- XRP is seeing its second day of positive trends after consecutive declines.

- Whale accumulation has yet to see a significant drop despite the slight price increase.

XRP’s recent price movements have sparked significant interest, particularly in whale activity, during its dip.

The digital asset’s rally to $2.43, alongside visible whale accumulation patterns, has prompted questions about the sustainability of its upward trajectory and the potential implications for smaller investors.

XRP whales seize opportunity

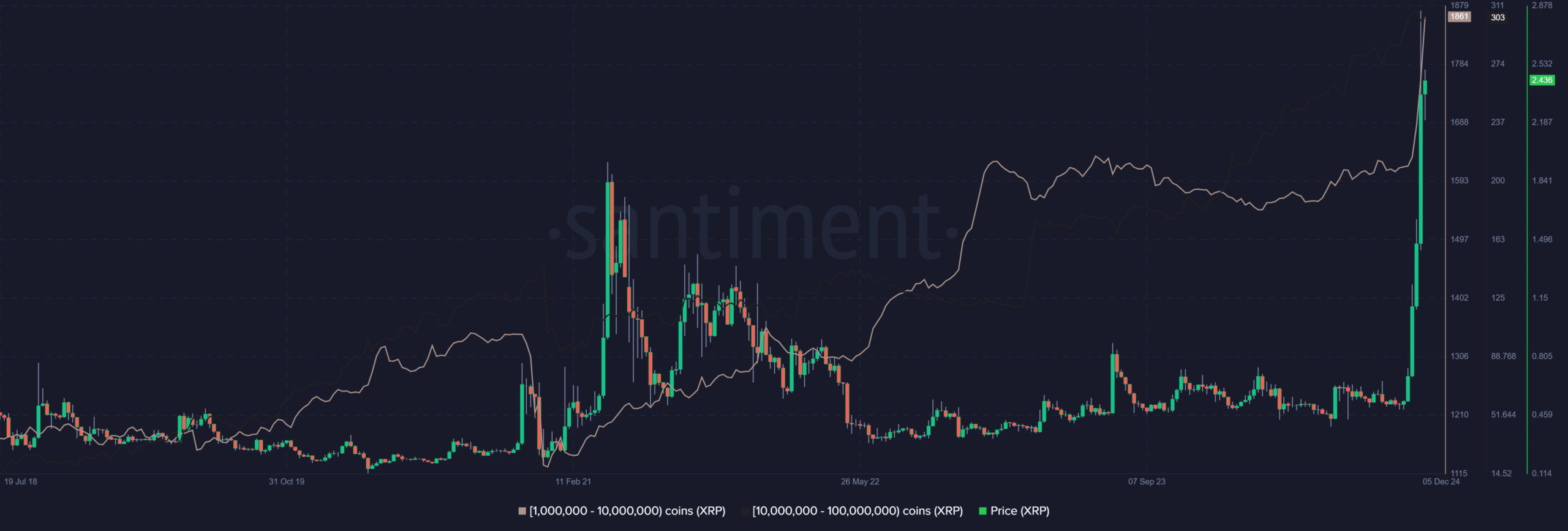

AMBCrypto’s look at Santiment data revealed that XRP whales—addresses holding between 1 million and 10 million coins—have increased their holdings as the price faced volatility.

As XRP dropped from $2.90 to $2.22, whales purchased over 120 million XRP, totaling $288 million. Historically, such whale activity during price dips has signaled confidence in the asset’s long-term prospects.

A look at the historical context suggests that whale accumulation often precedes bullish price action, as seen during XRP’s major rallies in 2021 and mid-2023.

Source: Santiment

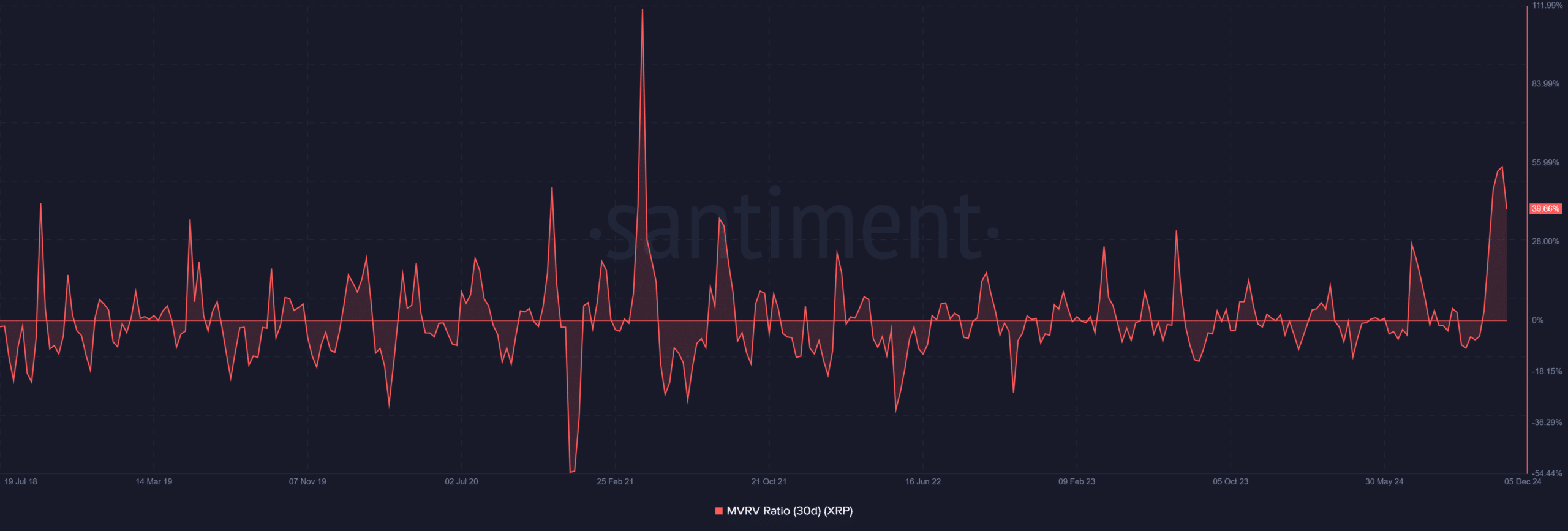

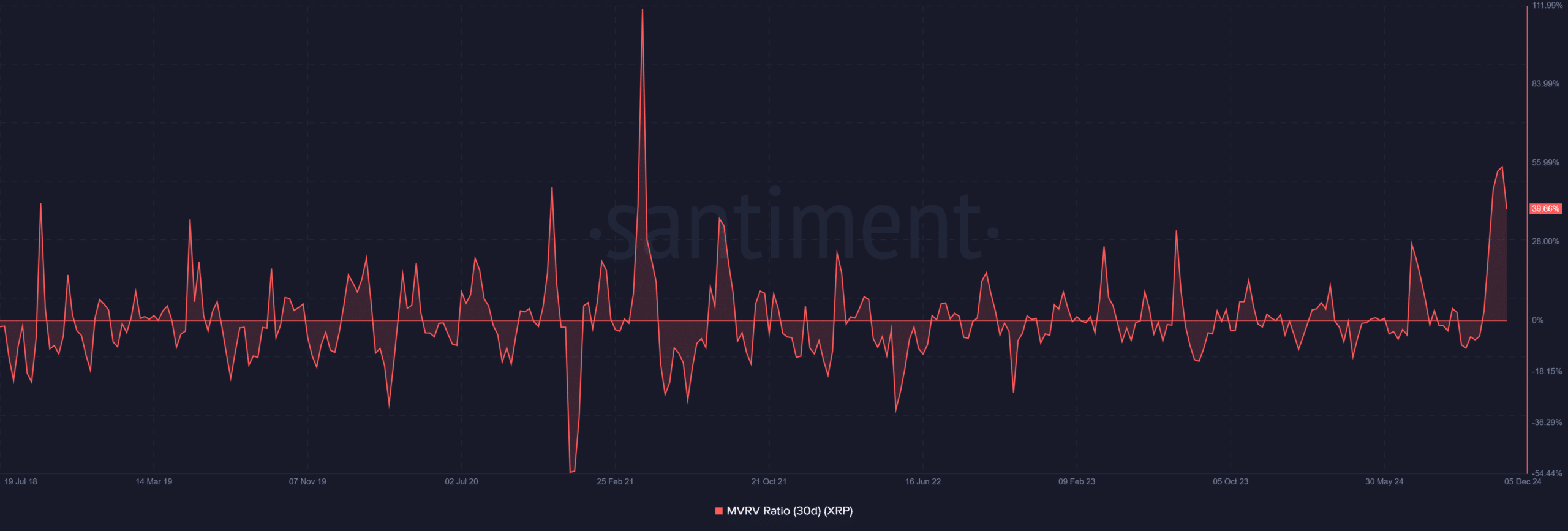

AMBCrypto’s look at the MVRV showed that the last time there was a spike in accumulation, the ratio was negative. This showed that the whales bought and held at a loss. Also, the MVRV was around -30% around that period.

Source: Santiment

However, the current scenario shows a more significant divergence. While whales have accumulated, the 30-day MVRV ratio was approximately 39.66%, signaling that XRP remained in overbought territory.

This ratio suggested that profits were higher than average, leaving the asset vulnerable to profit-taking in the short term.

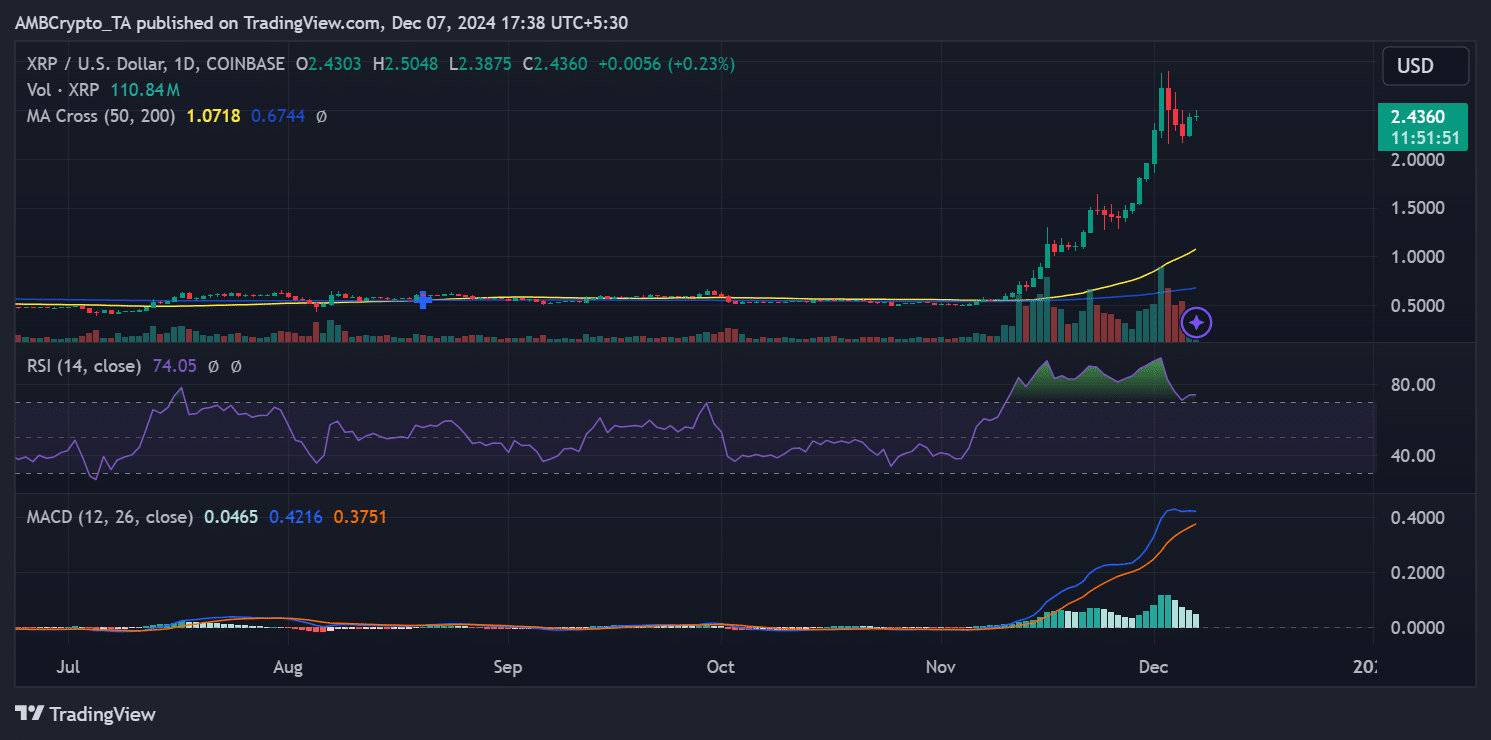

Price action and technical indicators

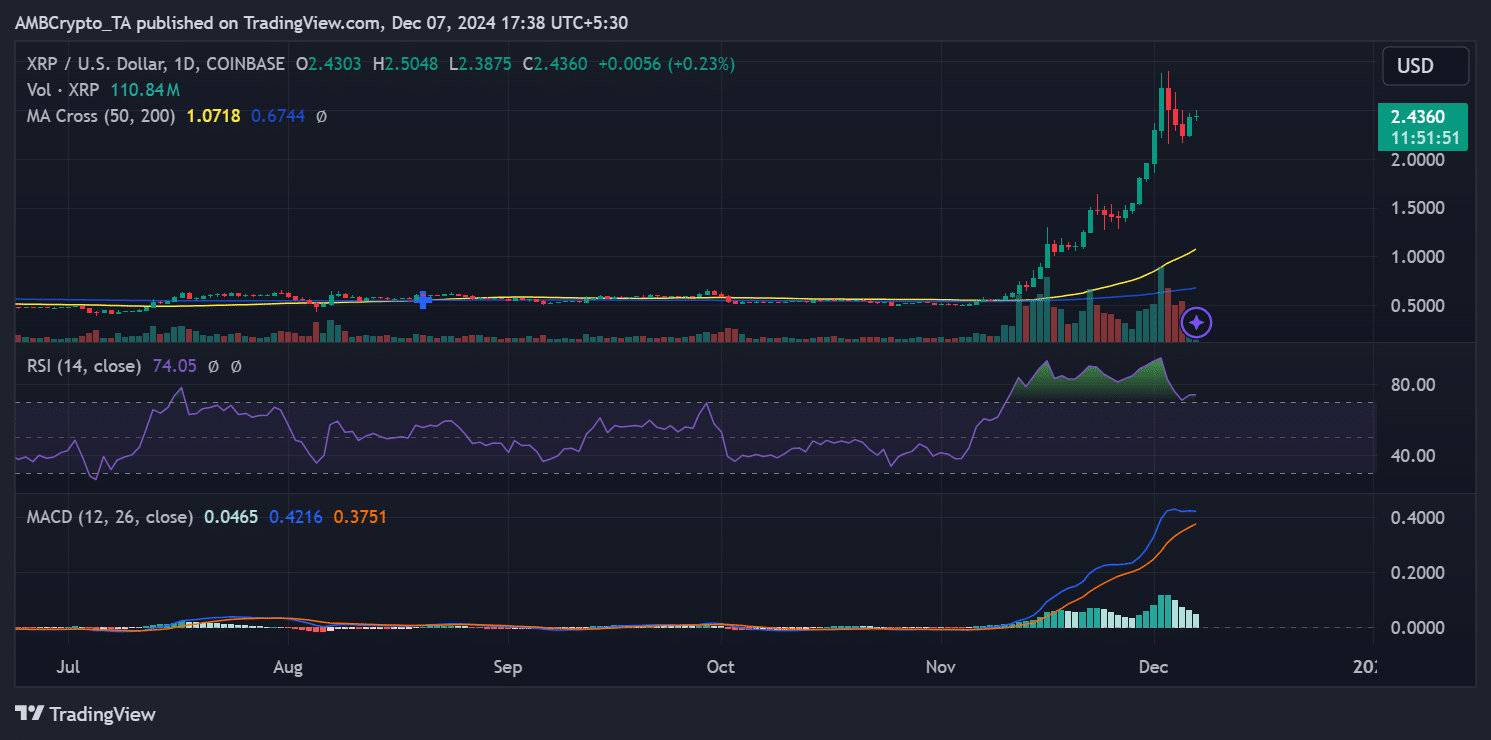

XRP’s price chart showed a steady upward trend with the RSI at 74, signaling overbought conditions. The MACD also indicated bullish momentum, supported by a positive crossover.

Despite these bullish signs, the asset’s rally may face resistance near the $2.50 level due to heightened selling pressure. As of this writing, it was trading at around $2.55, with a slight recovery.

Source: TradingView

A comparison with previous whale activity during dips reveals mixed outcomes.

For instance, whales that accumulated during dips in early 2021 saw substantial profits as XRP rallied, while those who bought during its mid-2023 dip experienced extended stagnation before recovery.

Market sentiment and broader context

The overall market sentiment plays a crucial role in determining whether whale accumulation can sustain XRP’s upward momentum.

If whale buying continues to drive demand, coupled with favorable macroeconomic conditions, XRP could challenge its next resistance levels.

Realistic or not, here’s XRP market cap in BTC’s terms

On the other hand, profit-taking by whales or a shift in broader market sentiment could lead to a consolidation or correction phase.

Historical patterns and current on-chain metrics suggested a mixed outlook, with bullish potential tempered by the possibility of a short-term pullback.