- BONK faces a massive 840.4 billion token liquidation at $0.00002838.

- Recent 4% price surge aims to test the rising wedge support.

With such exciting volatility, the crypto market is still attracted to meme coins. Among them, BONK has become a recognized player among investors and enthusiasts.

Recently, this Solana based token has undergone considerable price swings that saw it break down below an important support level. As BONK attempts to regain lost ground, the market eagerly watches for a pivotal moment in its journey.

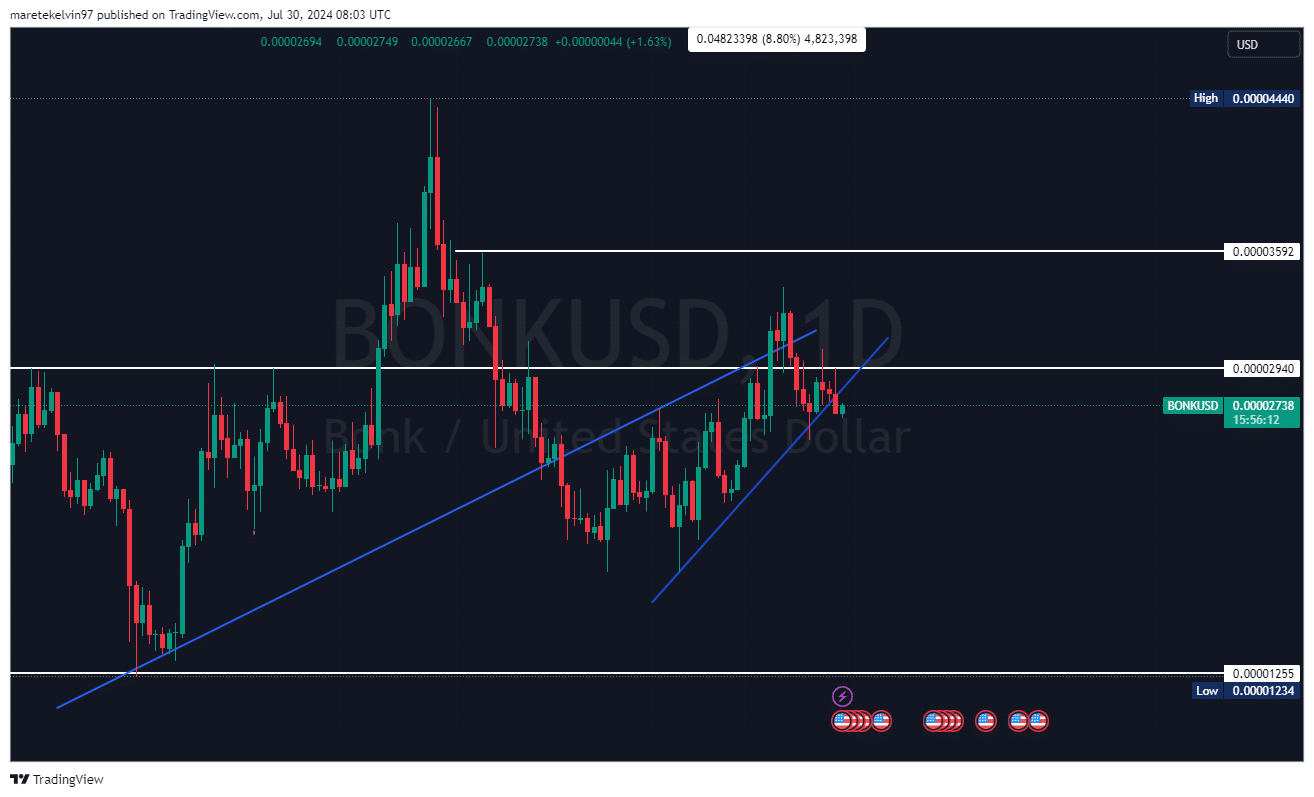

The price of BONK has recently shown signs of life, surging by 4% in what may be a retracement to test a critical rising wedge support level.

This move comes after a break below the key support level on 29th July, with traders left to wonder if it is just a short-term bounce or maybe the start of a bigger recovery.

As BONK approaches the rising wedge support level, investors are on the lookout for a breakthrough or rejection. If it can successfully breach this level, it may indicate renewed bullish rally.

However, if the move is rejected, it could result to further dips.

Source: Tradingview

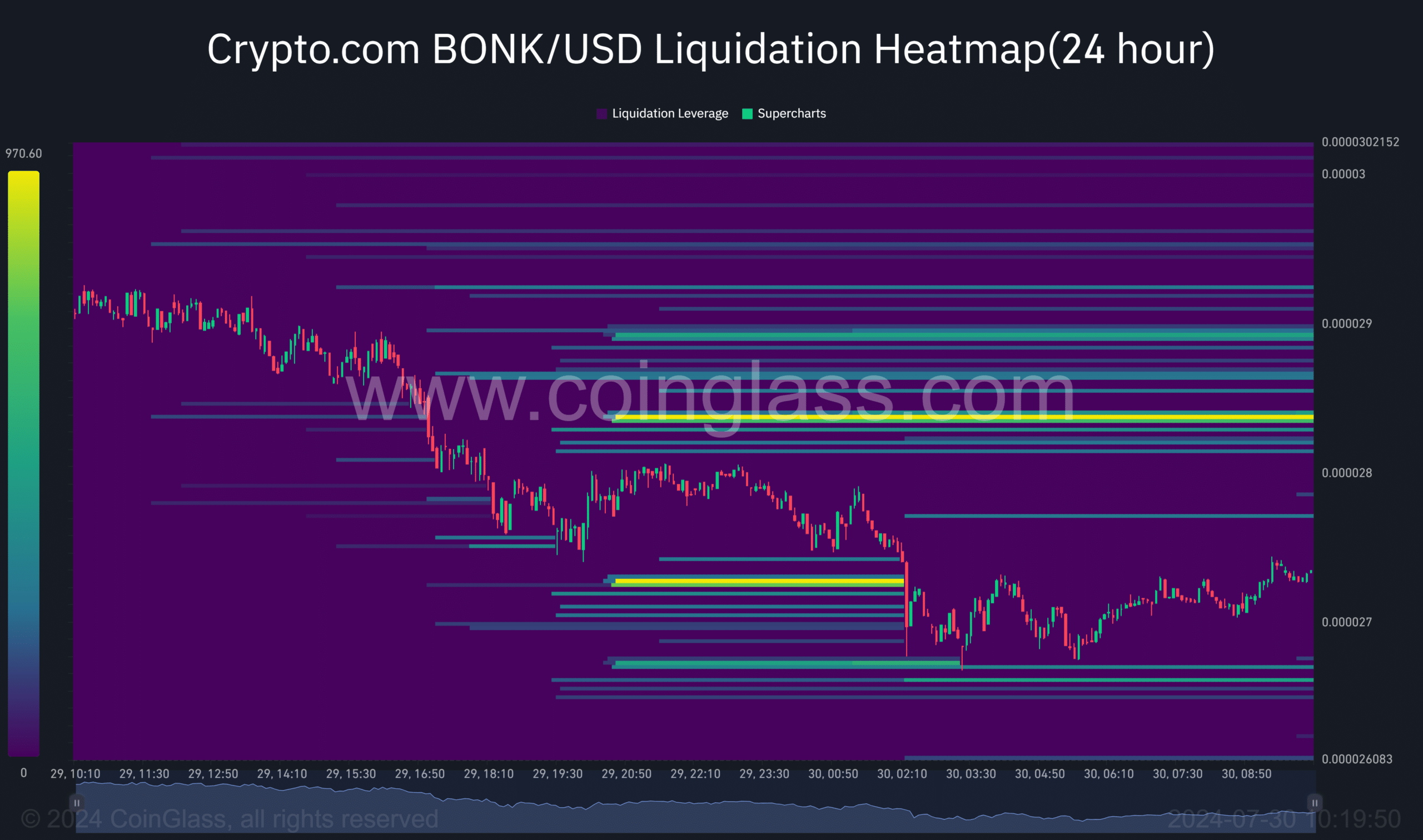

Liquidation pool influence

The large reserve of liquidated tokens at $0.00002838 presents a chance and a threat at the same time for the BONK price.

If the price gets to this level, it may lead to more liquidations, which may play a part in pushing its price further up. However, the large number of shares could also be a strong resistance level in the pool.

Source: Coinglass

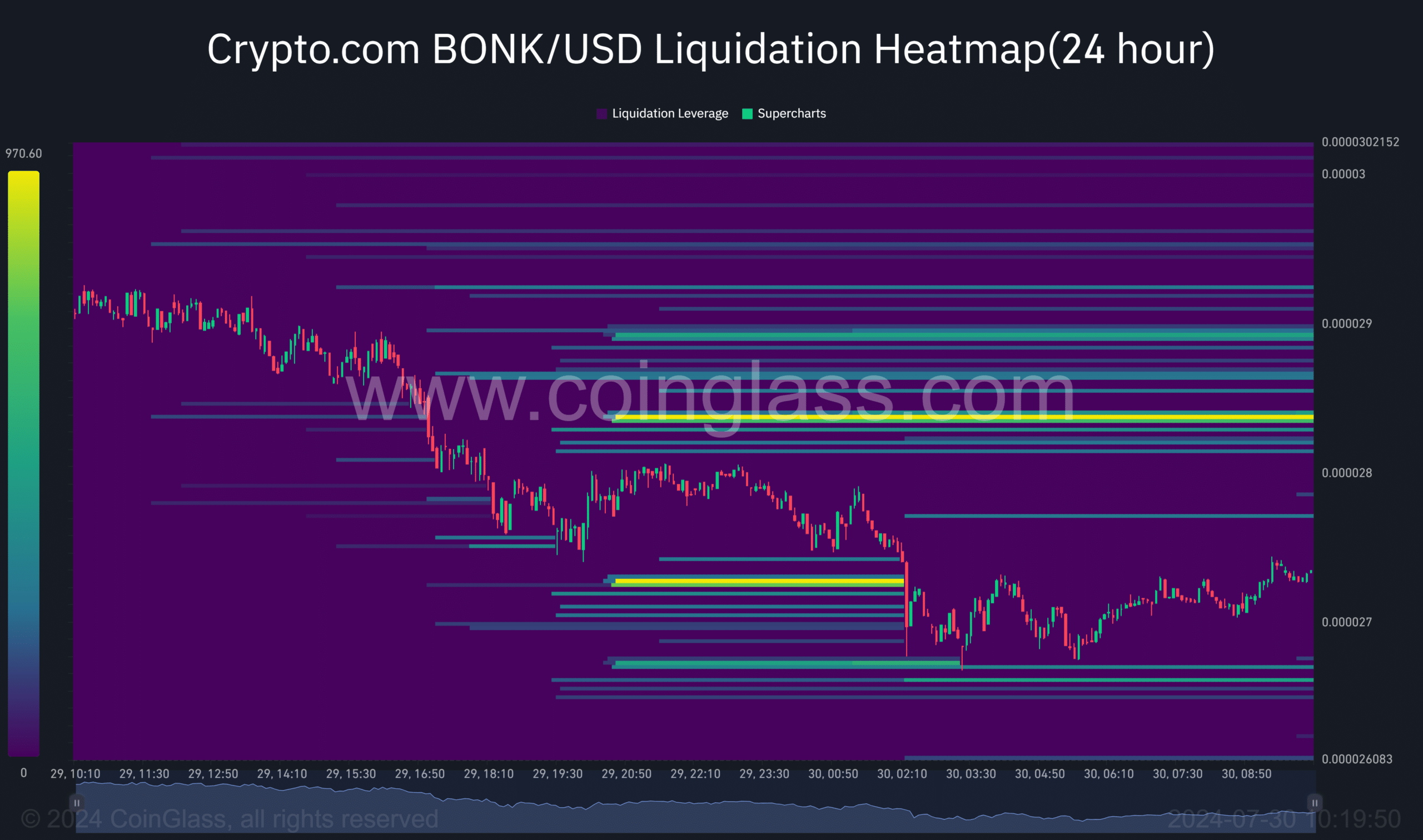

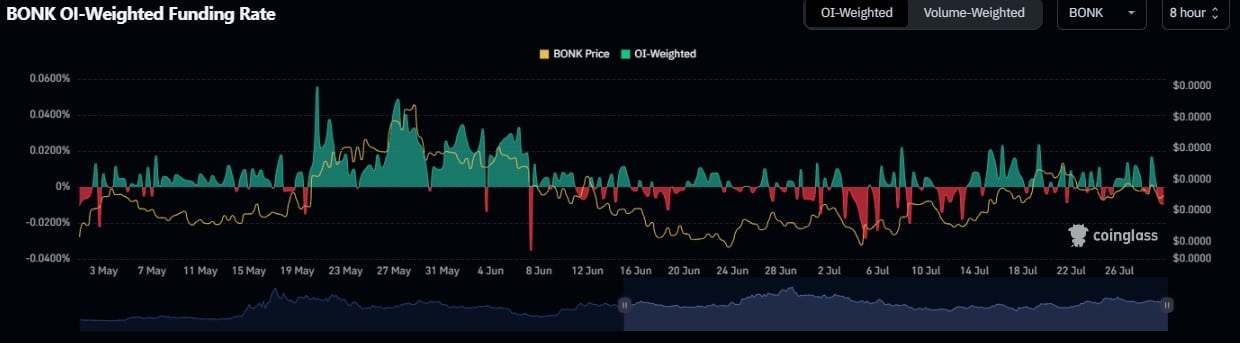

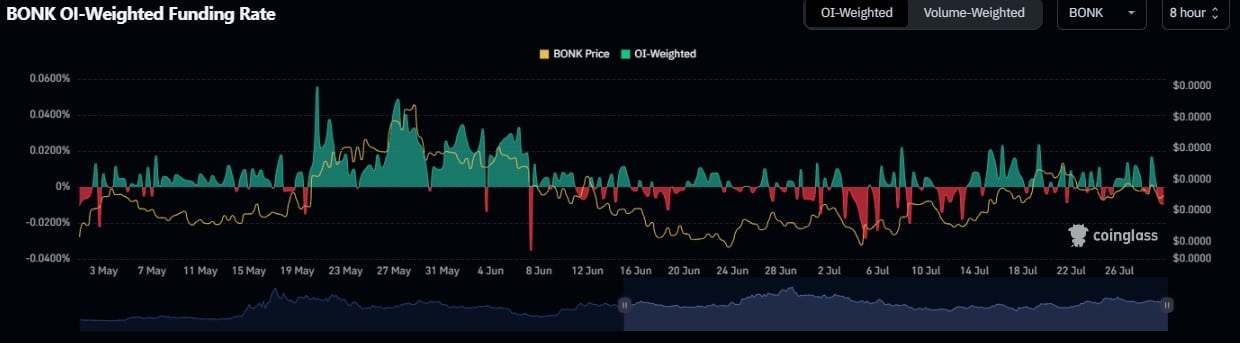

BONK’s fluctuating interest

The token witnessed a volatile price action. This was also reflected in the weighted open interest data for the same period. Open interest has surged during recent price hikes, pointing to more bullish trades and increased trader optimism.

In fact, there have been instances where a decline in open interest is followed by sharp falls in prices, suggesting profit-taking or liquidation.

Source: Coinglass

Realistic or not, here’s BONK’s market cap in BTC’s terms

Price action for BONK will be significant in the next few days. If the token can capitalize on its recent momentum and successfully liquidate the pool, it could lead to the anticipated recovery.

However, if it fails to break above the key level, it could suggest renewed selling pressure.