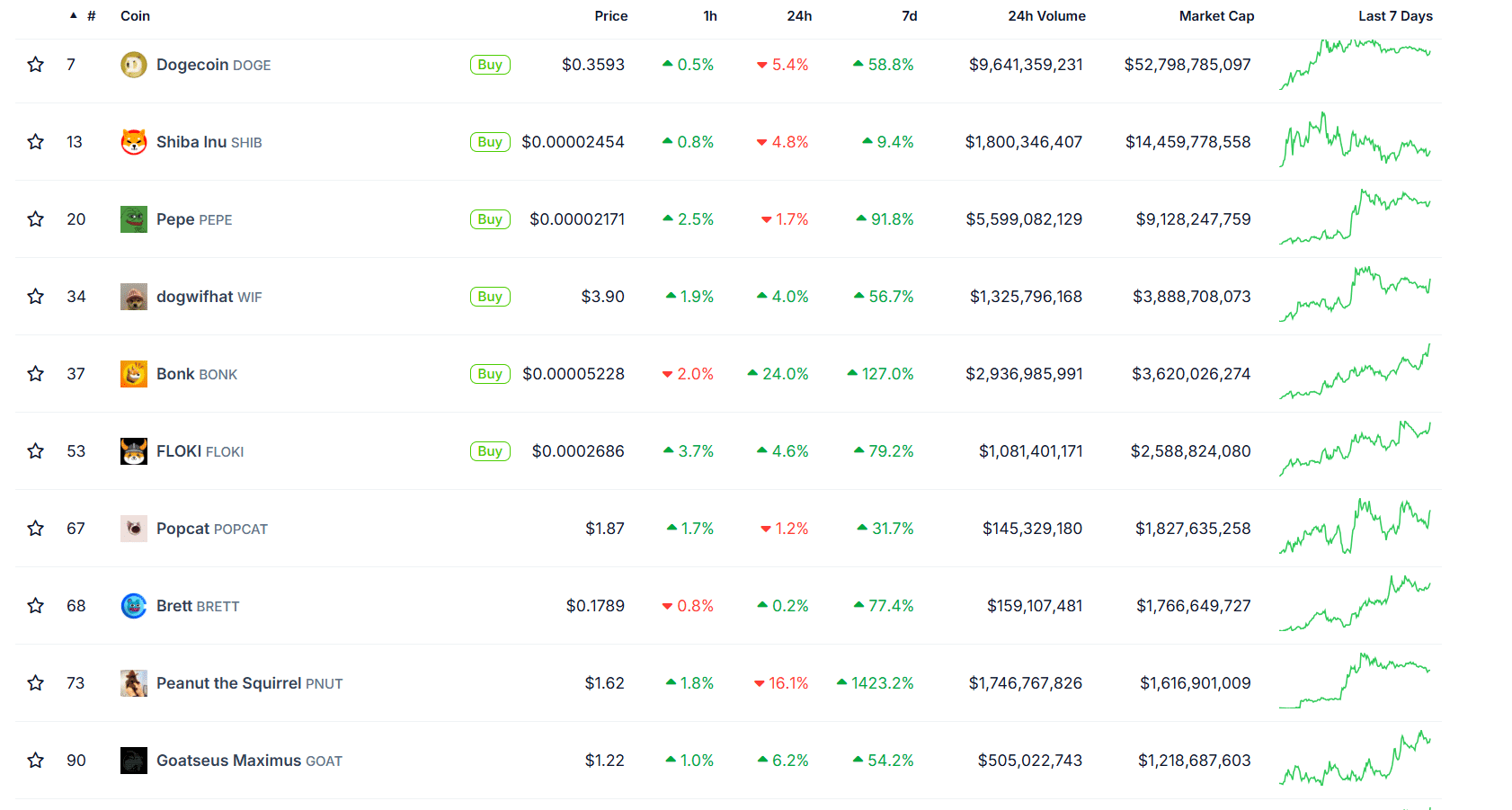

Source: CoinGecko

Memecoins are flexing their market muscle, with Dogecoin leading 24-hour trading volumes at $9.6 billion, followed by Pepe at $5.6 billion and Shiba Inu at $1.8 billion.

These figures rival top altcoins, underscoring their growing liquidity and activity.

Smaller tokens like Bonk [BONK], Peanut the Squirrel [PNUT], and Goatseus Maximus [GOAT] are also surging. Bonk’s 127% price spike in a week reflected rising speculative interest beyond established names.

While memecoins are proving their market presence, questions linger about their long-term viability.

Key differences and parallels

Altcoins focus on utility, powering DeFi and NFTs, while memecoins thrive on hype and speculative trading. Both, however, depend on community engagement.

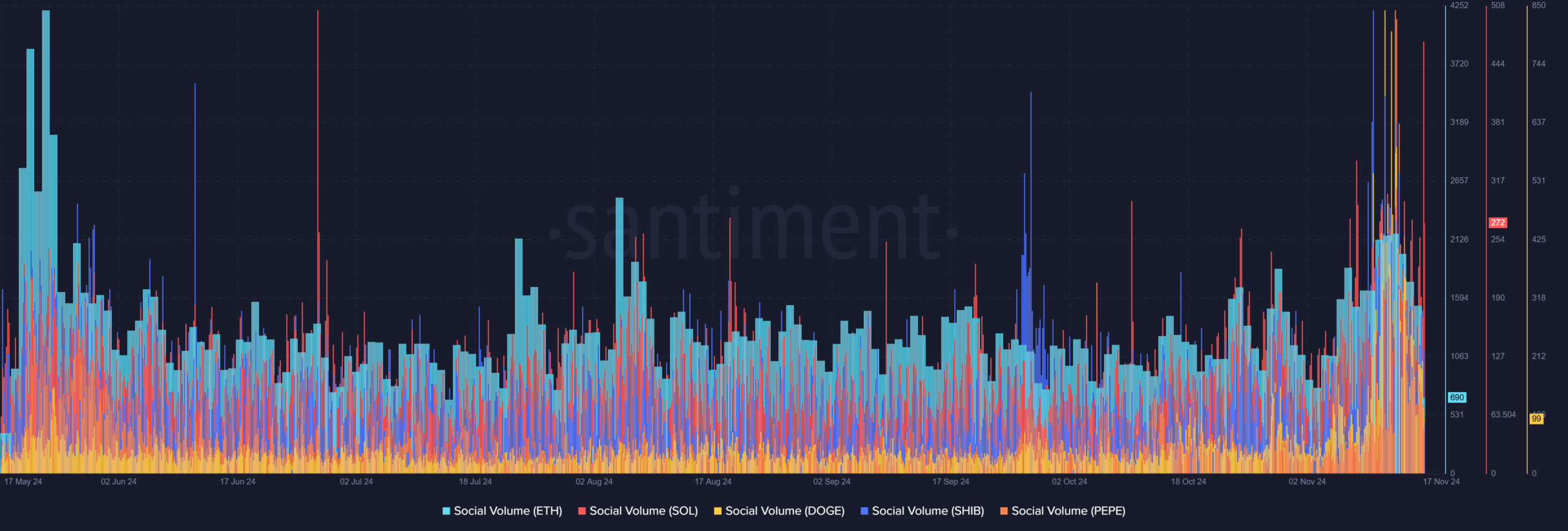

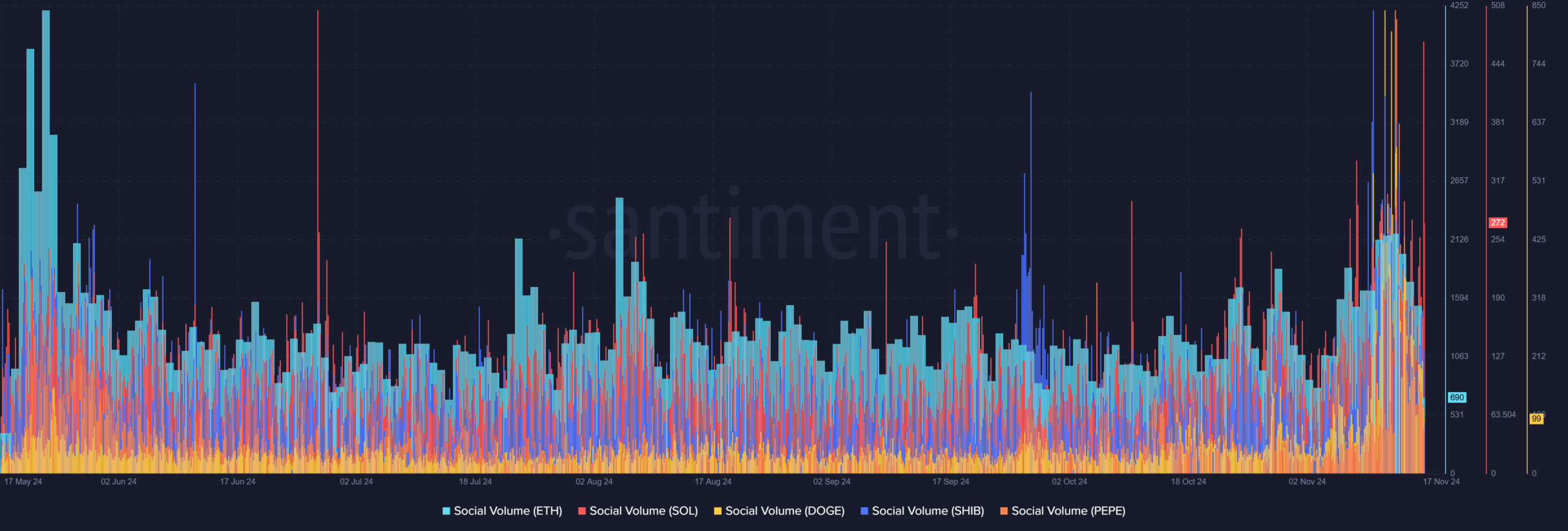

Source: Santiment

Altcoins show steady social volume, reflecting institutional and developer interest. In contrast, memecoins exhibit sharp spikes, with DOGE and PEPE leading recent surges fueled by viral trends.

Shiba Inu, however, struck a balance, showing consistent activity as it builds an ecosystem. This divide illustrated altcoins’ utility-driven growth versus memecoins’ reliance on social momentum.

Historical price volatility also reveals memecoins’ speculative nature, with memecoins showing sharp fluctuations during hype cycles.

On the contrary, altcoins demonstrated comparatively stable price movements, reflecting utility-driven demand and institutional backing.

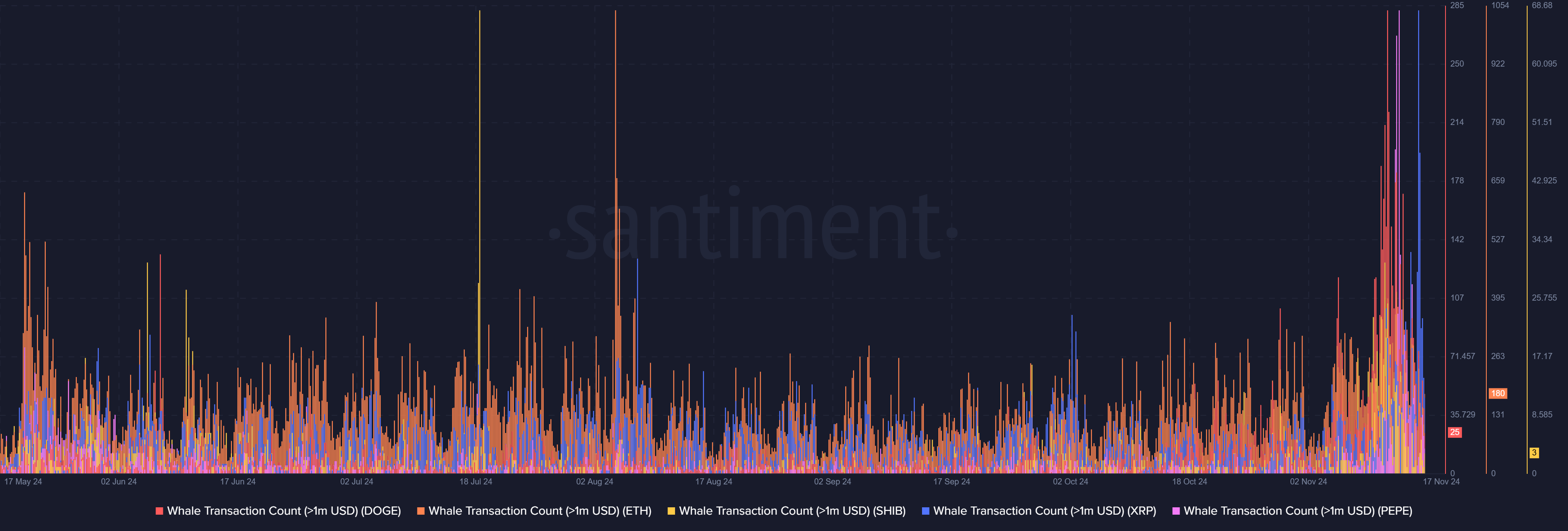

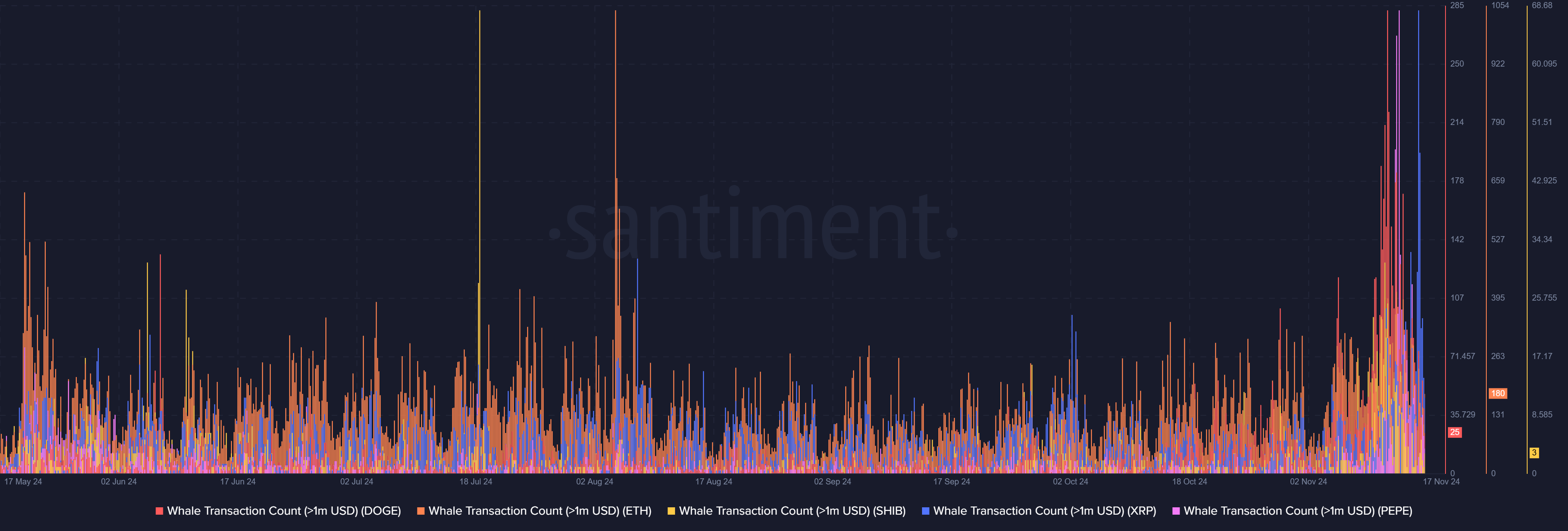

Source: Santiment

Santiment’s data showed that memecoins experienced sharp, sporadic whale activity driven by speculation, while altcoins maintained steadier transaction volumes.

Meme-based coins spark short-term spikes, but lacked the sustained growth seen in altcoins with stronger ecosystems. Their long-term relevance hinges on evolving beyond hype into broader blockchain applications.

Is memecoin season the new altcoin season?

Memecoins have captured the spotlight, driving speculative frenzies and short-term gains. While their viral appeal propels market surges, they lack the long-term utility and adoption seen in altcoins.

Meme-based coins may dominate the hype cycle, but their reliance on social momentum makes their future uncertain.

Whether this is the altcoin season reimagined or just a fleeting trend depends on their ability to transcend speculation and deliver lasting blockchain value.