- XRP consolidated near its resistance, with analysts forecasting a breakout that could ignite a major bull run.

- XRP’s liquidation data revealed growing short pressure, fueling bullish momentum and heightened market interest.

Ripple [XRP] has shown renewed strength in the past week, registering a 5% rise despite broader crypto market challenges.

Analysts are closely watching for a possible breakout that could potentially mirror the massive rally seen in 2017.

With XRP trading at $0.599 at press time and a circulating supply of 56 billion tokens, the asset’s market capitalization stood at $33.64 billion at press time.

The coming weeks could be crucial, as technical patterns suggested that XRP may be on the verge of a significant move.

Potential breakout after years of consolidation

Javon Marks, a crypto analyst, observed that XRP’s price was hovering near a critical point, suggesting a possible breakout from a long-standing resistance pattern.

He noted that XRP has been consolidating for over 2,424 days, dating back to the post-2017 bull run, which saw XRP surge to record highs.

According to Javon, a 3-4% increase could break this trend and signal the start of another rally.

Moreover, on the 6th of August, Javon Marks predicted,

“Price action and RSI patterns are indicating a potential bullish breakout.”

He emphasized that the current technical setup mirrors patterns seen in previous bull markets, which could pave the way for a strong price surge.

If successful, this breakout could open the door for a target range of $15 to $18, representing a 2,100% climb from current levels.

Source: X

Technical indicators show bullish momentum

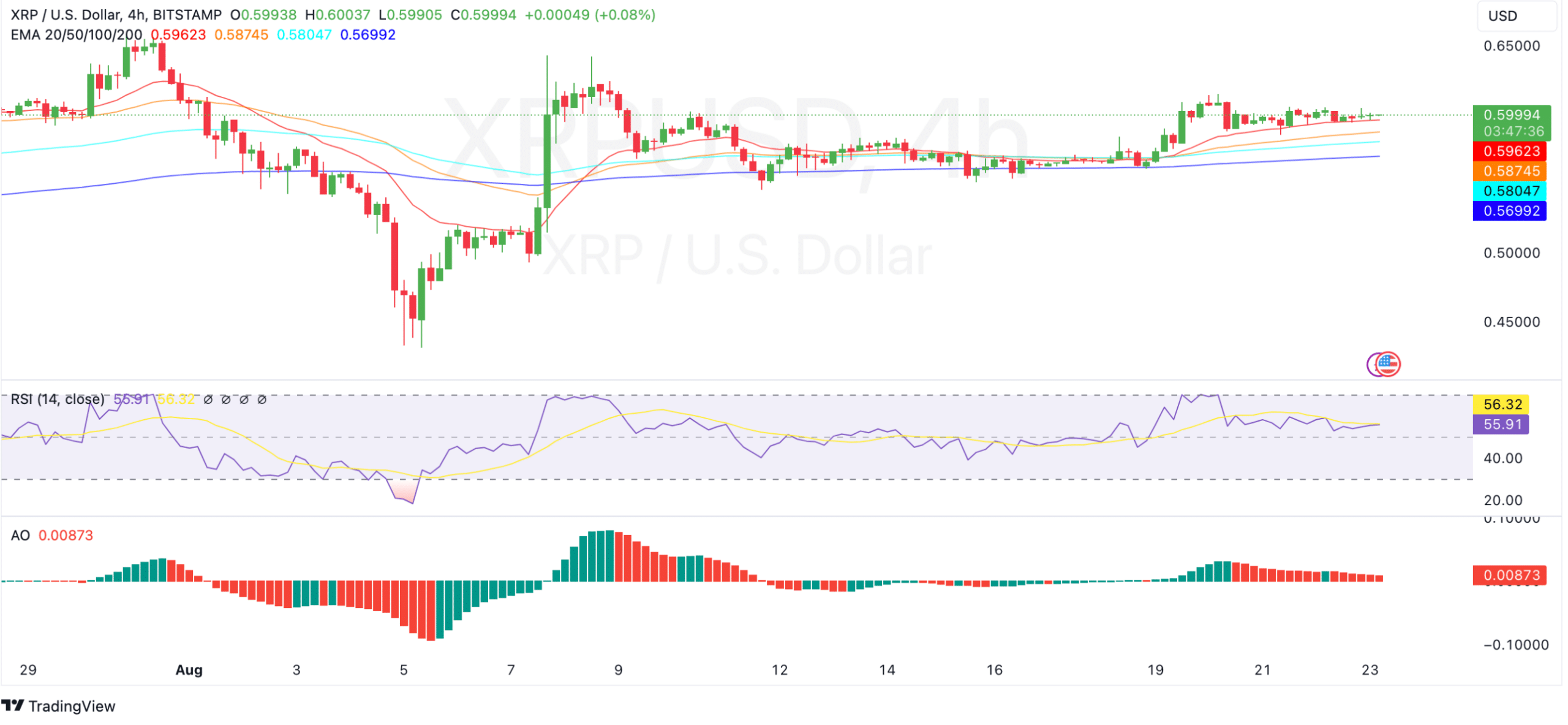

Several technical indicators supported the possibility of an imminent breakout. The Relative Strength Index (RSI) for XRP sat at 56.40 at press time, signaling a mild bullish trend without being overbought.

This suggested that there was still room for price growth without immediate risk of a market correction.

Additionally, the 100 and 200 Exponential Moving Averages (EMAs) provided solid support at the $0.58 to $0.56 range, which could help XRP maintain its upward trajectory.

Source: TradingView

The Awesome Oscillator (AO) was also displaying positive momentum, with green bars showing a weak but growing bullish trend.

Although the AO is still close to the zero line, an increase in green bars could confirm the start of a stronger upward move.

Traders are watching these indicators closely to assess whether XRP will sustain its current trajectory.

Liquidation data suggests strong short pressure

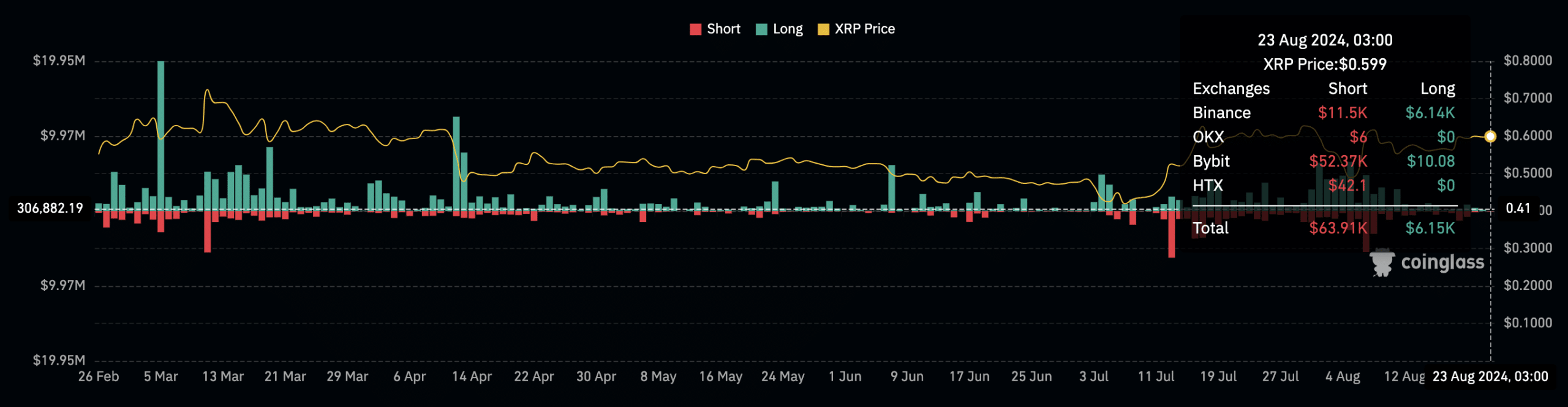

XRP’s recent price action has led to short liquidations, further supporting the case for a possible breakout.

Data from Coinglass showed that on the 23rd of August, $63.91K worth of short positions were liquidated, compared to just $6.15K in long liquidations.

This imbalance suggested that many traders betting against XRP have been caught off guard by the recent upward movement, possibly contributing to further upward price pressure.

Source: Coinglass

Read Ripple’s [XRP] Price Prediction 2024 – 2025

This liquidation data, combined with the growing Open Interest in XRP, points to increased trading activity and heightened expectations for a potential bullish breakout.

Open Interest rose by 2.55%, reaching $698.52M, while options volume surged by 200.30%. This spike in trading volume highlights the increased focus on XRP as it approaches a crucial price level.