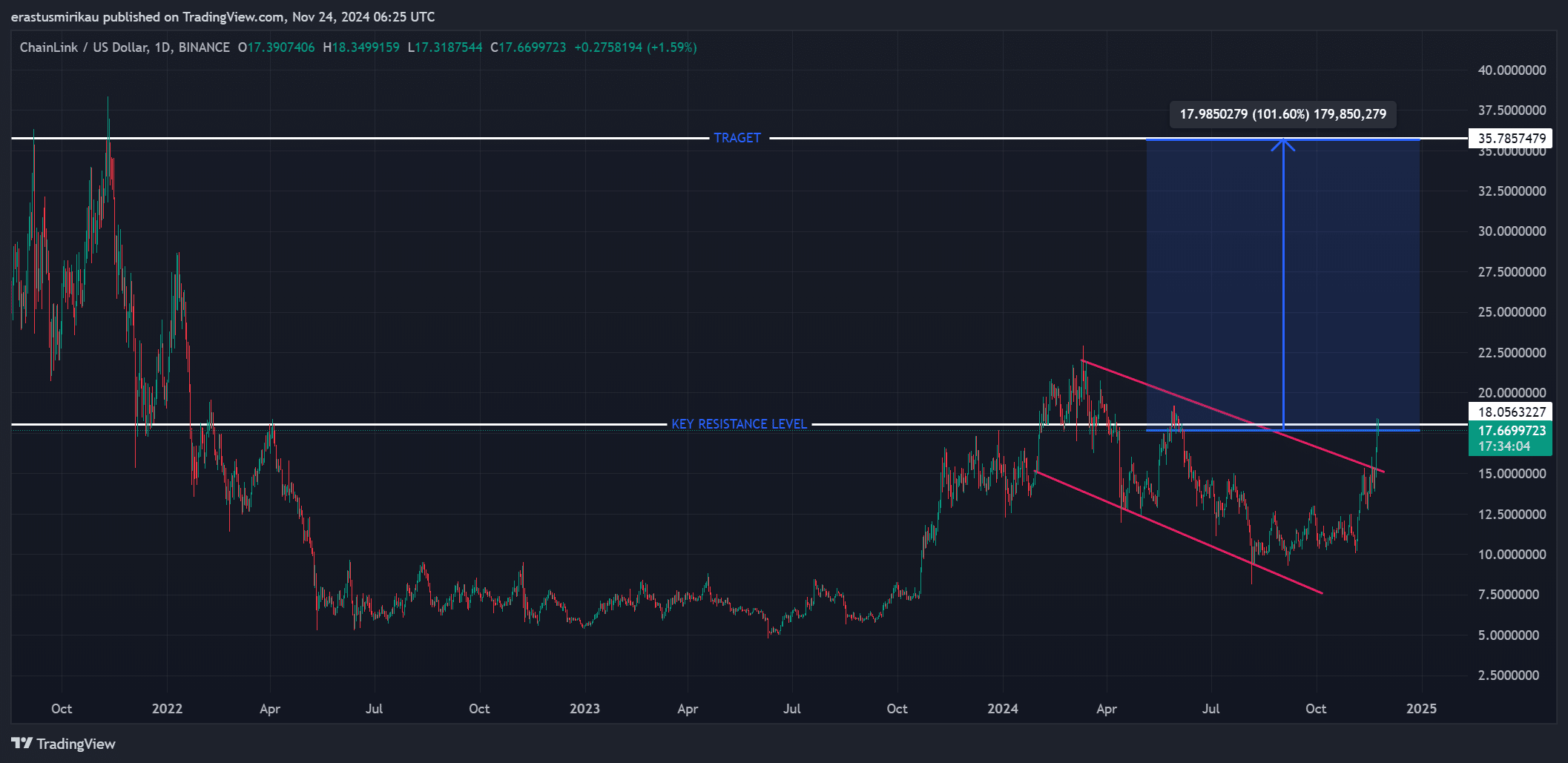

- LINK broke out of a prolonged downtrend, approaching key resistance at $18.

- On-chain activity and reduced selling pressure bolstered LINK’s potential to target $35.

Chainlink [LINK] is rapidly gaining traction as a key player in blockchain infrastructure, recently reaching an impressive $17.3 trillion in cumulative on-chain transaction value.

At press time, LINK was trading at $17.77, marking a 5.19% increase in just 24 hours.

With its price nearing a critical resistance at $18, the question now is whether LINK can capitalize on its momentum and reach the significant milestone of $35.

LINK breaking $18: The first hurdle toward $35

LINK’s recent price action indicated that the token was in a strong bullish phase. After successfully breaking through the $15.44 resistance, LINK now faces its next major challenge at $18.

Notably, the price has exited a prolonged downward channel, signaling a shift in sentiment.

Breaking through $18 would set the stage for LINK to aim for $35, its next significant target.

This level represented a potential 101.6% increase from press time prices, underscoring the importance of maintaining this momentum.

Source: TradingView

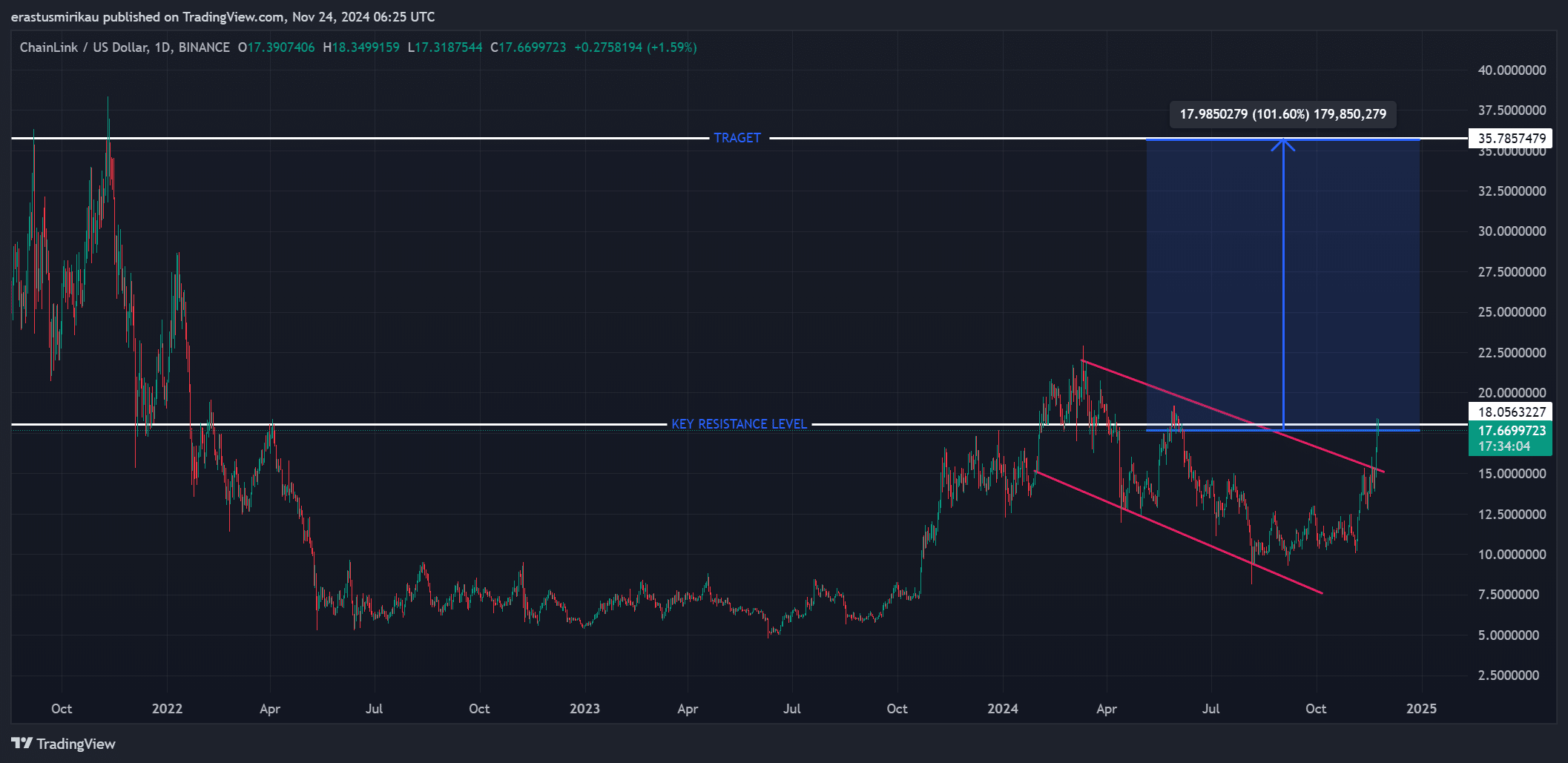

THIS suggests continued strength

LINK’s technical indicators provided a solid foundation for the ongoing rally. The 9-day and 21-day moving averages recently completed a bullish crossover, confirming upward momentum.

Additionally, the MACD indicator remained firmly positive, with the MACD line above the signal line and the histogram expanding steadily.

These signals reinforced the likelihood of LINK breaking $18 in the near term and continuing its upward trajectory.

Source: TradingView

On-chain activity accelerates adoption

The increase in daily active addresses for Chainlink was encouraging as well.

On the 23rd of November, active addresses surged to 7,417, highlighting growing user engagement and interest in Chainlink’s ecosystem.

Yhis surge in participation supports the token’s price growth, as increased demand often drives stronger market confidence. Therefore, adoption trends continue to favor LINK’s bullish outlook.

Source: Santiment

Declining selling pressure

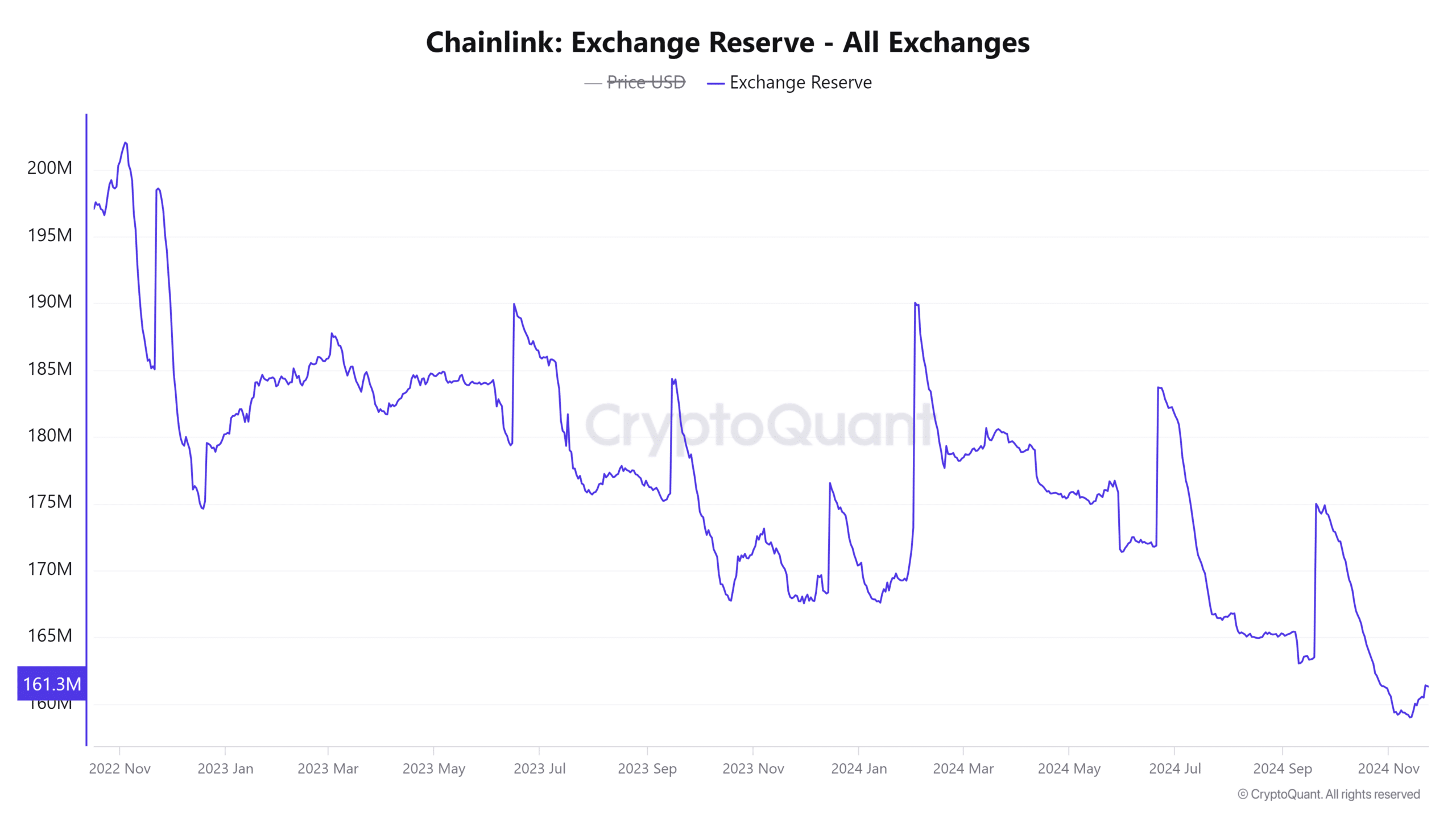

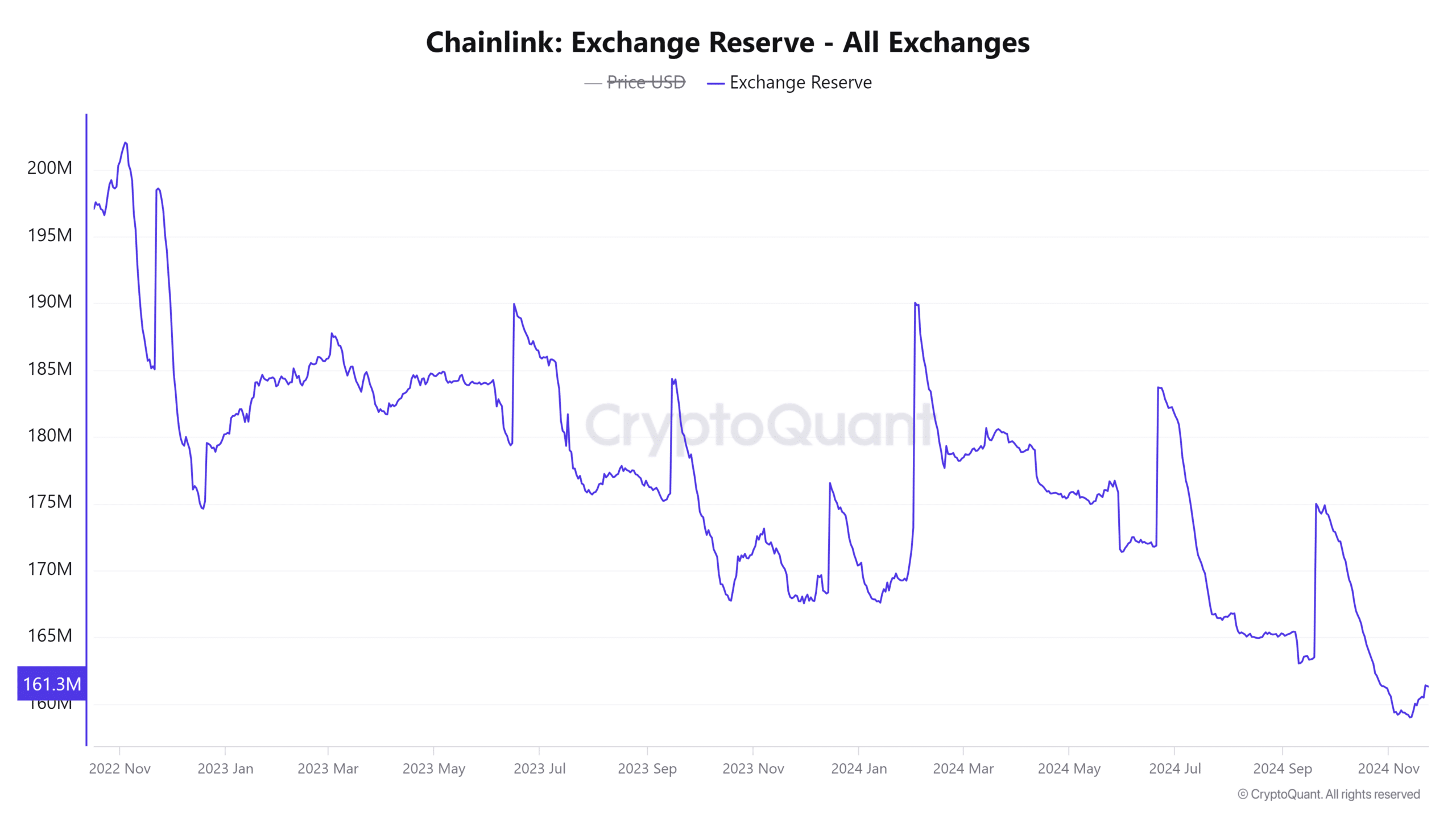

Moreover, the reduction in exchange reserves strengthened the bullish case for Chainlink.

With exchange reserves falling to 161.37 million tokens—a 0.13% decline over the past 24 hours—selling pressure has decreased.

This decline indicates that fewer tokens are being moved to exchanges, reducing the likelihood of significant sell-offs. Therefore, this metric aligns with the technical outlook for further gains.

Source: CryptoQuant

Is your portfolio green? Check out the LINK Profit Calculator

Conclusion: LINK is primed for $35

In conclusion, Chainlink’s strong technical indicators, surging on-chain activity, and reduced selling pressure positioned it to not only break the $18 resistance but also rally toward the $35 target.

The alignment of these metrics pointed to a sustained bullish trend, making a move to $35 not just possible but increasingly probable if the momentum continues.