- XRP encountered strong resistance near the $3 barrier, as profit-takers began cashing out.

- The decision to HODL will depend on both internal and external factors moving forward.

Among the top altcoins, Ripple [XRP] was strategically positioned by bulls to ride the wave of the Trump-pump. With an explosive monthly surge of over 300%, XRP became the talk of the market, drawing in both seasoned investors and eager newcomers.

As a result, in just 30 days, XRP shattered not one, but two key resistance levels. After reclaiming the $1 mark, it kept building momentum, defying the signs of an overheated market, and charged past the $2 resistance just a week ago.

This breakout, following three years of consolidation, understandably led to heavy profit-taking, as investors likely feared a potential correction. Dumping XRP seemed like the safest bet.

But here’s where it gets interesting: Market makers are still bullish on a $3 breakthrough. This sets the stage for XRP to smash its all-time high, sparking FOMO across the board.

Now, this leaves traders in a classic dilemma – cash out now and secure gains, or hold on in hopes of an even bigger surge?

XRP needs ‘consistent’ bull support

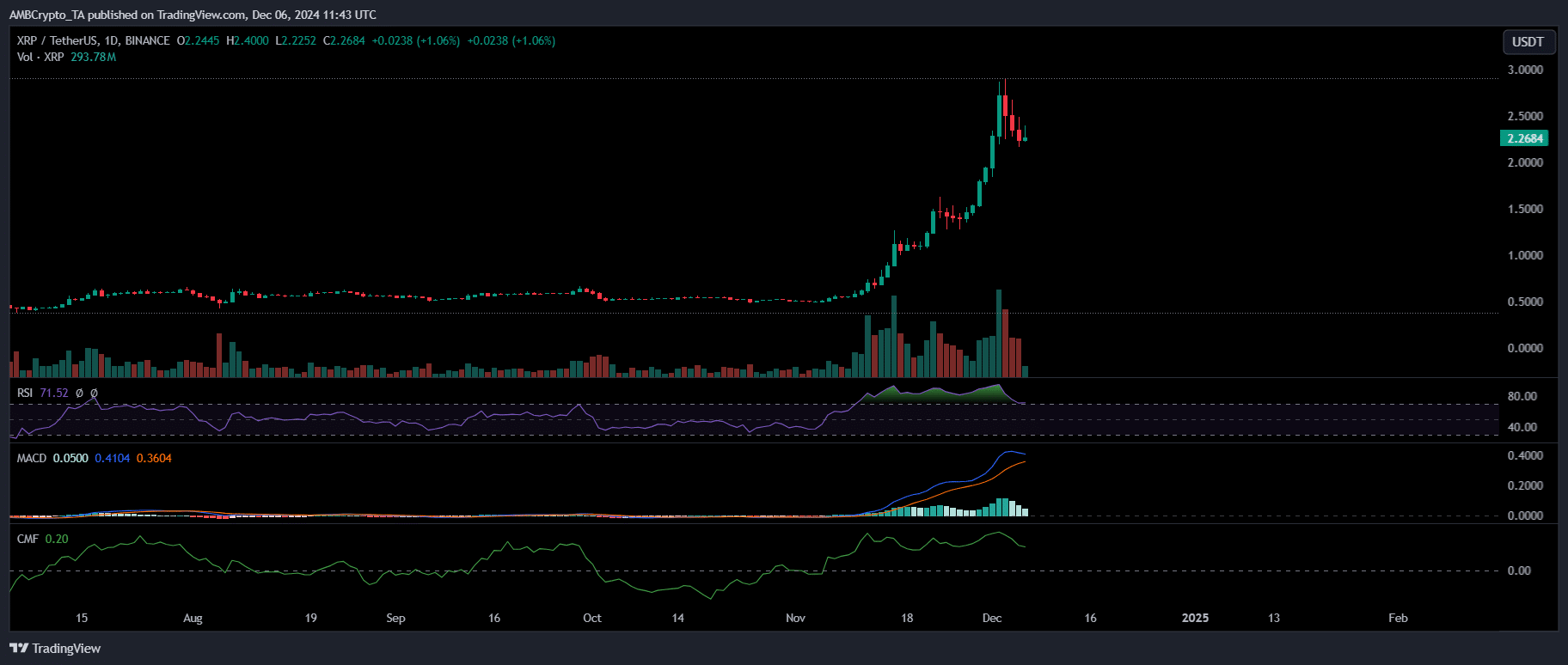

On the daily price chart, XRP has consistently shown signs of profit-taking after testing each resistance, with a maximum of four consecutive downtrend days. Interestingly, the fifth day often signals a strong rebound, bringing XRP back into full swing.

This pattern suggests that bulls are confident in countering any bearish divergence, making a $3 breakthrough not just plausible, but increasingly realistic.

However, this momentum alone won’t suffice. Just three days ago, XRP came close to $3, closing at $2.8 – the highest price of the day – after four straight days of long green candlesticks, each delivering higher highs exceeding 15%.

Source : TradingView

But this rapid ascent came at a price. Overbought conditions emerged swiftly, triggering a three-day downtrend. Currently trading at $2.27 (at the time of writing), XRP has erased gains from earlier bullish efforts.

Still, a solid base of XRP holders sits comfortably in realized profits, leaving the asset more susceptible to speculative swings.

Therefore, expecting an ‘uninterrupted’ move towards $3 might be an over-exaggeration.

If the earlier trend repeats, XRP could experience a slight rebound near $2.8, with corrections from profit-takers expected throughout.

So, is it wise to hold for greater gains?

The answer to this question depends on both internal and external factors. Internally, volume indicators suggest further upside potential, as the RSI hasn’t yet reached an overbought state, the MACD crossover remains bullish, and the CMF stays positive.

Additionally, extreme FOMO is anticipated to take hold of the market, with predictions now setting a $6 target for XRP in 2025.

However, the overall market volatility should not be overlooked. The past 24 hours have seen most altcoins dip into the red, with XRP leading the decline with a near 5% drop.

This follows a similar price action in Bitcoin after it breached $100K, making XRP’s movement more dependent on external factors than internal ones.

Read Ripple [XRP] Price Prediction 2024-2025

So, a $3 breakthrough could materialize if Bitcoin finds its market bottom and rebounds to its previous resistance, restoring market confidence in other altcoins, including XRP.

Until then, a reversal back to $2.8 seems more probable, as bulls remain confident in a recovery, making HODLing the more logical choice.

However, it will be important to see how the market responds to Bitcoin over the coming weekend to determine if a $3 breakout is achievable.