- Whale activity and rising active addresses suggested growing market engagement despite a price dip.

- Declining exchange reserves and strong long liquidations pointed to dipping selling pressure.

A massive 30 million Ripple [XRP] transfer, valued at $17.4 million, was recently withdrawn from Upbit, sparking bullish wave speculation.

As trading volume surges, traders are monitoring this whale movement, eager to see if the momentum will hold.

It remains to be seen whether XRP can sustain enough pressure to break past key resistance levels and trigger a potential breakout.

Is XRP poised for a market breakout?

The price of XRP was trading at $0.5861, down by 1.63% at press time. However, despite this slight dip, the growing whale activity and increased trading volume have many in the market hopeful for a recovery.

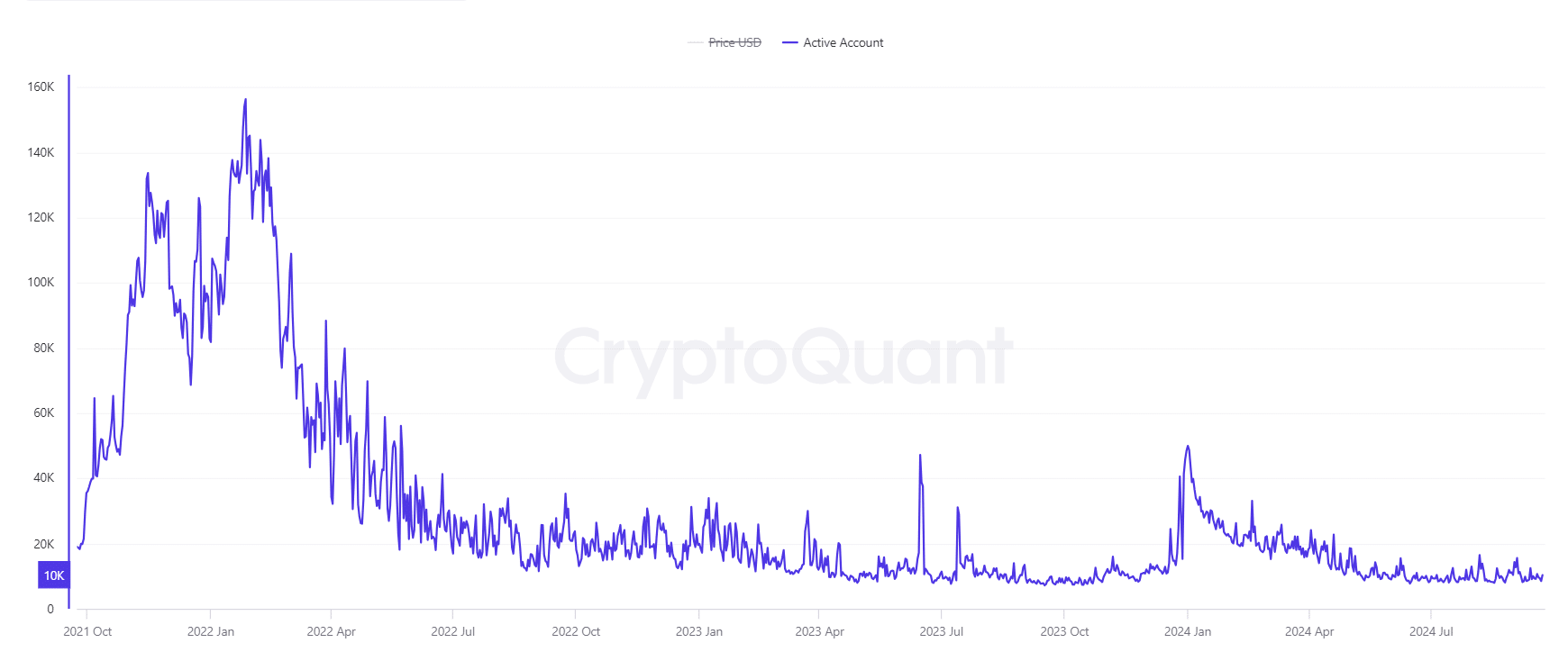

Over the past 24 hours, active addresses have risen by 1.21%, totaling 10,347 at press time. This suggests that more participants are engaging with the XRP ledger, which often correlates with rising demand.

Source: CryptoQuant

Moreover, the transaction count on the XRP ledger is also climbing, with a 0.72% increase over the last 24 hours, reaching a total of 1.388 million, according to CryptoQuant.

This uptick in transactions further signals growing network activity, typically a bullish sign for price action.

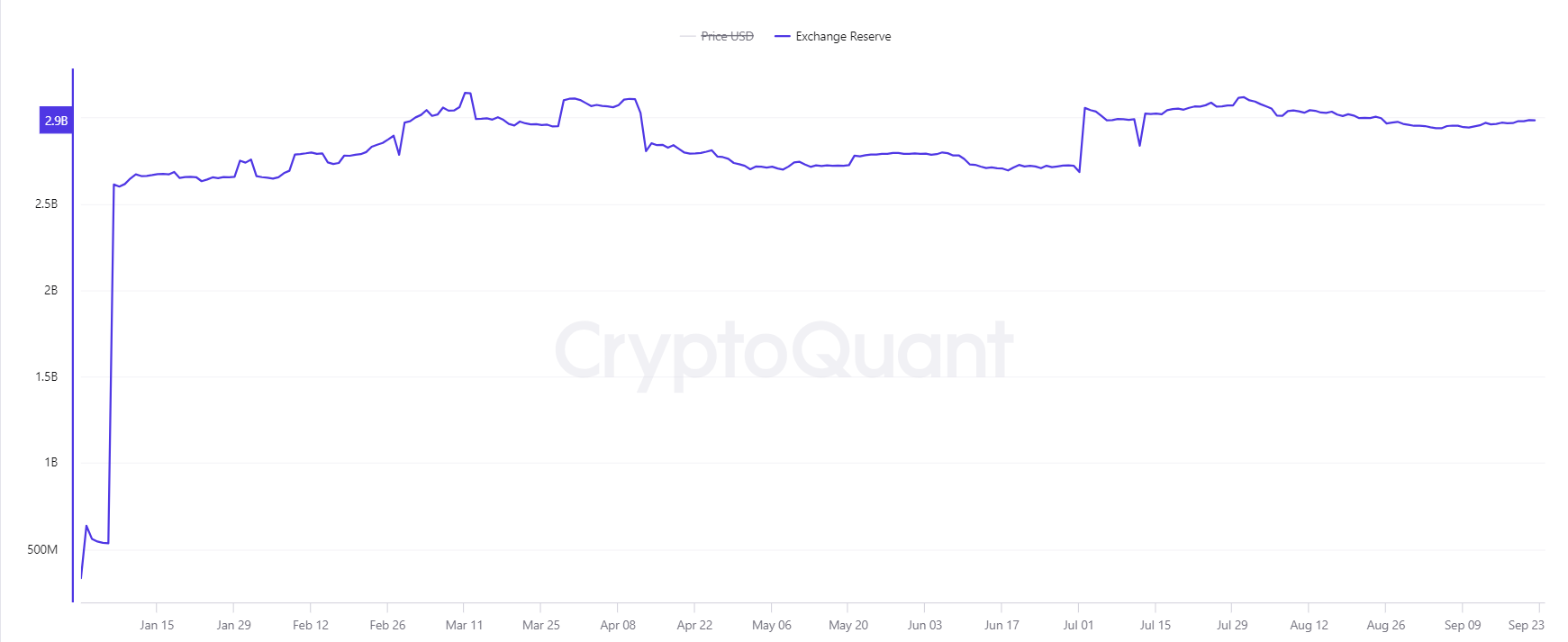

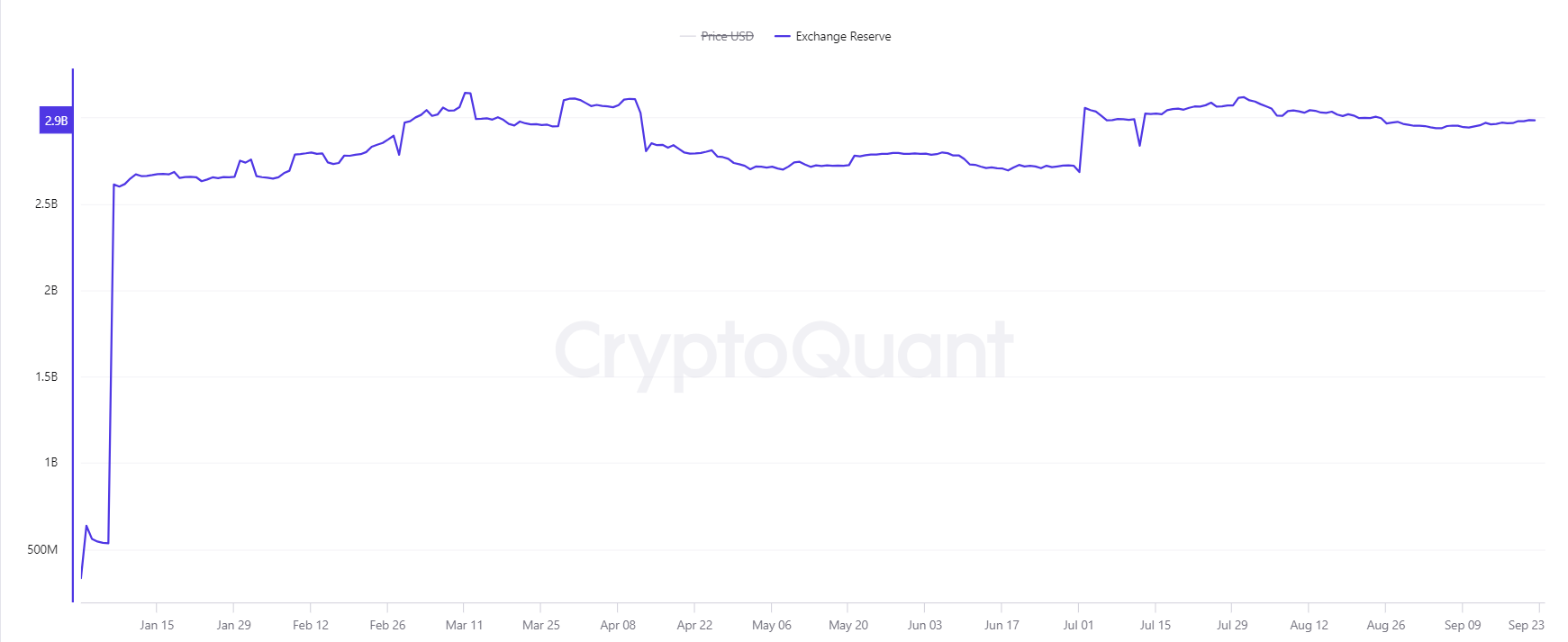

Exchange supply declines—bullish indicator?

Another key factor fueling the bullish fire is the decline in exchange reserves. At press time, XRP’s exchange supply dropped by 0.29% in the last 24 hours, sitting at 2.9769 billion XRP.

Lower exchange reserves often indicate reduced selling pressure as more tokens are withdrawn from exchanges and moved to personal wallets.

This trend could signify that investors are anticipating a price surge, leading to less supply available for immediate trading.

Source: CryptoQuant

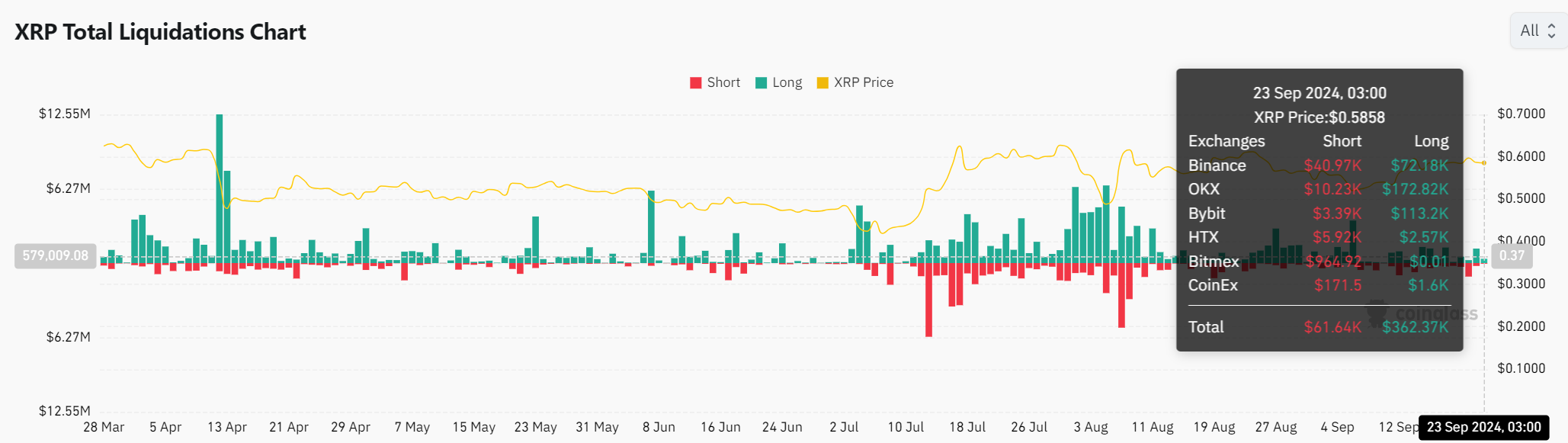

Liquidation activity: What does it mean for XRP’s future?

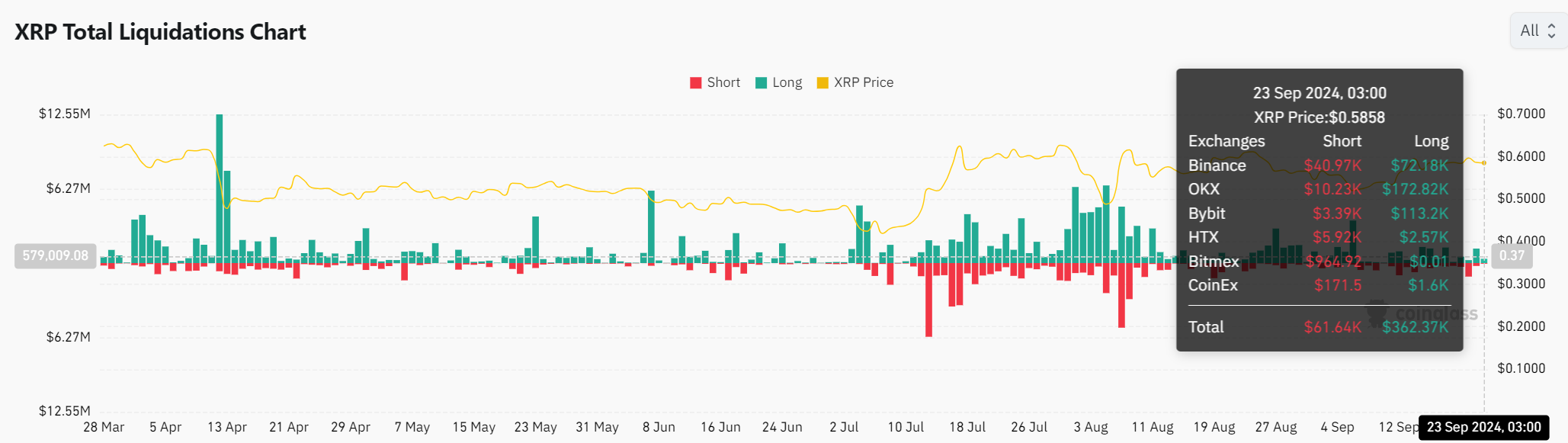

Looking at XRP’s liquidation data, there has been notable activity on both long and short positions.

On the 23rd of September, liquidations totaled $579,009, with the majority being short positions ($61,000) across exchanges like Binance and OKX.

Contrastingly, long positions reached over $362,000. This indicates that despite short-term fluctuations, there is strong support from long traders, which could help drive the price higher.

Source: Coinglass

Can XRP sustain its bullish momentum?

While XRP has experienced a slight price dip, the surge in whale activity, growing network engagement, and reduction in exchange reserves present a bullish case.

Realistic or not, here’s XRP’s market cap in BTC’s terms

If these trends continue, XRP could maintain its momentum and possibly push past key resistance levels.

However, traders should remain cautious, as sustained buying pressure is essential for a breakout. The coming days will reveal whether this whale activity is the spark needed for a lasting rally.